Back to Shorts?

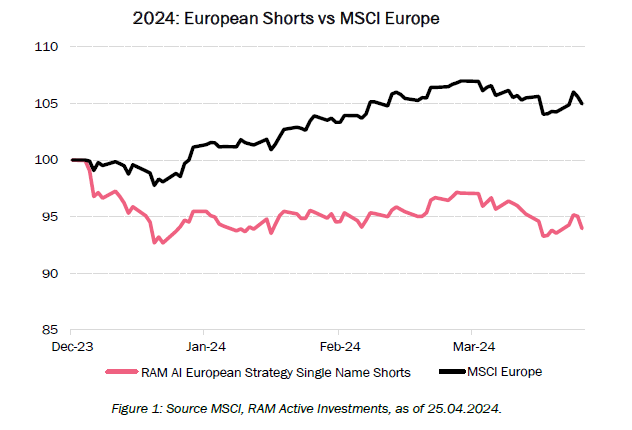

The beginning of 2024 has started off strongly for short picks targeting low-quality stocks, as the impact of higher interest rates continues to permeate the economy. This pressure is increasingly highlighting the vulnerabilities of these financially weaker companies, making them prime candidates for short selling as the European economy slows down.

Since the beginning of the year, cash-destroying industrial firms in renewable energies, energy storage and electric vehicles, and semiconductor companies as well as, more recently, highly valued luxury short picks have strongly contributed to the alpha of our short strategies.

This comes out of a context of short capitulation in 2023.

The Setup: 2023, the Year of Capitulation for Shorts

While the zero-rate environment and Quantitative Easing (QE) have led to easy financing of many unprofitable companies, boosting investments into speculative companies, one would have expected a major re-pricing of risky, unprofitable companies on the back of a normalisation of rates.

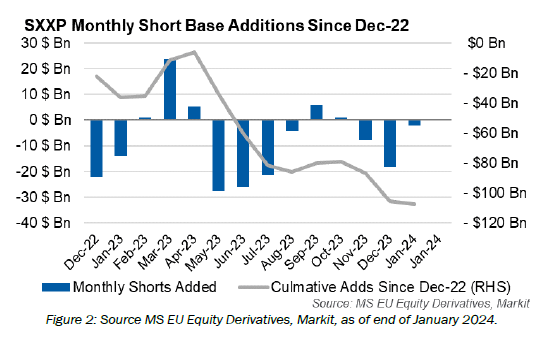

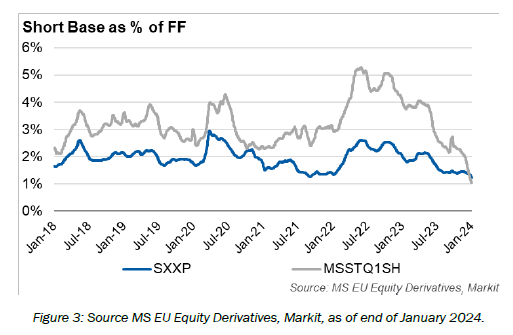

Ironically last year seems to have marked a capitulation in short-selling activity, large shorts covering and speculative buying of low-quality and unprofitable stocks leading to a strong upside in these companies despite the largest cumulative rate hike in decades.

This extreme level of short covering has led to new lows being reached on the outstanding proportion of market cap shorted across single names (cf. fig. 1).

The unprecedented rate hikes of the last 18 months and more are still impacting our economies with the traditional lag, the Eurozone being expected close to stagnant for the last quarter, with risks to next year growth still abounding.

High Market Concentration

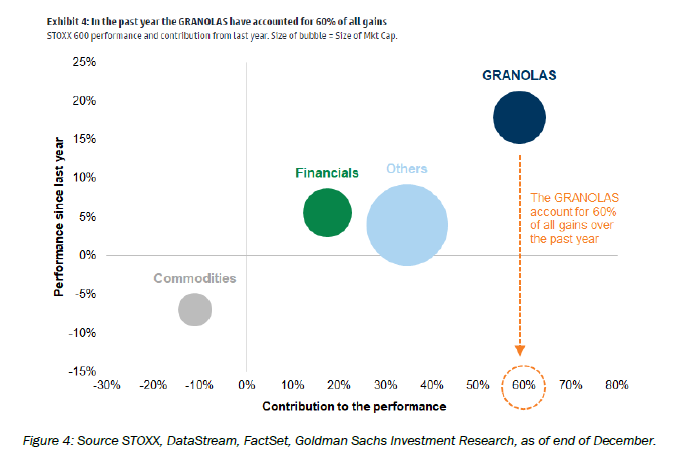

The GRANOLAS have dominated European markets in very much the same way the Magnificent 7 did in the US in 2023.

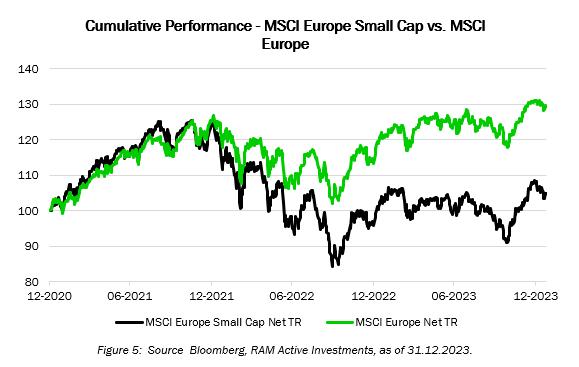

Small caps, on the other hand of the spectrum, have very significantly lagged, leading to an underperformance of around 25% over the last three years (cf. fig. 5).

Valuation Dispersion Offers Compelling Relative-Value Opportunities

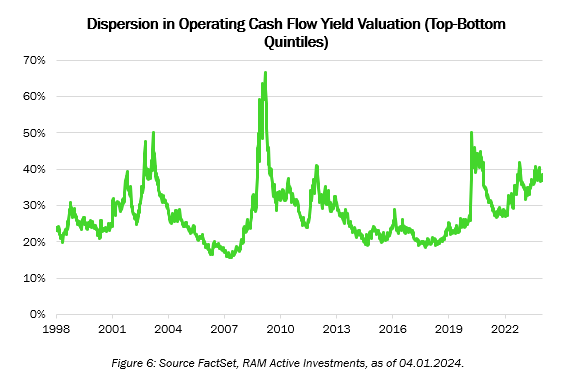

The concentration of returns has helped maintain a high level of dispersion in valuations across European stocks. After topping at the end of 2020, dispersion has increased again last year along with the risk-on trade of 2023.

The dispersion in operating cash flow yields is above the last twenty years average, offering attractive relative-value opportunities across European small- and mid-caps.

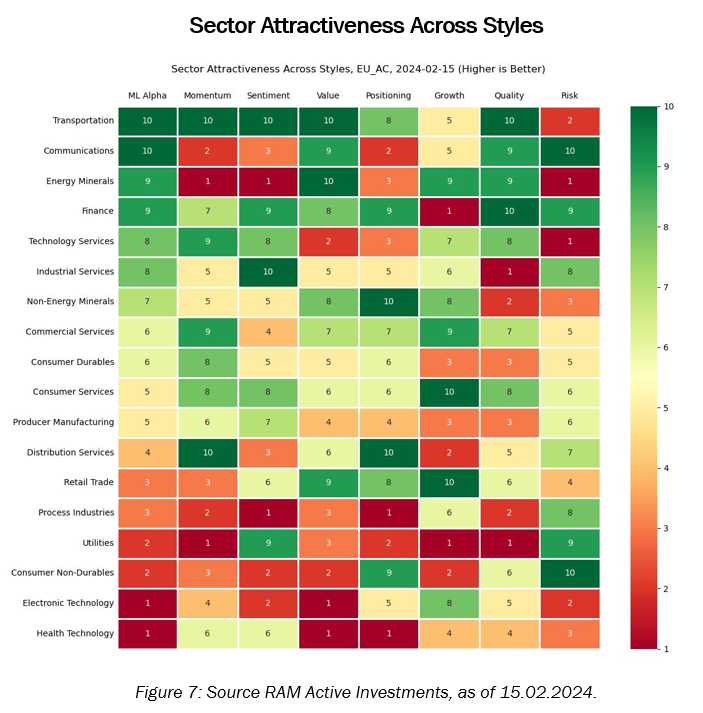

We see a wide disparity of opportunities from an alpha perspective in this beginning of year. Sectors like transportation benefit from a combination of strong earnings and price momentum as well as still attractive valuation levels (cf. fig. 6). Communications or energy are also attractively valued.

On the other hand of the spectrum, Health Tech has traded expensive for the tepid expected growth achievable in the coming years. We also find many short opportunities within some segments of Utilities, in particular among renewable energy plays which are expensive, struggle to generate attractive cash flows and are hurt by negative momentum flows.

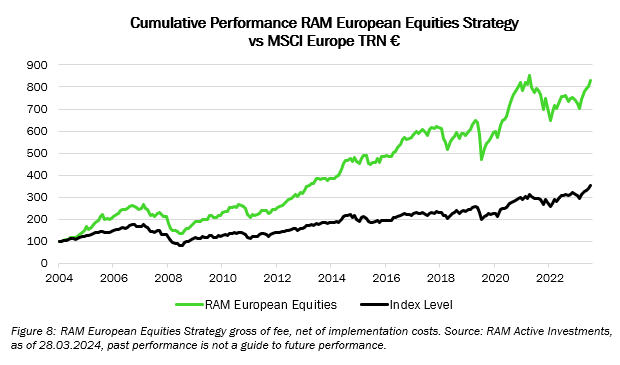

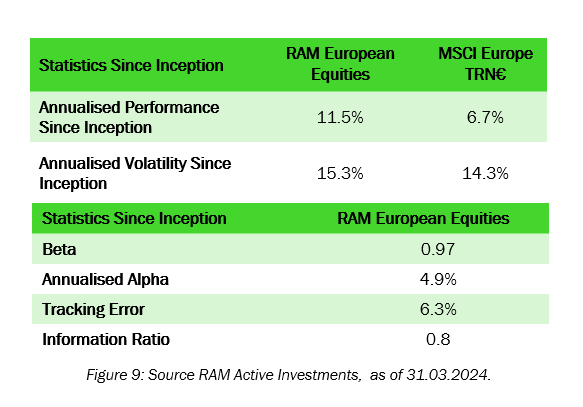

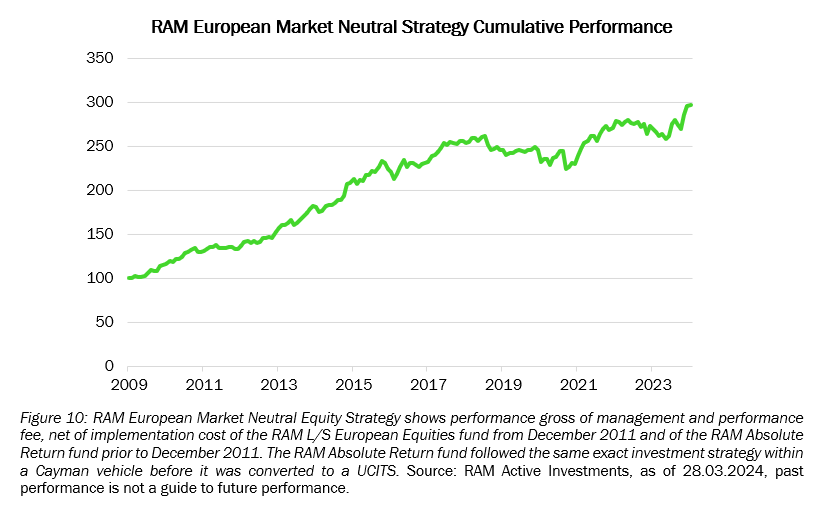

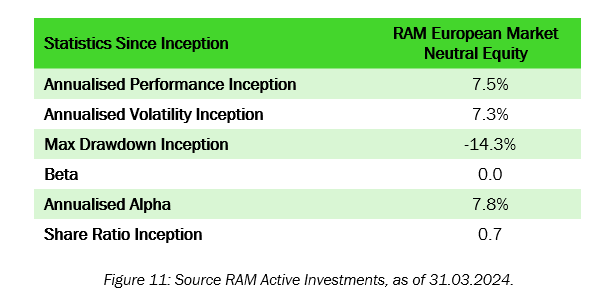

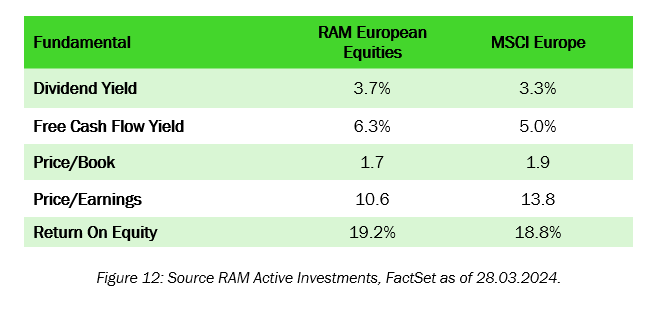

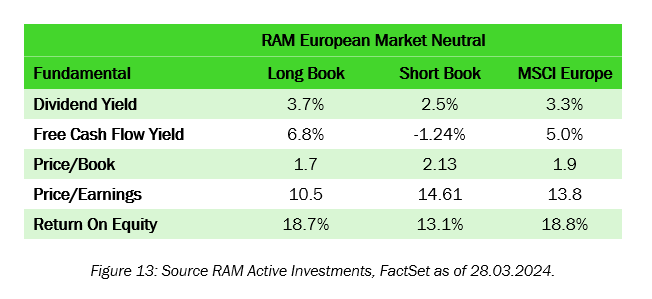

Long-Term Alpha Capture

In conclusion, our alpha engines, dating back to September 2004 for long-only investments and April 2009 for Market Neutral Strategies, have enabled us to consistently generate significant alpha while controlling risk.

Over the long-term, the non-linear interaction of fundamental, technical, liquidity and alternative inefficiencies on the stocks we trade helps us capture strong fundamental long and short opportunities with optimal timing.

Image Gallery

Legal Disclaimer

This marketing document is only provided for information purposes to professional clients, and it does not constitute an offer, investment advice or a solicitation to subscribe shares in any jurisdiction where such an offer or solicitation would not be authorised or it would be unlawful. In particular, the Fund is not offered for sale in the United States or its territories and possessions, nor to any US Person (citizens or residents of the United States of America).

This document is confidential and is intended only for the use of the person to whom it was delivered; it may not be reproduced or distributed.

There is no guarantee that the holdings shown will be held in the future. The investment described concerns the acquisition of shares in the Sub-Fund and not in a specific underlying asset. Past performance is not a guide to current or future results. There is no guarantee to get back the full amount invested.

Particular attention is paid to the contents of this document but no guarantee, warranty or representation, express or implied, is given to the accuracy, correctness or completeness thereof. Prior to any transaction, clients should check whether it is suited to their personal situation, and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary.

A summary of Investors’ rights is available on: https://www.ram-ai.com/en/regulatory-information Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, RAM Active Investments (Europe) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg.

The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments and the date of reference is the date of this document.

More News & insights

.png)

.png)

.png)

.png)

.png)

.png)