Thriving on Uncertainty: RAM AI’s Market-Neutral Funds Deliver in Volatile Markets

Persistent uncertainty continues to shape the investment landscape, turning volatility into a potential ally for disciplined stock-pickers. April continued the trend of choppy markets seen year-to-date, as investors grappled with a host of concerns – from renewed tariff hikes and unpredictable policy shifts to ambiguous inflation signals and heightened geopolitical risk. These crosscurrents have magnified valuation dislocations that began in the zero‑rate years before COVID‑19 and were stretched further by the pandemic‑era easy financing and surge in speculative growth stocks.

Successive waves of forced short‑covering pushed many hedge funds out of single‑name shorts. This environment significantly impacted fundamental-based market-neutral strategies but has also created new opportunities within the asset class. Going forward, we believe market-neutral strategies will offer strong risk-adjusted returns and important diversification in a concentrated market.

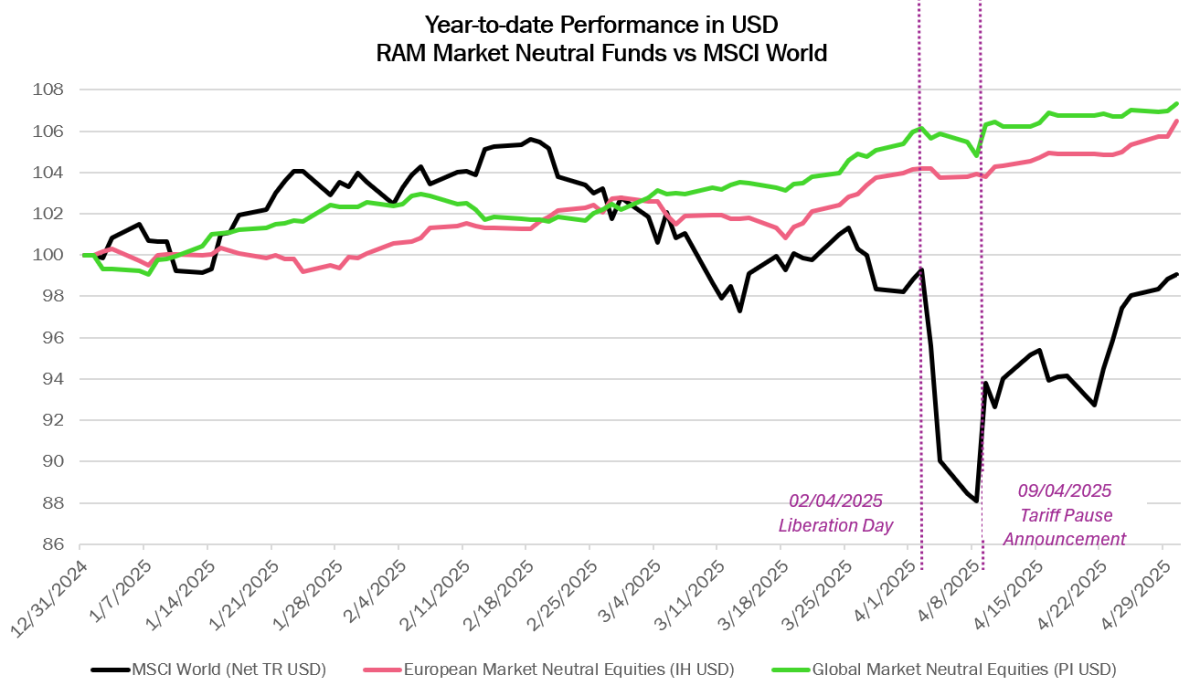

Our RAM European Market Neutral Equity Fund (IH USD net of fees, as of 30th April 2025) has navigated these conditions with results up +6.50% year-to-date and delivering +19.18% in 2024. Similarly, the RAM Global Market Neutral Equity Fund (PI USD net of fees, as of 30th April 2025) has returned +7.33% year-to-date after achieving +10.66% in 2024. The simultaneous alpha generation of our two market‑neutral funds, driven by the same philosophy yet applied to different universes, offers powerful cross‑validation of our process and confirms the depth of the opportunity set.

The gains have been broad‑based: longs were the main driver this year, shorts last year, and both core strategies delivered, namely the low-frequency strategy, which exploits fundamental and behavioural inefficiencies using the alpha predictions from our deep learning infrastructure, and the shorter-term statistical arbitrage strategy, which captures mean-reversion opportunities among highly cointegrated stocks on a daily horizon.

This multi-strategy framework enabled us to seize on dislocations like those in the industrial sector, particularly in Europe, where tariff-driven cost pressures punished certain capital goods exporters even as defence-related companies were revalued higher amid geopolitical tensions and the increased in defence budgets. By capturing these idiosyncratic opportunities, our funds have converted market dislocations into consistent alpha.

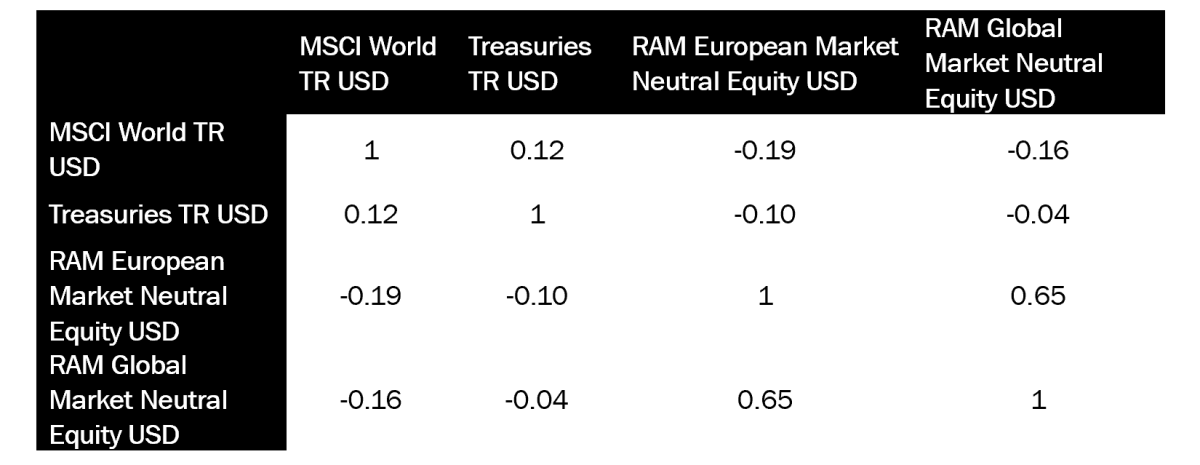

Crucially, this performance has been achieved with zero-beta positioning and minimal correlation to traditional asset classes. The table below illustrates our funds’ near-zero correlation to major markets, highlighting their potential role as diversifiers in an investor’s portfolio, particularly now that sovereign bonds have repeatedly failed to cushion portfolios in recent equity drawdowns.

5-year Weekly Return Correlations

Past performance is not an indicator of future results

With alpha flowing from both the long and short books, the funds have delivered across rising and falling markets this year:

In practice, the funds have generated positive returns independently of the market’s direction, with limited drawdowns. Since the strategy’s launch in March 2009, the European Market Neutral Equity (using monthly returns gross of fee in USD) has captured ‑27% of the equity market’s downside. A negative downside capture ratio that underlines its propensity to generate positive returns when markets fall - when low risk and quality inputs generally contribute strongly. And interestingly the strategy has captured +19% of the equity market’s upside, despite exhibiting zero beta. The Global Market Neutral Equity fund, run on the same philosophy, exhibits a similarly attractive upside/downside asymmetry.

Today’s macro uncertainty has widened valuation spreads and deepened idiosyncratic dislocations, broadening the hunting ground for our models. We see the current volatility as a continuous source of opportunities.

Image Gallery

Legal Disclaimer

The sub-funds mentioned above are Sub-Funds of RAM (Lux) Systematic Funds, a Luxembourg SICAV with registered office: 14, Boulevard Royal L-2449 Luxembourg, approved by the CSSF and constituting a UCITS (Directive 2009/65/EC). Mediobanca Management Company S.A. 2 Boulevard de la Foire 1528, Luxembourg, Grand Duchy of Luxembourg is the Management Company.

The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM Active Investments S.A. cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is forbidden, and is not intended for any person or entity to whom or to which it would be illegal to address such a document.

In particular, the investment products are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). Past performance, including periods of decline, is not a reliable indicator of future results. The value of investments may go down as well as up, and investors may not recover the full amount invested. The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation, and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary.

This marketing document has not been approved by any financial Authority. This document is strictly confidential and addressed solely to its intended recipient; its reproduction and distribution are prohibited. Issued in by RAM Active Investments S.A. (Rue du Rhône 8 CH-1204 Geneva) which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA).

No part of this document may be copied, stored electronically or transferred in any way, whether manually or electronically, without the prior agreement of RAM Active Investments S.A.

-

Marketing Material | For Professional Investors only.

Plus d'actualités et d'informations

.png)

.png)

.png)

.png)

.png)

.png)