Commentaries

14 August 2019

July 2019 - Volatility returns as the trade war saga enters a new stage - Systematic Fund Manager's Comments

The announcement from President Trump to impose a 10% tariff on a further $300bn of Chinese goods and the immediate retaliatory measures from Chinese authorities sent a shock wave through global financial markets. The inability of both nations to make progress in the discussions could well morph into a monetary and financial war. An early sign is the fact that the U.S. has listed China as a currency manipulator. Additionally, the deteriorating economic outlook globally, with manufacturing PMIs across the Euro area, China, Japan and South Korea standing below 50 and the investment trend and corporate earnings showing signs of a loss of impetus, represents for risk assets, a field for erratic moves in the coming months.

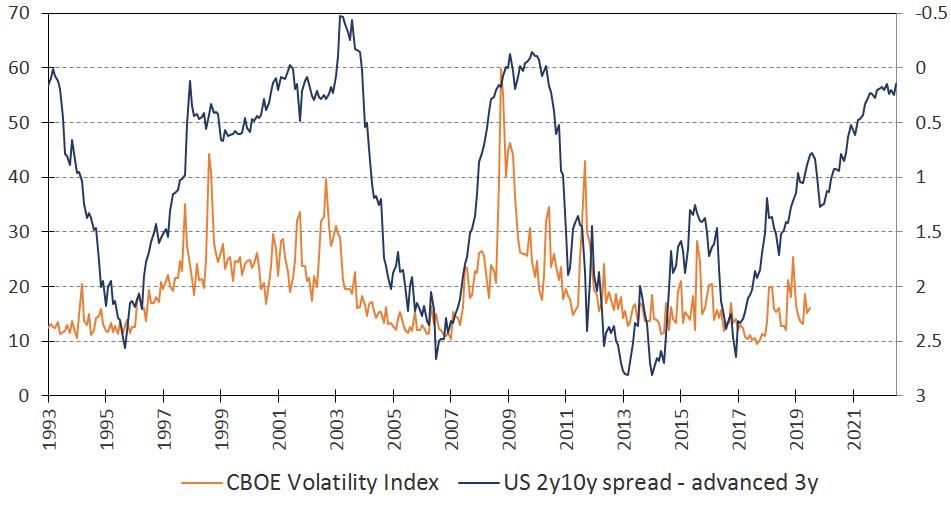

By analyzing the long-term behavior of the U.S. interest rates curve and the equity market volatility, there appears to be a relationship between the two (see chart below), advocating for the fact that a volatility regime change is likely to happen in the coming quarters.

US Treasury 2y10y spread advanced 3 years vs VIX Index

Source : Bloomberg, RAM Active Investments, at 31/07/2019

Lower interest rates are no guarantee for the survival of leveraged companies with poor fundamentals

Central banks’ actions are already an implicit acknowledgement that rising debt levels are unsustainable at higher rates and under tighter liquidity conditions. On the other side, there will be a point at which some arbitrage needs to be done between supporting growth at any cost and limiting the consequences of a drastic reversal in risk appetite due to several factors that built up during the decade following the GFC:

- The non-financial corporate debt stock has increased dramatically since 2008. According to BIS figures, in G20 countries, total credit to the non-financial sector (core debt) represents 235.5% of aggregate GDP as at the end of 2018, up from 199.60% in Q3 2008. There is an increasing number of companies facing higher debt levels with deteriorating margin and cash flow situation. Instead of their stock price reflecting company fundamentals, they have been taking the opposite direction as if cheap refinancing is warranted for the coming years!

- One shot equity market supporting factors are having diminishing effects (corporate tax cuts, stock buyback programs, advances in automation reducing the labor costs, etc.).

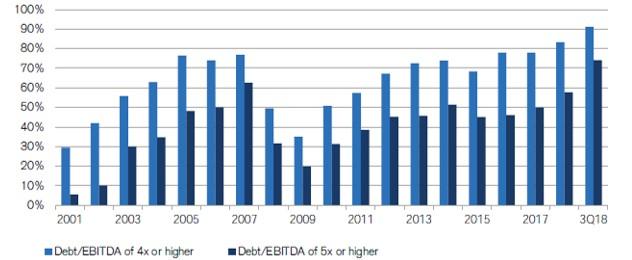

The following chart indicates a worrying signal that 70% and 80% of issuance in US corporate loans has been performed by companies with leverage (debt/EBITDA) above 5x and 4x respectively:

Increasing leverage in the corporate loan market

Source: S&P LCD, Credit Suisse

Companies with strikingly weak earnings generation ability and deteriorating return on assets would be heavily penalized once stocks are selected based on company specific factors, rather than macro/liquidity reasons alone. We believe the gradual integration of the incoming micro and macro data by the market will correct the extreme market inefficiencies in place today our models are currently detecting and on which they will be able to capitalize in the coming quarters, with a particular focus on:

- Liquidity

- Company fundamentals

- Diversification

- All cap exposure

- Efficient and rapid integration of new information

The establishment of our strong long-term track record has been based amongst others on these points and in our view, they can’t be dissociated from any process driven-investment strategy. Investors should be prepared for this eventuality, as investor perception can shift quicker than everyone expects.

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments SA and the date of reference is the date of this document, end of the previous month.