Articles et Interviews

6 mars 2024

The Return of Attractive Real Yields [EN]

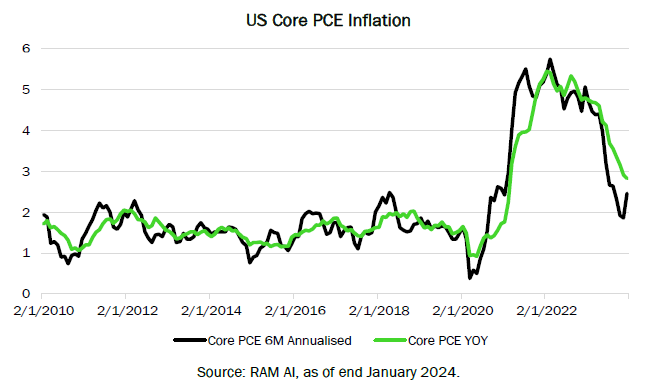

In their fight against post COVID-19 inflation surge, Central Banks over the world have embarked on an aggressive tightening of their monetary policies. As a result, inflation dynamic has materially turned at the end of 2022, and current underlying trends are pointing towards inflation levels returning decisively towards the 2% target, as can be seen on a 6-month annualised rate for US Core Personal Consumption Expenditures (PCE).

With monetary policies now restrictive in most developed countries, real yields available to Fixed Income Investors are not only in positive territory, but also elevated relative to historical levels. Even after the Q4-2023 yield decline, US 10-year real yields remain at levels similar to those prevailing before the 2008 Great Financial Crisis.

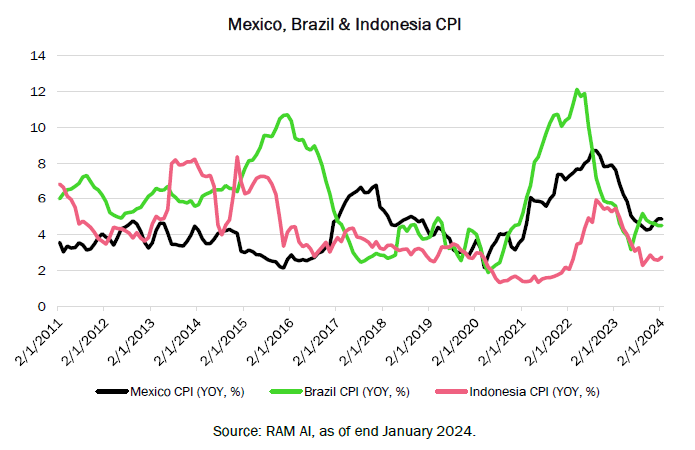

Beyond developed markets, real yields are also compelling in some Emerging countries. Indeed, several Emerging Markets’ (EM) central banks have aggressively tightened their monetary policy since 2021, anchoring inflation expectations and allowing for a significant disinflation process, as illustrated below for Mexico, Brazil and Indonesia.

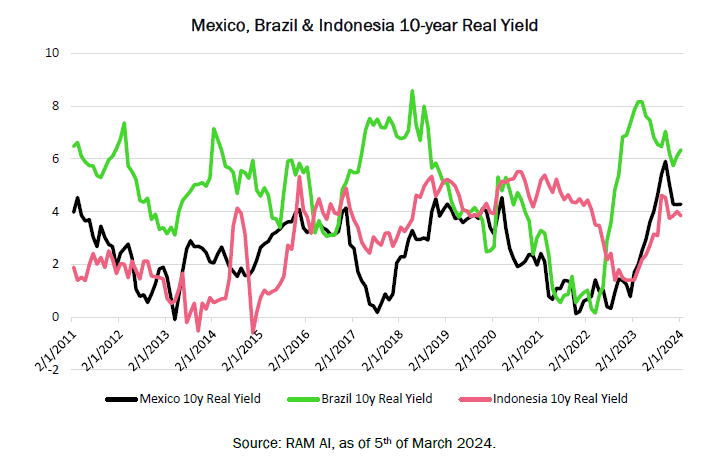

Looking at current real yields for the same countries, and even after the Q4-2023 rally, they remain compelling, sitting at or close to, the last 15 years highs.

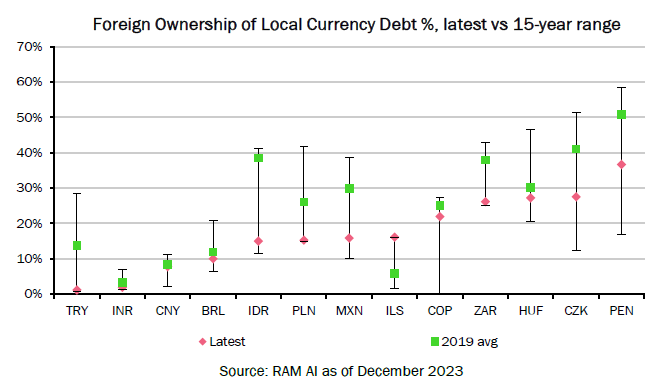

On top of orthodox monetary policies, most EM local currency markets have been under-owned by foreign investor, making them not only less vulnerable to outflows, but also subject to potential catch-up.

Fixed Income investors are now rewarded by positive and sometimes significant real yields, and some EM local currency markets also offer very attractive opportunities for a global and diversified portfolio.

by Gilles Pradère

Senior Fixed Income Portfolio Manager

_________

Important Information

The RAM (Lux) Tactical Funds – Global Bond Total Return is a Sub-Fund of RAM (Lux) Tactical Funds a Luxembourg SICAV with registered office: 14, Boulevard Royal L-2449 Luxembourg, approved by the CSSF and constituting a UCITS (Directive 2009/65/EC).

The RAM (Lux) Tactical Funds II – Asia Bond Total Return is a Sub-Fund of RAM (Lux) Tactical Funds II, a Luxembourg SICAV with registered office: 14, Boulevard Royal L-2449 Luxembourg, approved by the CSSF and constituting a UCITS (Directive 2009/65/EC).

Please note that the share classes mentioned in this document may not be registered in your country of domicile.

This marketing document is only provided for information purposes to professional clients, and it does not constitute an offer, investment advice or a solicitation to subscribe shares in any jurisdiction where such an offer or solicitation would not be authorised or it would be unlawful. In particular, the Funds are not offered for sale in the United States or its territories and possessions, nor to any US Person (citizens or residents of the United States of America).

This document is confidential and is intended only for the use of the person to whom it was delivered; it may not be reproduced or distributed.

There is no guarantee that the holdings shown will be held in the future. The investment described concerns the acquisition of shares in the Sub-Funds and not in a specific underlying asset.

Past performance is not a guide to current or future results. There is no guarantee to get back the full amount invested. The performance data do not take into account fees and expenses charged on subscription and redemption of shares nor any taxes that may be levied. As a subscription fee calculation example, if an investor invests EUR 1000 in a fund with a subscription fee of 5%, the investor will pay to his financial intermediary EUR 50.00 on the investment amount, resulting with a subscribed amount of EUR 950.00 in fund shares. In addition, potential account keeping costs (by investor’s custodian) may reduce the performance. Some shares in the Sub-Funds apply a performance fee. Leverage intensifies the risk of potential increased losses or returns.

RAM Active Investments may decide to terminate the marketing arrangement in place in any given country in accordance with Article 93a of Directive 2009/65/EC.

Changes in exchange rates may cause the NAV per share in the investor's base currency to fluctuate.

Particular attention is paid to the contents of this document but no guarantee, warranty or representation, express or implied, is given to the accuracy, correctness or completeness thereof.

Prior to any transaction, clients should check whether it is suited to their personal situation, and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary.

Please refer to the Key Investor Information Document and prospectus with special attention to the risk warnings before investing. For further information on ESG, please refer to https://www.ram-ai.com/en/regulatory-information and the relevant Sub-Fund webpage.

The prospectus, constitutive documents and financial reports are available in English and French while PRIIPs KID are available in the relevant local languages. These documents can be obtained, free of charge, from the SICAVs’ and Management Company’s head office and www.ram-ai.com, its representative and distributor in Switzerland, RAM Active Investments S.A. and the relevant local representatives in the distribution countries.

A summary of Investors’ rights is available on: https://www.ram-ai.com/en/regulatory-information

Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, RAM Active Investments (Europe) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg.

The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments and the date of reference is the date of this document.