Commentaries

14 January 2021

December 2020 - 2020, the outlier of all extremes - Systematic Fund Manager's Comments

The year 2020 has been the most challenging one we have experienced in terms of systematic stock selection since we started RAM AI in 2007. The difficulty in systematic stock selection lies in outliers, in points never witnessed in the distribution before. Some of our alpha engines behave differently in these circumstances than what we have ever witnessed, analyzed (in the last 30 years of data available to us) or predicted. 2020 was marred by these outliers. The market moves on the surge of a global coronavirus pandemic in March, the central banks’ led rotation in June or the November vaccine-led risk-on have all been a large number of standard deviations away from the norm or from anything the markets have witnessed in the three decades.

To mitigate the pain caused by these extreme market moves and outliers, we rely on diversification. Our Long blend of Value Convergence, Growth Momentum, Low Risk Carry and Machine Learning Agnostic strategies aims to reduce the impact of outliers on our funds’ returns. Blending these strategies together and researching on an ongoing basis how to improve the risk-adjusted returns of these engines has helped us go through extremely challenging market conditions for systematic managers before: the 2008 Great Financial Crisis, the 2013 QE tapering hurting EM, the 2016 ECB-led risk-on rotation in Europe, to name a few. We must recognize that 2020 proved more challenging than any of these prior market circumstances.

We first witnessed an extraordinary negative environment for Value Convergence-playing strategies, which under-performed significantly on the March downside and in a very unusual manner kept underperforming in the rebound until Q3. This Value underperformance, which came after two years of sharp Value unwind in the market has led these names to trade at a historically attractive discount levels, creating a large number of investment opportunities that both our Value and Machine Learning engines have started benefiting from in Q4 after a significant underperformance.

Offsetting the above strategies’ weakness globally, our Momentum and Low Risk engines helped contribute positively to our performance until Q3, our Growth/Momentum strategy leading the way, to give back a lot of that during the November vaccine-led risk on phase.

The Growth bubble or the Great Short Capitulation

Fiscal and monetary stimulus globally have been a strong support to the world’s economy and an essential part of the market recovery from the March correction. A high level of interventionism is not the best warrantor of efficient markets and tends to be unfavorable to our more “fundamental-driven” strategies, particularly to our Short stock selection strategies. It has definitely been the case in 2020. Unprecedented monetary stimulus has helped fuel the inflation of financial assets globally, helping them even to diverge at least momentarily from developments in the economy. December saw a new record of negative-yielding debt (USD 18trn), illustrating this record valuations well.

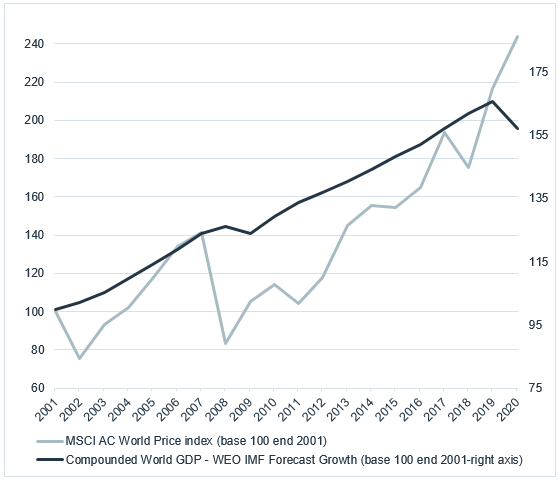

This unprecedented stimulus has helped avert a potential economic collapse and led global markets to diverge from the GDP contraction (cf. fig.1) but it has other unavoidable consequences. When it took five years for global Equity markets to revisit their highs after the Global Financial Crisis, it took a few months this time, with high expectations of market participants on central banks actions and a prompt recovery.

Compounded World GDP vs World Equities

Source: RAM AI, Bloomberg, as of 31.12.2020

It has also helped fuel highly speculative trends in a number of fashionable growth industries. From EVs and hydrogen plays to data software, food delivery or biotech stocks, some sub-industries are boasting levels of valuation on revenues that were last seen (with much smaller market caps) at the height of the dotcom bubble. Bubbles are only commonly accepted after they have burst, but it is clear to us that the recent round of stimulus has only pushed to new extremes parts of the market, this move being likely alimented by speculative buying of more retail participants (not dissimilar to the parallel upswing in the largest cryptocurrencies).

It has been extremely difficult to short in this market environment leading eventually to what almost amounts to a capitulation on shorting and the largest short covering we ever witnessed with the Pfizer/BioNTech vaccine announcement at the beginning of November. Our Short strategies have been very strongly negatively hit by this short covering and the risk-on environment that has prevailed in the second half of the year despite a still highly uncertain environment and contradictory fundamental trends.

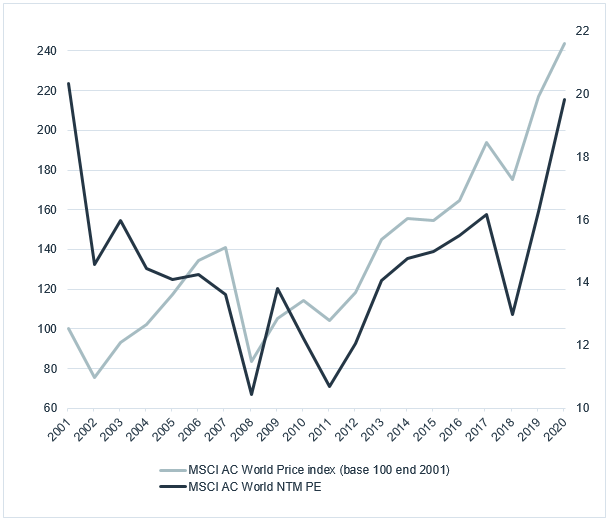

This speculative environment has created record-high dispersion of valuations in the market which should we hope convert into strong performance for systematic Market-Neutral strategies after three dismal years. The high levels of valuation reached globally (cf. fig. 2) on the back of the stimulus make it likely that this should be delivered on re-pricings with market downsides.

The World Equities Performance vs P/E

Source: RAM AI, Bloomberg, as of 31.12.2020

In this challenging backdrop, we remain in 2021 committed to provide our investors attractive Equity investments that diversify their risks away from concentrated benchmarks, maintain strong valuation and fundamental dynamics, with strong and sustainable long-term risk-adjusted returns.

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the Management Company RAM Active Investments (Europe) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg. The reference to RAM AI Group includes both entities, RAM Active Investments S.A. and RAM Active Investments (Europe) S.A.