As Of

RAM (Lux) Systematic

Stable Climate Global Equities - Art. 9

Fund information

Tot. Asset (Eur MN)

Num. of holdings

Fund Launch Date

Summary risk indicator

- Characteristics of the Sub-fund

- Performance

- Subscription and redemptions modalities

- Glossary

-

Management CompanyMediobanca Management Company SA

-

DepositaryBanque de Luxembourg SA, Luxembourg

-

Central AdministrationEuropean Fund Administration S.A, Luxembourg

-

AuditorErnst & Young S.A., Luxembourg

-

Regulatory AuthorityCSSF, Luxembourg

-

Legal StructureSICAV (UCITS V)

-

CurrencyUSD

-

LiquidityDaily

-

Duration of the Sub-FundIndefinite (Open Sub-Fund)

- Performance as of

Source: RAM Active Investments

This graph only displays information over full calendar years of realized track record for the selected share class. All fees and charges have been taken into account, with the exception of entry and exit fees. The initial fee may have a substantial impact on the performance of your investment.

All fees and charges have been taken into account, with the exception of entry and exit fees.The initial fee may have a substantial impact on the performance of your investment.

All fees and charges have been taken into account, with the exception of entry and exit fees.The initial fee may have a substantial impact on the performance of your investment.

Subscription and redemptions modalities

We recommend that you contact your usual financial adviser, who will be able to help you to:

-

1Assess your investor profile

-

2Take your current financial situation into account

-

3Tailor your investment objectives to your personal situation

-

4Plan the best way to achieve your objectives

Whenever you instruct your bank, your financial adviser or any other intermediary to carry out a transaction involving one of the RAM Active Investments sub-funds, we recommend that you read the sub-fund’s legal documents and identify the ISINs of the sub-funds/share classes that interest you ahead of time so that you can discuss them with your financial adviser directly. You will find these codes on the sub-funds’ factsheets (and other legal documents), and on the website.

Glossary

-

Alpha

Alpha is the difference between the performance of the fund and its expected performance given its market sensitivity or Beta. Alpha is used as a measure of value added by a fund manager. A positive alpha indicates that a fund has performed better than its Beta, systematic risk exposure, would predict. Alpha is the intercept value derived from the single-factor (market index) regression defined to calculate Beta.

-

Beta

Beta is defined as a fund’s sensitivity to market movements and is used to evaluate systematic risk. Beta is a measure of the linear relationship over time, the slope, of the fund’s returns and those of the benchmark. Beta is computed by regressing the fund’s excess returns over the risk-free rate against the excess returns of the benchmark over the risk-free rate. A beta greater than 1 means that the fund tends to amplify market movements, when it amortizes them when beta is lower than 1, suggesting a more defensive behavior.

-

Max Drawdown

Max Drawdown is a downside risk analytic that measures the worst period of peak-to-valley performance of the fund, regardless of whether or not the drawdown consisted of consecutive observations of negative performance. It represents the maximum loss that an investor could have incurred during the period.

-

Sharpe

Sharpe Ratio is a Risk/Return measure of the annualized fund's returns in excess of the risk free rate to the annualized standard deviation of these returns. The higher the ratio, the better is the fund, since it will have delivered a higher marginal return per unit of risk, represented by the volatility. A negative Sharpe ratio only indicates that a risk-free asset would have performed better than the fund.

-

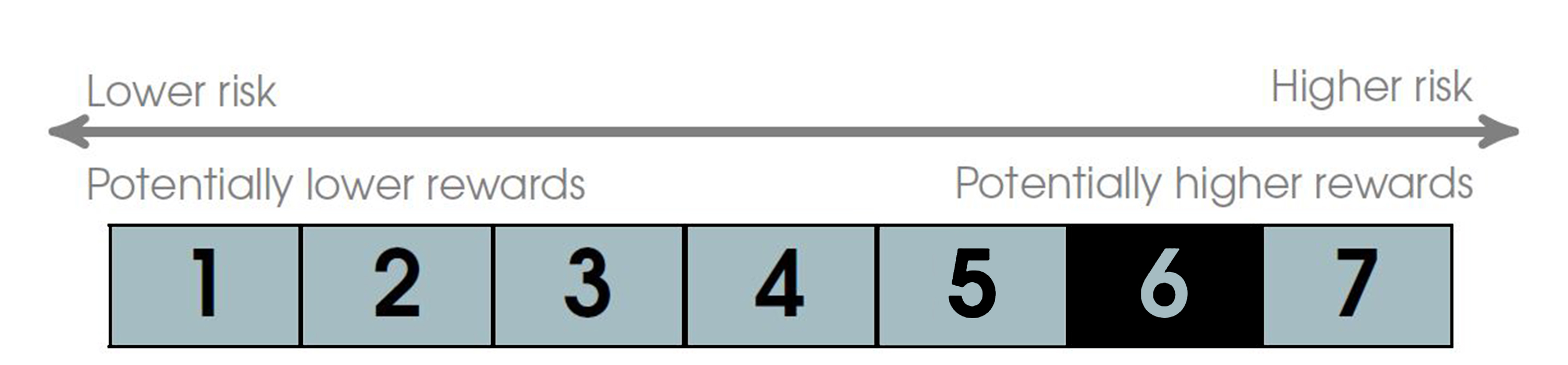

SRRI

The SRRI represents the risk and return profile as presented in the Key Investor Information Document (KIID). The lowest category does not imply the investment is risk free. The SRRI is not guaranteed and may change over time.

-

Volatility

Amplitude of the variation of the price/of the value of a security, a sub-fund, a market or an index, measuring the importance of risk over a given period. Volatility is calculated through the standard deviation obtained through calculating the square root of the variance. Variance being the average of the squared differences of deviations from the mean.The higher the volatility, the riskier the security, the sub-fund may be.

-

Swing Pricing

Swing pricing refers to a process for adjusting a fund’s net asset value (NAV) to effectively pass on transaction and market impact costs stemming from net capital activity (i.e., flows into or out of the fund) to the investors associated with that activity during the life of a fund, excluding ramp-up period or termination.

-

High-Water Mark

This is the highest net asset value (NAV) that a fund has reached and for which a performance fee was paid.

Using a high-water mark prevents the fund manager from receiving any performance fees on downside outperformance. It also means that investors do not end up paying performance fees more than once for the same increase in their fund's NAV (which is something that could otherwise happen in a fluctuating or sideways market).

Objectives & Investments Policy

The sub-fund mainly invests, without sector restrictions, in shares of companies. The sub-fund predominantly invests in companies which are or should be able to benefit from seeking solutions in the context of the energy transition and reduction of carbon emissions. The proportion of the sub-fund’s net asset value invested in the equities market and in equity securities in the capital of any company is at least 51%.

The sub-fund may invest up to 10% of its net assets in units of UCITS or other UCIs.

The manager may use derivatives to hedge or optimise the portfolio’s exposure. Furthermore, the sub-fund may hold cash on an ancillary basis. The portfolio is actively managed on a systematic basis without using a reference benchmark.