Commentaries

11 April 2019

March 2019 - It’s time to focus on market fundamentals, diversification and valuation: The example of Emerging Markets - Systematic Fund Manager's Comments

Following a period driven by liquidity and macro on financial markets, it’s time to focus on market fundamentals, diversification and valuation: The example of Emerging Markets

For the past 12 months, equity markets have been mostly led by liquidity (an increase in passive beta ETFs, hedge funds deleveraging, short covering effects...), macro stories (central bank’s actions, trade wars, Brexit …) or by “Growth/Mega Cap” themes. For us, this period is not exceptional in markets’ history, and the question now for investors is where to invest now? According to us, it’s time to focus on the risk allocation, valuations and fundamentals of equities. In this editorial, we analyse the current Emerging Markets situation and where we see a unique opportunity for stock picking, especially on small and mid-caps.

Key Takeaways:

- EM structural growth calls for long-term diversified portfolio allocation as the story is not all about China

- All-Cap approach: an efficient way to capture both domestic and global growth, to diversify the risk and an outstanding source of inefficiencies to capture on the long term

- EM Small & Mid Cap stocks current potential: last seen in the late 90’s

- Growth versus Value, the trend should turn in favour of Value, active managers could start outperforming again

1. EM structural growth calls for long-term diversified portfolio allocation as the story is not all about China

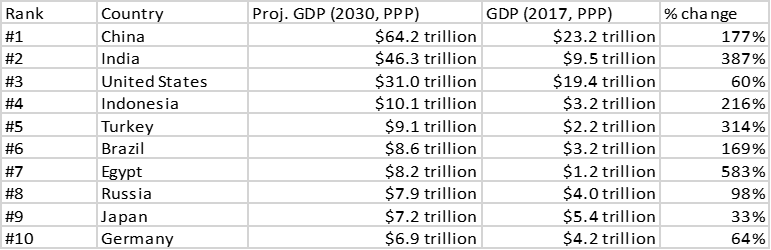

The economic growth potential in EM measured by PPP (Purchasing Power Parity) will outstrip that of their developed peers. In 2030, seven of the world’s largest 10 economies by GDP (PPP) should be from emerging markets. Growth in EM is not exclusively a Chinese story!

Source: Standard Chartered

In a global asset allocation context, an exposure to economies with growing purchasing power brings an additional source of return and diversification benefits. However, long-term expansions rarely occur in a linear fashion. Short-term adjustments in this trajectory to maturing economies are accompanied with volatility linked to global macroeconomic and political forces, as well as technical and country specific factors. Although the timing of these events remains a difficult exercise, investors have at their disposal various tools to mitigate any adverse effects. Market cap, country, sector and strategy diversification (essential elements in any portfolio allocation) bears even more importance when it comes to investing in EM.

2. All-Cap approach: an efficient way to capture both domestic and global growth, to diversify the risk and an outstanding source of inefficiencies to capture on the long term

Broad EM indices can often present undesirable exposures such as market cap (large cap), country (China), sectors (Tech, Financials, Oil) as well as single name concentration. Additionally, given the Large/Mega Cap tilt of passive investment vehicles, a significant number of constituents are highly dependent of global growth trends, making them vulnerable to liquidity and market cap risks.

EM Mid & Small Caps present the following characteristics compared to their Large Caps counterparts:

- Significantly tilted towards domestic demand

- Less vulnerable to global growth woes (less exposed to foreign revenues)

- Exhibit long-term source of inefficiencies (see Figure 1)

- Diversified sector & country allocation and risk (see Figure 2) especially after the recent concentration of risk on mega caps

Data since composite Inception (01.2010)

3. EM Small & Mid Cap stocks current potential: last seen in the late 90’s

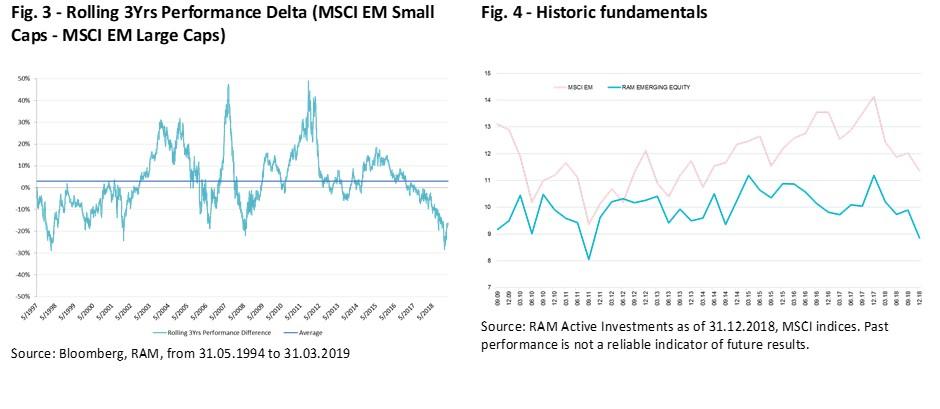

The crowding effect into large and mega caps has been continuing unabated, aided by the accommodative monetary policies across the globe. The consequences for Mid/Small Caps; there lengthy neglection. Figure 3, below, illustrates the cumulative 36-month rolling performance of EM Small vs Large Caps. EM Small Caps’ underperformance has reached levels unseen since the 1998 Asian Financial Crisis. History tells us that this situation represents an attractive entry point for investors looking for a true all-cap approach to investing in the region.

Accordingly, since we began managing our Strategy in 2009, we’ve not seen valuations of our portfolio positions this inexpensive (P/E basis – Figure 4). We strongly believe that the odds of a trend reversal in the coming quarters have increased significantly. Our all-caps Strategy is well positioned to capture a normalization of this extreme situation, and it can produce strong outperformance in a diversified manner

4. Growth versus Value, the trend should turn in favor of Value, active managers should start outperforming again

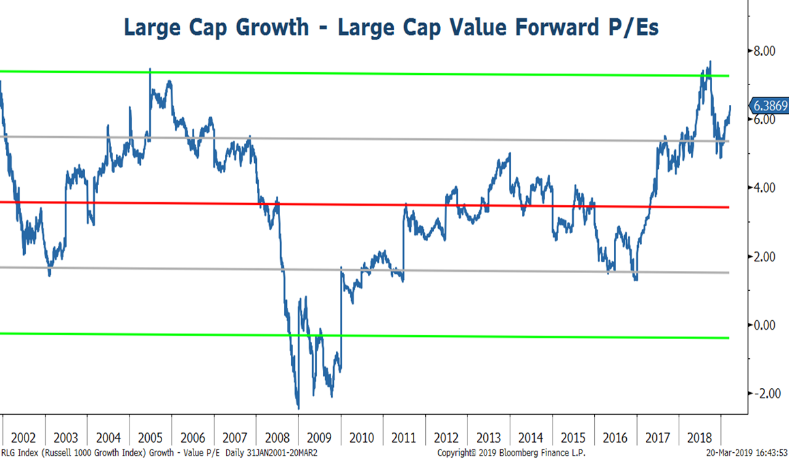

“Real interest rates remain elevated making “valuation” a critical factor to consider. Expensive long duration assets—growth stocks—remain vulnerable (…) With idiosyncratic risk now higher than average, active managers should be able to outperform passive. Alternative strategies should also do better as alpha opportunity set improves and beta trade subsides with QE era over.” Morgan Stanley

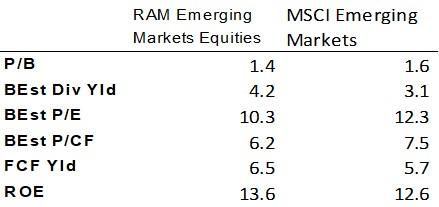

Given the current stage of the economic cycle, valuations should become increasingly important for investors after a non-discriminating period and the current relative generous valuation of growth stocks versus value stocks. Our Emerging Markets Strategy is well positioned to take advantage of this environment:

Conclusion:

The trend in policy change and structural reforms in EM will continue to help boost middle class emergence, simultaneously increasing at the share of EM in global growth. From an investment perspective, we believe an all-cap diversified approach is the most efficient way to extract the benefits of a secular growth story, as mid and small size companies will be the main beneficiaries of this process in our opinion. Such an approach is an efficient way to navigate short-term volatility since it helps mitigate any potential negative impact from foreign revenues (large & mega cap related mainly). In addition, the current discount of EM small versus large caps and our portfolio valuation levels indicate an interesting and compelling setup for our Emerging Markets Equity Strategy, which can produce strong returns in the coming quarters.

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments SA and the date of reference is the date of this document, end of the previous month.