Commenti

30 Agosto 2024

Emerging Markets: What's Next? [In English Only]

Despite the strong Chinese slowdown, Emerging Markets (EM) remain the largest global growth driver and provide investors with a wealth of investment opportunities. Stabilising inflation and anticipated rate cuts further enhance the investment appeal in these regions. Where can we find growth opportunities with quality and attractive valuations today?

EM: The Global Growth Driver

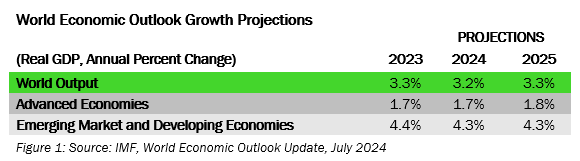

According to the International Monetary Fund’s most recent projections (IMF World Economic Outlook, July 2024), EM are projected to grow 4.3% this year and next, more than double the pace of advanced economies.

A key factor in this optimistic outlook is the rapid decline in inflation seen since early 2023. Inflation rates have quickly returned to target levels, surpassing the progress made in developed economies. Significant improvements have been noted in Asian markets and in general across Latin American and CEEMEA (Central and Eastern Europe, Middle East and Africa) economies.

Central banks in these regions have maintained a cautious, hawkish stance, keeping interest rates high to anchor inflation expectations. While this strategy may limit short-term growth, it is designed to ensure long-term economic stability. It is expected that more central banks will begin easing monetary policies later in 2024, particularly in Mexico and Brazil. The timing of these rate cuts will depend on the actions of the US Federal Reserve, whose policies significantly impact the global economic environment. The anticipated easing of monetary policies is likely to stimulate economic activity by reducing borrowing costs and encouraging investment.

In the long term, most emerging countries have the advantage of positive demographics and ascendant middle classes, which should further support growth.

Valuations are Attractive, with Quality

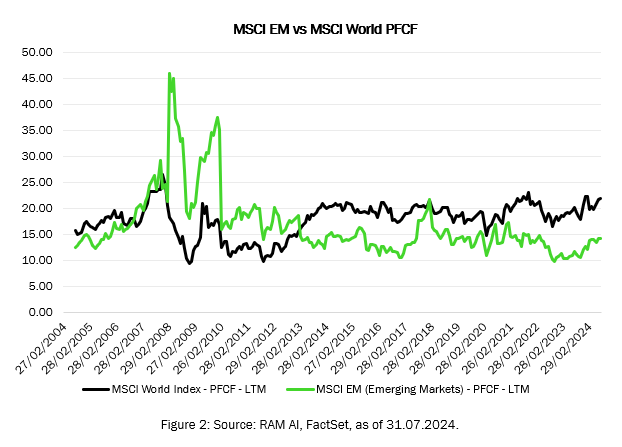

While Developed Markets equities trade close to the most expensive historically, looking at Free-cash-flow-based valuations, EM equities remain below their last 20-year average valuations and trade at a large discount compared to their developed counterparts. This discount reflects both the attractive Value and Quality characteristics of many EM companies today, which have the ability to invest in their growth with less reliance on external financing than before.

Outside of the Heavyweights, a Wealth of Opportunities

The first challenge to consider when investing in EM today is the concentration risk.

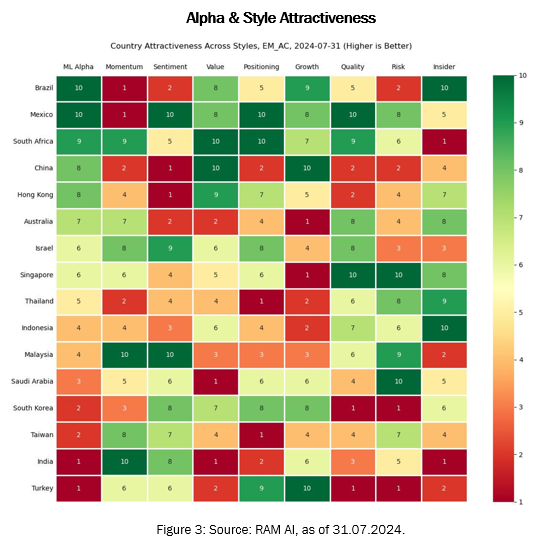

China, the largest market heavyweight, is now very attractively valued on the Equity side but still suffers from negative fundamental momentum and low overall quality of a market burdened by excessive leverage.

India, the challenger, still has strong momentum but is marred with excessive valuation across sectors after years of speculative flows into the country stocks, with local companies today ranking among the least attractive globally from a valuation and insider selling perspective.

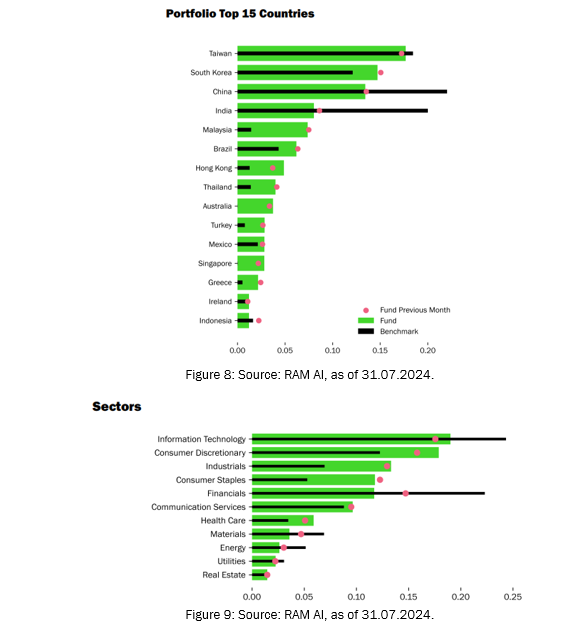

Together, the two heavyweights represent 43% of the market and the MSCI EM weighting, with a considerable concentration of risks for ETF investors. The RAM Emerging Markets Equities strategy currently has an allocation of 22% to both countries combined, with Taiwan currently at the top of our EM allocation.

On the Value side, South Africa, Brazil and Mexico provide many selective opportunities to investors, with compelling price levels and attractive growth prospects.

The current market concentration leads Taiwan Semiconductor to an allocation of more than 9% in the MSCI EM, exposing passive investors to a large stock-specific risk in the index.

Over the long run, broader country and stock diversifications help mitigate risks from sharp rotations, such as the Chinese Mega-Cap trade unwind in 2021. The RAM EM Equities Strategy was up more than 12% that year, while the Chinese stock reversal led the index into negative territory.

Artificial Intelligence in EM

AI has been one of the largest drivers of developed markets’ upside in the last two years, but we are still in the early stages of realising AI's potential in EM. Taiwan still dominates the semiconductor market, both in graphics processing unit (GPU) and AI-ready central processing unit (CPU) manufacturing. A number of local companies still trade at very reasonable valuations, making them compelling compared to their US and EU counterparts.

The AI upside potential in EM is real and this year has seen the beginning of a trend in the most visible companies in the sector, which is likely to broaden more in the upcoming quarters.

Long-term Return Generation in the RAM EM Equities

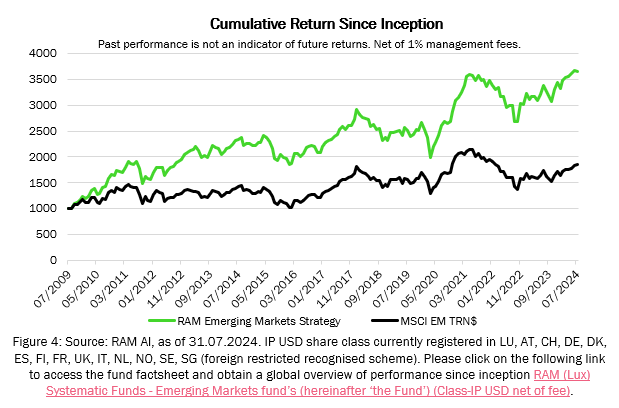

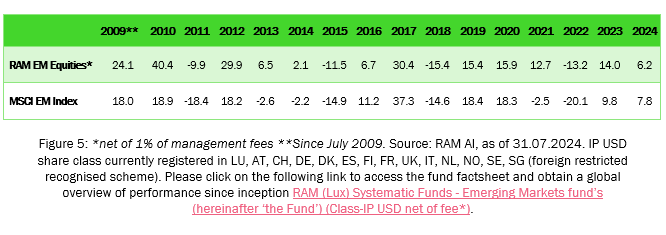

Since 2009, the RAM EM strategy has delivered an annualised return of 9%, up 266% in the last 15 years while MSCI EM was up 85%.1

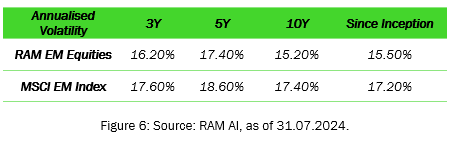

The strategy has delivered risk-adjusted positive returns relative to the MSCI EM Index. Since its inception in 2009, the strategy has often outperformed the index in cumulative returns while maintaining lower volatility across multiple time periods. Notably, the strategy has shown resilience in challenging market conditions, achieving positive returns during some periods when the MSCI EM Index has faced declines.

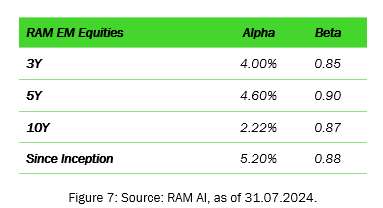

The strategy has generated positive annualised alpha ranging from 2.22% to 5.2%, showing a potential to generate excess return. The beta values indicate that our strategy has lower volatility compared to the market, reflecting our focus on delivering strong returns while maintaining a more stable performance.

Sector & Country Diversification

Our strategy is built on a foundation of broad sector and geographic diversification, which is critical for navigating the complexities of EM. As depicted in the accompanying charts, the strategy avoids overconcentration in any single sector or country, unlike the MSCI EM Index, which is heavily skewed towards specific areas. For instance, our portfolio maintains substantial allocations across the Information Technology, Consumer Discretionary and Industrials sectors, ensuring that our investment exposure is balanced and resilient to sector-specific downturns.

Similarly, the strategy's geographic distribution includes significant allocations to Taiwan, South Korea, China and India, while also providing meaningful exposure to countries like Malaysia, Brazil and Turkey. This diversified approach not only mitigates risks associated with regional or sector-specific economic shifts but also positions the strategy to capitalise on a wider array of growth opportunities across the EM landscape.

Active Management in Inefficient Markets

EM are often characterised by inefficiencies driven by factors such as lower liquidity, less transparent corporate governance and fluctuating economic conditions. These inefficiencies create unique opportunities that require a dynamic and proactive management approach to fully exploit. The RAM EM Equities strategy is specifically designed to capitalise on these market inefficiencies through an advanced, systematic investment process that leverages AI and Machine Learning.

The active management strategy is not confined to static allocations or long-term predictions. Instead, it continuously adapts to real-time market conditions, sector trends and country-specific developments. By actively managing the portfolio, we can adjust our exposure to different sectors, countries and market caps, ensuring that we are well-positioned to seize emerging opportunities and mitigate risks. This ability to move quickly and decisively is crucial in EM, where market conditions can change rapidly and opportunities can be fleeting.

The integration of AI within our active management process enhances our ability to detect and react to these market inefficiencies. Our proprietary AI-driven models continuously analyse vast amounts of data, identifying patterns and predicting alpha across various market segments. This allows us to make informed, data-driven decisions that optimise our portfolio's performance in real-time. Over the long term, this active approach has delivered positive returns, often outperforming the MSCI EM Index which relies on passive management strategies.

In conclusion, the RAM EM Equities strategy has shown a strong track record of delivering positive risk-adjusted returns through a diversified and actively managed approach. The strategic sector and geographic diversification, combined with advanced AI-driven models, enable us to capture opportunities in the inefficient EM. The strategy’s generation of positive alpha and lower volatility compared to the market underscores our determination to providing stable, long-term growth for our investors.

1 Past returns are not a reliable predictor of current or future returns. Investments carry inherent risks, and there is no guarantee of profit or protection against loss.

Disclaimer

Important Information:

The Emerging Markets Equities Fund is a Sub-Fund of RAM (Lux) Systematic Funds, a Luxembourg SICAV with registered office: 14, Boulevard Royal L-2449 Luxembourg, approved by the CSSF and constituting a UCITS (Directive 2009/65/EC). Mediobanca Management Company S.A. 2 Boulevard de la Foire 1528, Luxembourg, Grand Duchy of Luxembourg is the Management Company. The portfolio is actively managed on a discretionary basis with reference to a benchmark. While the product compares its performance against the MSCI Daily TR Net Emerging Markets , it does not try to replicate this benchmark and freely selects the securities that it invests in. The deviation with this benchmark can be significant. Before making an investment decision, please read the prospectus and KID.

The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM Active Investments S.A. cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice.

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is forbidden, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the investment products are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation, and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary.

Note to investors domiciled in Singapore: shares of the Sub-Fund offered in Singapore are restricted schemes under the Sixth Schedule to the Securities and Futures (Offers of Investments)

(Collective Investment Schemes) Regulations of Singapore.

There is no guarantee that the holdings shown will be held in the future. The investment described concerns the acquisition of shares in the Sub-Fund and not in a specific underlying asset. Past performance is not a guide to current or future results. There is no guarantee to get back the full amount invested. The performance data do not take into account fees and expenses charged on subscription and redemption of shares nor any taxes that may be levied.

RAM Active Investments may decide to terminate the marketing arrangement in place in any given country in accordance with Article 93a of Directive 2009/65/EC.

Leverage intensifies the risk of potential increased losses or returns. Changes in exchange rates may cause the NAV per share in the investor’s base currency to fluctuate.

Please refer to the Key Investor Information Document and prospectus with special attention to the risk warnings before investing. For further information on ESG, please refer to https://www.ram-ai.com/en/regulatory-information and the relevant Sub-Fund webpage (section ‘sustainability-related disclosures’). The prospectus, constitutive documents and financial reports are available in English and French while PRIIPs KIDs are available in the relevant local languages. These documents can be obtained, free of charge, from the SICAVs’ and Management Company’s head office and www.ram-ai.com, its representative and distributor in Switzerland, RAM Active Investments S.A. and the relevant local representatives in the distribution countries.

This marketing document has not been approved by any financial Authority. A summary of Investors’ rights is available on: https://www.ram-ai.com/en/regulatory-information

This document is strictly confidential and addressed solely to its intended recipient; its reproduction and distribution are prohibited. It has not been approved by any financial

Authority. Issued in Switzerland by RAM Active Investments S.A. (Rue du Rhône 8 CH-1204 Geneva) which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise)

Note legali

Il presente documento è stato redatto unicamente a scopo informativo. Esso non costituisce un'offerta né una sollecitazione ad acquistare o vendere i prodotti d'investimento ivi riportati e non può essere interpretato come un servizio di consulenza per gli investimenti. Il documento non è destinato alla distribuzione, pubblicazione o utilizzo in una giurisdizione nella quale tale distribuzione, pubblicazione o utilizzo siano vietati, né è indirizzato a soggetti o entità ai quali sarebbe illegale indirizzare tale documento. In particolare, i prodotti ivi riportati non sono offerti in vendita negli Stati Uniti o nei loro territori e possedimenti, né a qualsivoglia soggetto statunitense (cittadini o residenti degli Stati Uniti d'America). Le opinioni qui espresse non tengono conto delle circostanze, degli obiettivi o delle esigenze di singoli investitori. Si raccomanda agli investitori di formarsi una propria opinione in merito ai titoli o agli strumenti finanziari menzionati nel presente documento. Prima di qualsiasi operazione, gli investitori dovrebbero verificare che la transazione proposta sia adeguata alla propria situazione personale, e analizzare gli specifici rischi ad essa associati, soprattutto quelli di natura finanziaria, legale e fiscale, rivolgendosi se del caso a un consulente professionale. Le informazioni e le analisi contenute nel presente documento sono basate su fonti ritenute attendibili. Tuttavia, RAM AI Group non rilascia alcuna garanzia che tali informazioni e analisi siano aggiornate, accurate o esaustive, né si assume alcuna responsabilità per eventuali danni o perdite che potrebbero derivare dal loro uso. Tutte le informazioni e le valutazioni possono variare senza preavviso. Si raccomanda agli investitori di decidere se investire o meno nelle quote dei fondi sulla base delle ultime relazioni o dei più recenti prospetti informativi. che contengono ulteriori informazioni sui prodotti in questione. Il valore delle quote e il reddito da esse derivante possono sia aumentare che diminuire e non sono in alcun modo garantiti. Il prezzo dei prodotti finanziari menzionati nel presente documento potrebbe essere soggetto a fluttuazioni e ad ampie e brusche flessioni, ed è persino possibile che un investitore perda l'intero importo investito. RAM AI Group fornirà su richiesta agli investitori informazioni più dettagliate sui rischi associati a specifici investimenti. Le variazioni dei tassi di cambio possono altresì provocare un aumento o una diminuzione del valore di un investimento. I rendimenti passati, siano essi reali o simulati, non costituiscono necessariamente un indicatore affidabile dei risultati futuri. Il prospetto informativo, il documento contenente le informazioni chiave per gli investitori (KIID ), lo statuto e le relazioni finanziarie sono disponibili gratuitamente presso la sede centrale della SICAV, il suo rappresentante e distributore in Svizzera, RAM Active Investments S.A., Ginevra, e il rappresentante dei fondi nel paese di registrazione degli stessi. Il presente documento commerciale non è stato approvato par nessuna autorità finanziaria et ce documento è riservato e destinato all'uso esclusivo da parte del destinatario; ne sono vietate la riproduzione e la distribuzione totale o parziale. Rilasciato in Svizzera dalla RAM Active Investments S.A. è autorizzata e regolamentata in Svizzera dall’Autorità federale di vigilanza sui mercati finanziari (FINMA). Rilasciato nell'Unione Europea e nel SEE dalla Società di gestione autorizzata e regolamentata, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Lussemburgo, Granducato di Lussemburgo. La fonte delle suddette informazioni (salvo diversa indicazione) è RAM Active Investments SA e la data di riferimento è la data del presente documento, fine del mese precedente.