Commentaries

17 March 2025

Market Concentration & Opportunities

As investors focus on mega-cap U.S. equities, under-the-radar opportunities in dispersed Emerging Markets (EM) provide attractive diversification and potential for strong returns.

The Concentration Dilemma: A Market at Historic Extremes

Global equity markets are witnessing an extraordinary level of concentration, with U.S. stocks now making up 72.5% of the MSCI World Index—the highest on record. The dominance of a handful of mega-cap U.S. companies, comprising 19.2% of the S&P 500, has driven valuations to historic highs, echoing the extreme market environment of the dot-com bubble in 2000. While U.S. equities have delivered stellar returns, this concentration presents a risk that investors cannot afford to ignore.

With valuations stretched and economic uncertainty looming, diversification is paramount. History suggests that similar market conditions have led to reversals, rewarding those who broaden their equity exposure. Investors should consider opportunities beyond the crowded U.S. market, particularly in EM, where inefficiencies create fertile ground for active stock selection.

Figure 1. Source: RAM AI, MSCI, data as of end of December 2024.

EM: an Attractive and Underappreciated Opportunity

Despite recent headwinds, EM present a compelling investment case.

As we enter 2025 with a consensus favouring higher rates for longer, a US Dollar close to multi-year highs and the prospects of cuts in the post-COVID deficit-driven US stimulus, the asymmetry in both rates and the dollar lies in the downside.

Lower rates are likely in the US as disinflationary forces—ranging from ever-cheaper China exports to AI and reduced deficits--permeate through the economy.

These lower US rates would support EM currencies and flows into EM assets, which have lagged behind in the normalising rates environment.

Valuation Divergence: Justified by Growth Divergence?

Valuations in developed markets have diverged significantly from those in EM over the past few years. The MSCI EM index now trades at a FY1 PE of 14 while MSCI World at a FY1 PE of 22 (cf. Figure 2). EM equities are now better cash-flow plays than developed as they provide a free cash flow yield of close to 7.7%, while developed markets equities provide only a modest 4.3% yield, which is close to the 20-year low reached in 2007.

Figure 2. Source: FactSet, MSCI, data as of end of January 2025.

It is hard to justify these valuation spreads by earnings growth divergence, as EM just overtook developed markets on trailing 12-month EPS growth, barely positive for both universes last year (cf. Fig. 3).

Figure 3. Source: FactSet, MSCI, data as of end of January 2025.

The current free cash flow yield of EM equities and the yield attractiveness of EM assets or currencies in general are likely to stimulate demand as real rates in developed markets go back to lower levels in line with their debt burdens and demographics.

Looking long-term, structural growth drivers—such as a rising middle class, technological innovation and favourable demographics—support the long-term potential of EM over developed at these discount valuations.

Current market concentration and macro dynamics are very reminiscent of the beginning of the 2000s, which proved extremely favourable for a then lagging, under-invested EM market.

Selection Opportunities in EM

The current EM stock universe is characterised by a high level of valuation dispersions, offering a wealth of trading opportunities.

EM have historically been where fundamental, price and liquidity-based inefficiencies prevail the most. They are particularly attractive in terms of stock dispersion, as many investors adopt a top-down approach, with country flows often driving divergence in company valuations within sectors.

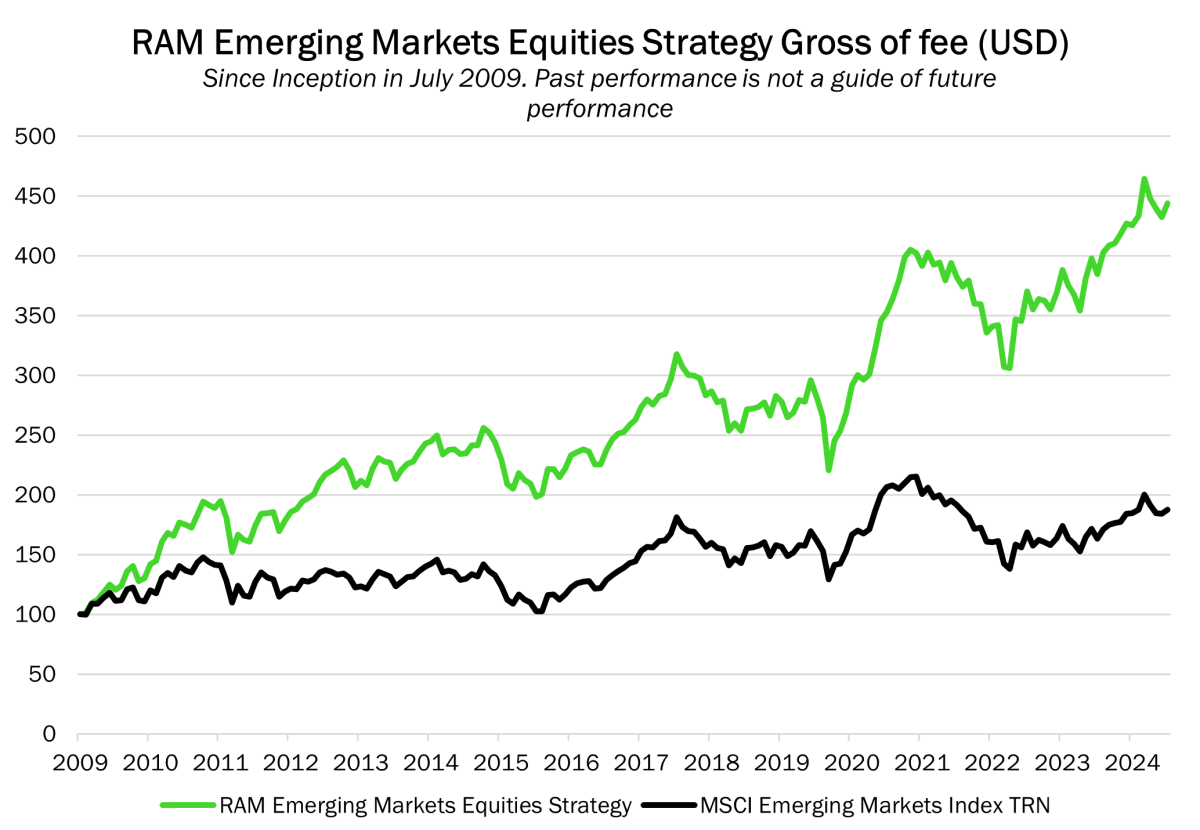

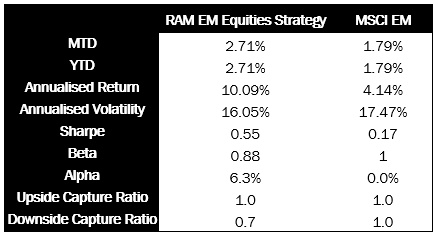

Since 2009, we have provided access to stock opportunities in EM, employing a strong fundamental stock selection process, systematised to ensure the repeatability of positive outcomes. We have refined our approach to incorporate the most effective processes for capturing a balanced mix of value, low-risk income and growth momentum opportunities across EM. Our well-diversified portfolio spans countries, sectors, styles and market capitalisations, allowing us to effectively manage volatility.

By leveraging a disciplined, systematic process, we analyse thousands of stocks often overlooked by large asset managers, who typically focus on a limited universe of a few hundred names. This allows us to identify high-quality mid-cap companies with significant upside potential that remain off the broad market’s radar.

Since 2009, the strategy has generated a 6% annualised excess return relative to MSCI, with 1.5 points less volatility than the market.

Figure 4. RAM Active Investments, FactSet Fundamentals, data as of 31.01.2025.

Figure 5. RAM Active Investments, FactSet Fundamentals, data as of 31.01.2025.

Artificial Intelligence and Timing

At RAM AI, to generate strong returns, we focus not only on identifying high-quality fundamental stocks but also on constantly refining the timing precision, knowing when to enter and exit these positions.

As the complexity of timing grows with the multiplication of datasets and inputs available to market participants, Artificial Intelligence (AI) has become an important tool to manage it efficiently.

Our Machine Learning models help us dynamically adjust position sizing by analysing hundreds of factors—including price, liquidity, risk, technical indicators and sentiment—alongside fundamental data. This ensures optimal timing management, to maximise alpha while minimising risk, effectively capturing and trading market opportunities.

Recent developments in AI, with the strong improvement of Large Language Models (LLMs) help us enrich these inputs with news (see Fine-Tuning Large Language Models for Stock Return Prediction Using Newsflow), earnings calls transcripts and improve the estimation of return potential for each stock across our strategies.

Regarding recent AI developments, DeepSeek highlights the fantastic dynamic in the open-source models community, and the trend towards lightweight LLMs. At RAM AI, we have been leveraging these advancements for years to make better sense of our data and continually enhance our investment process.

Figure 6. Source: RAM Active Investments, data as of January 2025.

by Emmanuel Hauptmann

CIO & Head of Systematic Equities

Disclaimer

Marketing Material. All forms of investment involve risk. The value of investments and the income derived from them is not guaranteed and it can fall as well as rise and you may not get back the original amount invested.

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments SA and the date of reference is the date of this document, end of the previous month.