Commentaries

10 April 2020

March 2020 - Risk assets reset – opportunities in equities and fixed income - Systematic Fund Manager's Comments

Extreme dispersion across asset classes

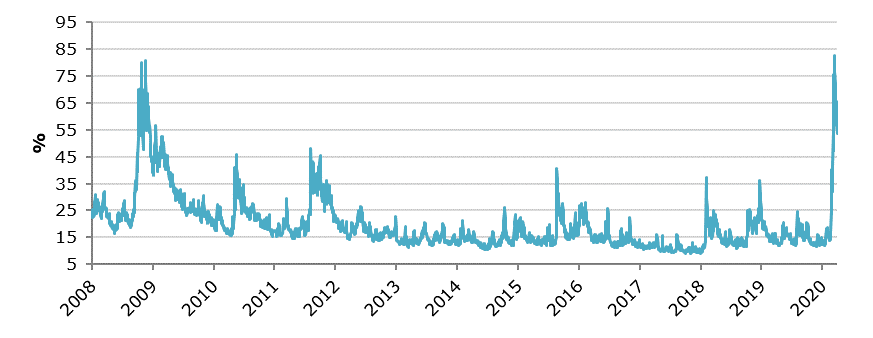

The rapid spread of the coronavirus pandemic resulted in the lockdown of one-third of the global population. In addition, the unexpected collapse of oil prices in early March added fuel to an already volatile market. Consequently, global risk assets went through a material reset, with the equity market’s implied volatility trading in line with 2008 peak levels.

Source: Bloomberg, RAM AI, as of 31.03.2020

The sharp volatility spikes across financial markets have created a significant dispersion inter and intra asset classes. In March, the market experienced an unprecedented dislocation, stemming from an extreme deleveraging across investors’ portfolios. From the 9th to the 18th, there was literally nowhere to hide as even “safe haven” assets suffered an incredible reversal. As an illustration, the 10-year US Treasury yield moved from 0.54% to 1.14% during that period.

The following table shows the YTD performance of the most liquid futures instruments across the four major asset classes, giving a sense of the dispersion and the extent of the moves so far this year.

Source: Bloomberg, RAM AI, as of 31.03.2020

Value and Mid & Small Caps’ behaviour draws parallels with previous market crashes

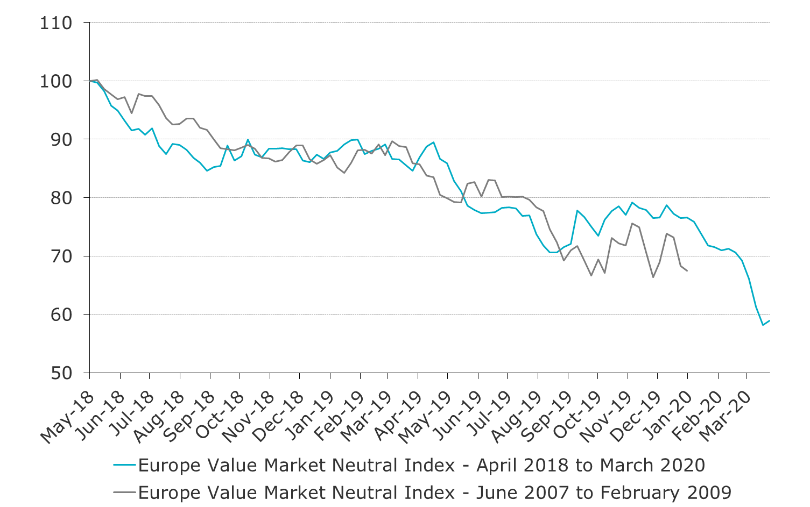

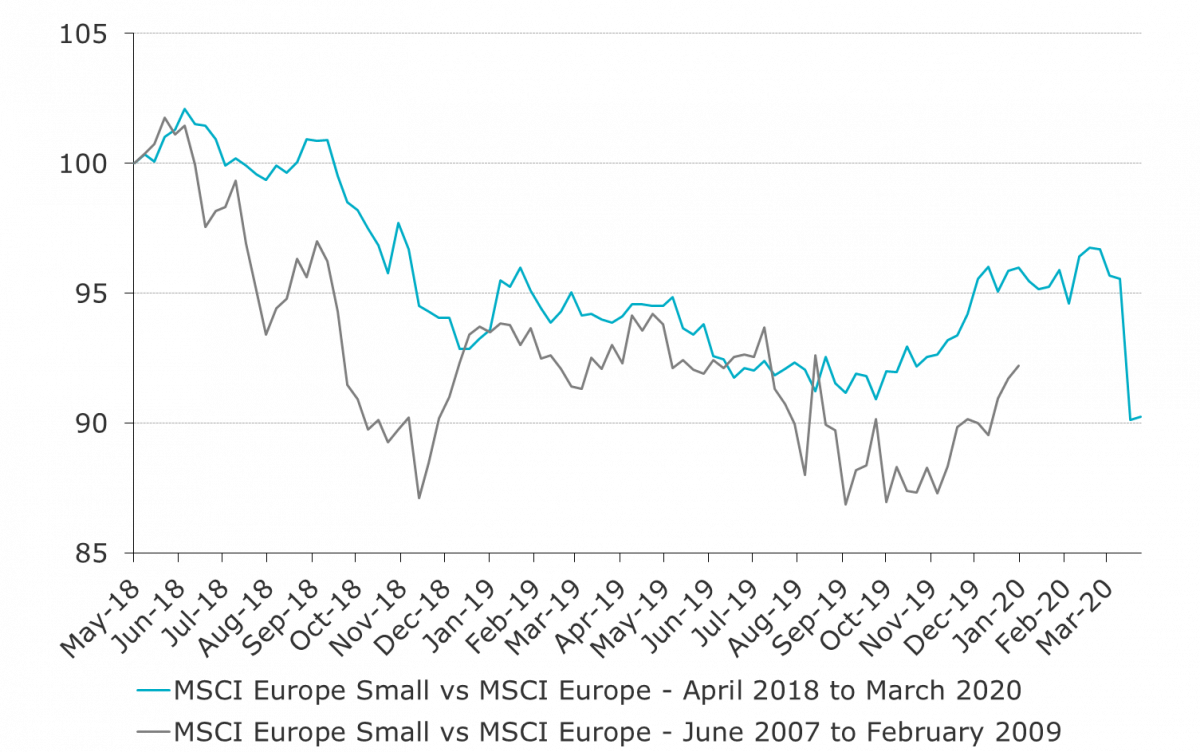

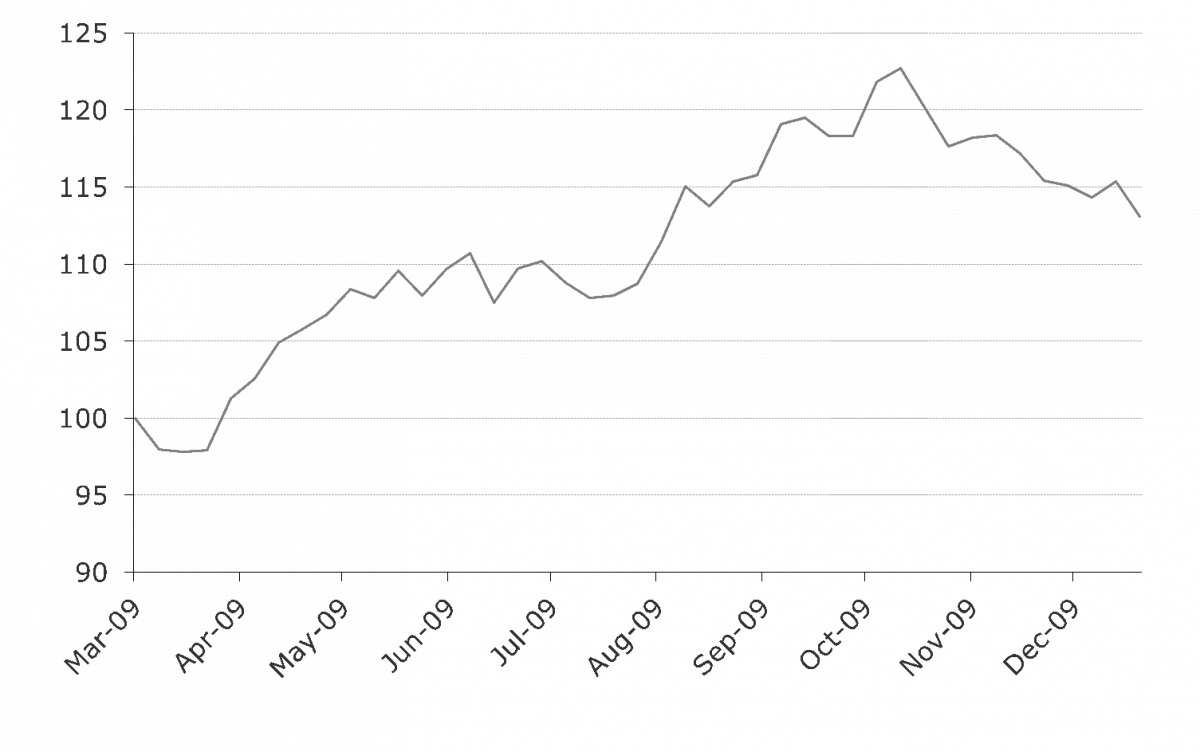

The divergence between Value and Growth stocks has been pushed further into extreme territories. An analysis of European Value names’ behaviour during the GFC period and through a market neutral approach, reveals a similar price action since May 2018 (see below chart). The last leg of the Value underperformance in recent weeks compares worse now than the 2007-2009 period. Phases following extreme dislocations in equity markets are generally very positive for Value and Mid & Small Caps names. We see several potential catalysts to bring mean reversion at this point; the recent acceleration of outflows suffered from Value-biased funds looks like a capitulation; the current economic backdrop does not speak in favour of a strong growth cycle. In that respect, we expect Value companies with a “Quality” tilt to perform well on a relative basis. From March 2009 to December 2009, Value names have been significantly bid up, widely outperforming both the market and Growth stocks.

Value Market Neutral Factor Index in Europe – Today vs GFC

Source: Morgan Stanley, Bloomberg, as of 31.03.2020

+44% Rebound of the Value Market Neutral Factor Index from March to December 2009

Source: Morgan Stanley, Bloomberg

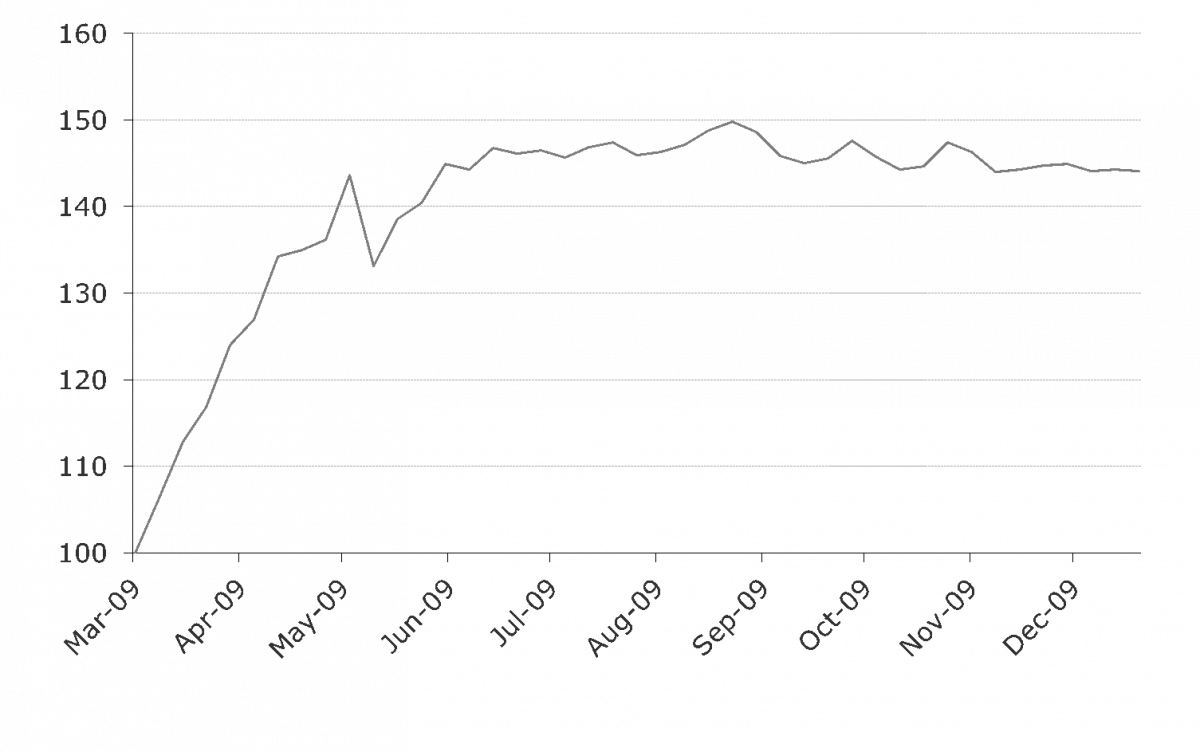

Mid & Small Caps also exhibit a similar behaviour after a clean-up phase, performing extremely well as the market starts focusing on companies with sustainable and strong fundamentals. European Small Caps delivered +13% outperformance vs MSCI Europe Index from February-end to December-end 2009.

MSCI Europe Small Cap vs MSCI Europe – Excess Returns – Today vs GFC

Source: Bloomberg, RAM AI, as of 31.03.2020

+13% Excess Return of MSCI Small Cap vs MSCI Europe Index from March to December 2009

Source: Bloomberg, RAM AI

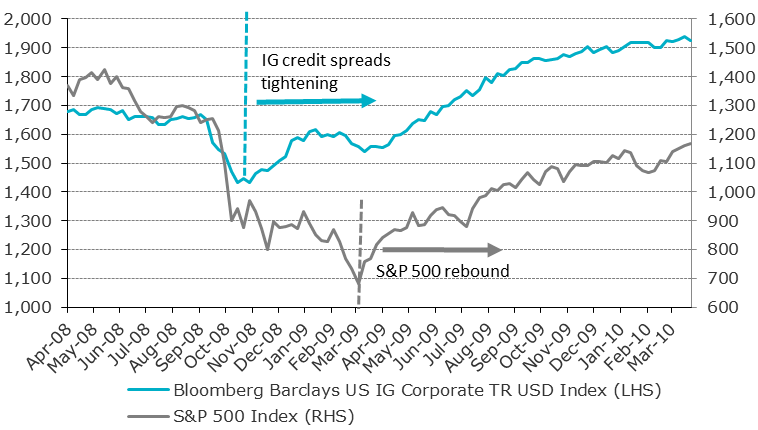

IG credit: a conservative way to deploy capital during turbulent times

Investment Grade credit generally rebounds weeks before the equity market turnaround (i.e. High Yield). As an illustration, the next chart shows the lag between the behaviour of the equity market and Investment Grade credit during the Global Financial Crisis. US Investment Grade Credit spreads started to tighten towards the end of November 2008, while the S&P 500 rebounded in March 2009 only. This time developed markets central banks are massively buying Investment Grade bonds. Given the system’s debt level, we believe monetary authorities are bound to keep rates at low levels for the foreseeable future. For investors wanting to deploy capital in a “safer” manner, Investment Grade bonds could present an appealing opportunity, given where credit spreads stand today.

US Investment Grade Bonds vs S&P 500 Index – from April 2008 to March 2010

Source: Bloomberg, RAM AI

Our RAM Global Bond Total Return Strategy is well-equipped to navigate today’s investment environment. While aiming at capturing the upside, capital preservation is anchored to the investment philosophy. The last 3 years annualised volatility has been at 2.20% (based on monthly data). The two Portfolio Managers have close to 30 years fixed income investment experience each and it is important to highlight that their interests are fully aligned with investors, as they both are personally invested. RAM Global Bond Total Return presents the following characteristics, which are strong prerequisites in this volatile period:

- Flexible & Diversified: combining a long only global bond portfolio with tactical overlay strategies in credit, rates and FX

- Quality bonds focused: a minimum of 75% Investment Grade bonds at any time

- Liquid portfolio: currently mainly invested in Sovereign and Quasi-Sovereign names

- Risk/reward driven: investments are systematically assessed in a framework of potential loss versus gains

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments SA and the date of reference is the date of this document, end of the previous month.