Commentaries

12 February 2021

January 2021 - The Big Short Tantrum - Systematic Fund Manager's Comments

New player on the street

Abundant central bank liquidity boosting financial assets’ upside and government stimuli in the form of blank checks have both contributed to a significant growth of individual investors’ trading volumes in the US over the last twelve months.

The growth of trading volumes by individual investors seems to have led to large speculative upside in numerous stocks and is now the source of new risks in the market on the long and short side of books.

The Tesla precedent

The first large “Short Squeeze” likely related to significant retail flows actually started before the more recent Covid investment boost, when Tesla was identified as being at the crossroads of nascent thematic plays in the fields of disruptive innovation, autonomous driving and electric vehicles. As the EV front-runner and given the current welcome transition to lower emission vehicles, it was natural for Tesla to record historically strong appreciation of its stock in the last two years. What is more unnatural is the level of valuation it now trades at, retail flows helping to contribute to the stock incredible upside and short squeeze of the stock (the stock was multiplied by more than 20, while shares shorted went from more than 200M in May 2019 to 56M shares shorted mid-January).

The Tesla “Short Squeeze” was the first victory claimed by individual investors against hedge funds across social networks. We could probably see there the genesis of a high Short-Interest targeting philosophy which only progressed in the last months in the US market.

The Gamestop squeeze

The Gamestop event of January was for now the most extreme illustration of the threat current developments pose to functional Equity markets. Gamestop was in recent months subject to very significant investor flows, alimented by social networks advertising the extremely high Short-Interest position (at some points more than 140% of float). It was followed by large coordinated purchases of the stock, which led the stock from a level of $4 end of July 2020 to $483 intraday on Wednesday January 28th. Other high Short Interest US stocks seemingly targeted the same way with significant trading volumes and large upsides in the last weeks were AMC Entertainment, Naked Brand Group, Nokia, Bed Bath & Beyond and BlackBerry.

Deleveraging across the board

This environment has led to abyssal losses for some concentrated hedge fund managers, to forced deleveraging of some market participants, and a large reduction of exposure by Long/Short Equity funds globally.

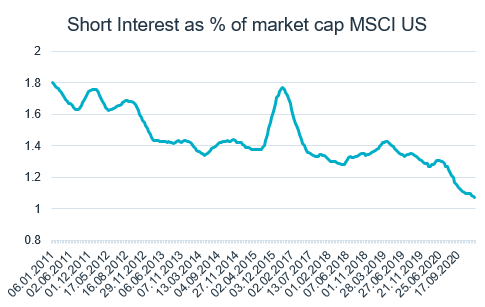

In an environment of historically high economic uncertainty and Equity valuations not seen since the 90’s Tech Bubble, we are probably witnessing close to a capitulation by the market on the strategy of short selling. Recent risk-on thanks to the vaccine and the January turmoil have led to historically low levels of Short Interest in the US and globally, after high Short Interest names had an historical out-performance.

Source: RAM AI, Markit as of end September 2020

Short Tantrum in Europe

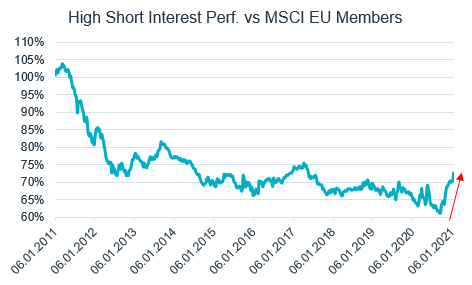

The recent market extremes in the US impacted European equities too, with a large number of high Short Interest stocks (among them growing ranks of zombie companies) out-performing significantly in recent months.

If we look at the 10% most shorted companies within MSCI Europe, these stocks out-performed the market by more than 3% in January and 14% since November. They are back in-line in terms of relative performance with other MSCI EU members to the levels they were trading at mid-2012, the year after the last previous European recession.

Source: RAM AI, Markit as of 06.01.2021

Additionally, to further illustrate the extreme moves in the market, the following chart shows the significant increase in the number of European companies with negative Operation Cash Flows.

Source: RAM AI, Factset Fundamentals, as of end of January 2021

Update on RAM Market-Neutral strategies

RAM European and Global market-neutral strategies were resilient last month as the negative performance brought by the upside of a few short names in our books with large upside was offset by positive contributions in the rest of the Long and Short books through last week’s market volatility. The high Short Interest names which cost us the most last week were already reverting back in our favour on Friday, both funds being still significantly up for the month (more than 2%).

Our Market-Neutral strategies behaved well last month thanks first to the large diversification of the Short book (hundreds of names) versus more concentrated discretionary approaches, as well as our bias in the short book towards not shorting the stocks with the highest levels of Short Interest and borrow costs. High Short Interest levels, as well as making the stock expensive to borrow, also tends to result in highly volatile future performance, which often prevents them from coming into our Short selection.

Finally, it is worthwhile mentioning that there was no active reduction of the funds’ gross exposure last week.

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments SA and the date of reference is the date of this document, end of the previous month.