Articles & Interviews

14 May 2024

Equity Volatility: A Prolonged Period of Complacency

The anticipated level of expected market volatility, also known as implied volatility, influences numerous financial instruments. Its significance within investment portfolios has elevated volatility to the status of an asset class characterised by its unique attributes. The VIX Index, which measures one-month implied volatility for the S&P 500 Index, stands out as the most renowned volatility gauge.

The relationship between the VIX Index and the S&P 500 Index is crucial for the performance of several tail risk hedging strategies, which depend on volatility increasing as the market declines. The subdued volatility in Equities and limited upward movements during periods of high market uncertainty over the past 18 months have led some market analysts to question whether this relationship has been compromised. Among the reasons cited, zero-days-to-expiration options and the surge in option-writing strategies represent prominent factors.

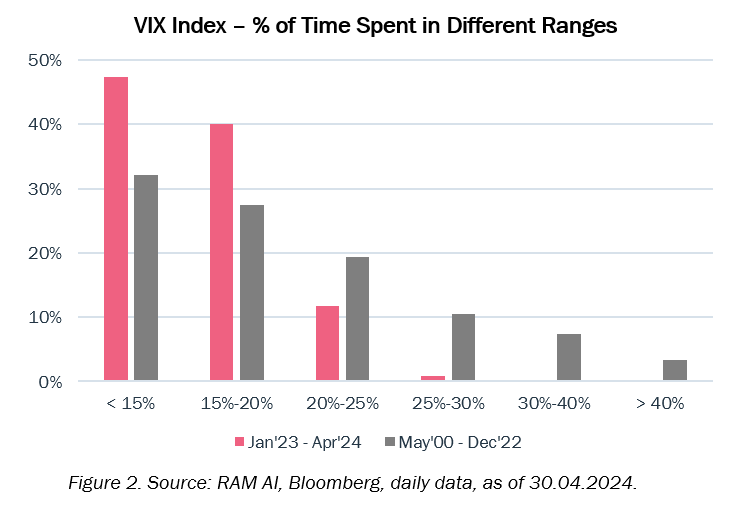

The below chart illustrates the range in which the VIX Index evolved during major stress periods. We have also included a period of stable equity market behaviour for comparison purposes. It is noteworthy that the last two events, namely the US Regional Banking Crisis and the Israel-Hamas conflict, exhibited movements similar to those of the stable market in terms of scale and range.

Another way of highlighting the subdued volatility level is to compare the time spent in different ranges. Between May 2000 and December 2022, the VIX remained below 20% for 59% of the time. However, during the period from January 2023 to April 2024, this percentage increased to 87%.

The chasing of volatility with option-writing strategies for the sake of earning income is attracting an increasing number of investors, with particular concern over the growing participation of retail investors. ETFs selling volatility as at the end of last year (source Bloomberg, Global X ETFs) accounted for almost USD 60 billion. The increase shows a parabolic move over the past two years. On top of that, institutional investors’ involvement in zero-days-to-expirations options remains relatively low. The complacency in equity volatility market is striking. Justifying such behaviour boils down to the notion of ‘this time is different,’ we believe the broken relationship is set to normalise.

At RAM AI, we use both directional and long/short strategies to capture anomalies in equity volatility market. With the adjustment appearing to be closer today, a difficult rather than a gradual wake-up will prevail in our view, creating at the same time opportunities for our strategies trading equity volatility linked instruments.

by Hasan Aslan

Portfolio Manager