News

14 October 2017

Diversifying Away from Rising Benchmark Risk Concentration in Mega Cap IT Names

We’ve observed lately a disproportionate amount of the MSCI EM index weight and risk concentrated in the largest stocks within the IT sector. The MSCI Emerging Market Index’s performance has been largely driven by its exposure to specific mega-cap names in the IT sector, causing an over-concentration effect here. While the market has enjoyed a strong 2017 so far, our defensive profile has behaved as it was designed to.

Our RAM (Lux) Systematic Funds - Emerging Markets Equities continues to lag given its high levels of diversification and its flexible cap fundamental approach that helps us uncover the most attractive fundamental opportunities across the universe, and this strong diversification leads to a lower volatility profile than the one exhibited by the more concentrated benchmark. Both our flexible cap approach and our strong risk diversification play an inherent role in the way we capitalize on recurring sources of inefficiencies over the medium and long term, but can penalise our Fund relative to a market-cap weighted index in these risk-on phases.

**Note: The RAM EM Broad: our investable universe contains all stocks which have minimum market capitalization of US $150mn and a minimum average daily volume of US $500,000.

An equally-weighted portfolio of our liquid All Cap EM stocks’ universe returned 20% over the last 18 months, while the MSCI Emerging Markets Index rose by 34% (52% for the MSCI EM 50 Index) over the same period. This underperformance is almost entirely due to the MSCI EM’s high concentration in just a handful of mega cap names. The IT sector accounts for nearly 24% of the index’s total weight over this time period (28% as of today). Again our diversification and quality bias hurt us, with our Fund maintaining its underweight here.

Within the IT sector just 4 heavyweight names accounted for more than 30% of the outperformance over this period; while also accounted for over 15% of the IT sector’s weight (our Fund had just around a little more than 0.82%) to these same names:

Source: RAM Active Investments, Factset MSCI indices as of 29.09.2017, Past performance is not a guide to future performance

The Top 10 stocks within the MSCI Emerging Markets Index represent only 1.2% of the total number of index constituents, but have a weight of 25% in the index.

Source : Risk Metrics, RAM Active Investments , as of 12.10.2017

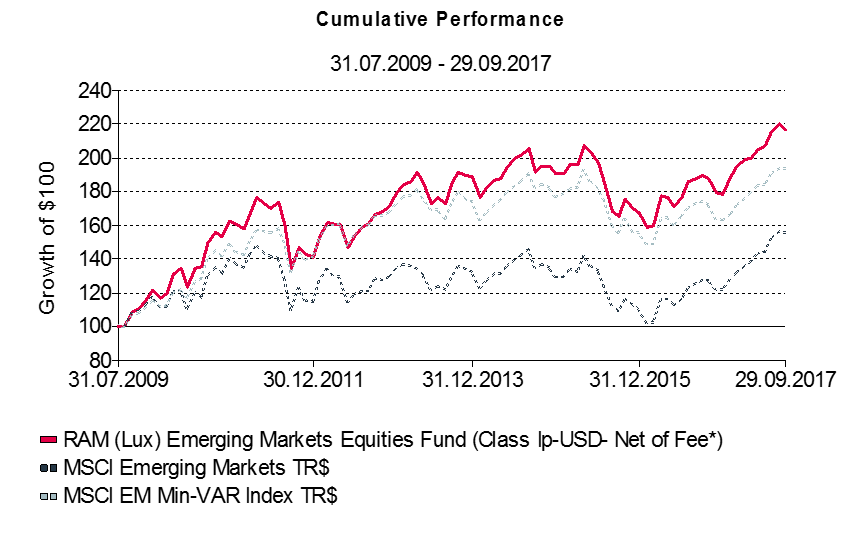

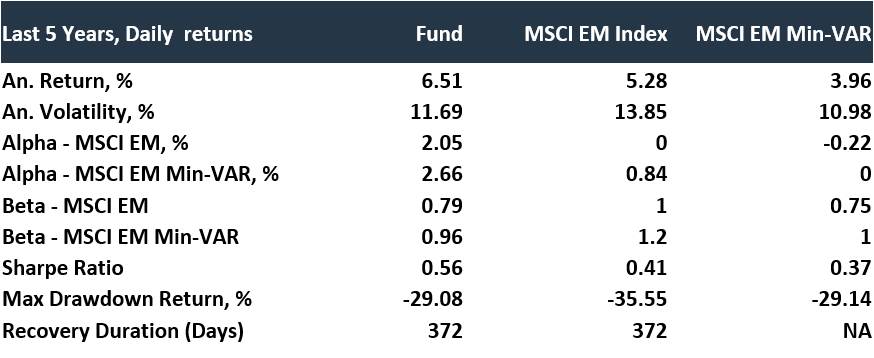

Our RAM (Lux) Systematic Funds - Emerging Markets Equities has continued to outperform over the long-term, providing diversification for investors amid a higher beta and more concentrated environment in emerging market stocks (see above).

Looking at the last 5 years, the Fund offers an alternative profile for investors who want exposure across market caps in emerging markets, but want a more defensive, lower-volatility approach. Relative to both the MSCI Emerging Markets and MSCI EM Min-Var indices, our Fund has exhibited both strong returns and lower volatility, as well as a significantly higher Sharpe ratio. This low volatility has enabled the Fund to maintain its long-term performance targets. Our attractive dividend yield and our diversified all-cap approach give our Fund a relatively defensive profile.

Note: RAM Emerging Market Equities Fund performance net of fee (Class Ip-USD, 1.0% of MF+15% of PF- prior 02.2012 performance are simulated on realised track record) / Source: RAM Active Investments, MSCI indices as of 31.08.2017 / Past performance is not a guide to future performance.

Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM Active Investments S.A. cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM Active Investments S.A. will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, KIID, articles of association and financial reports are available free of charge from the SICAV’s head office, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This document is confidential and addressed solely to its intended recipient; its reproduction and distribution are prohibited. RAM Active Investments S.A. is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the UK by RAM Active Investments (UK) Limited which is authorised and regulated by the Financial Conduct Authority.