News

13 February 2018

Asian hard currency credit offers attractive yield opportunities

Please join us for a conference call to get insight from Carl Wong, PM of the RAM Tactical Funds II - Asia Bond Total Return Fund

March 13, 2018 at 10:00am CET

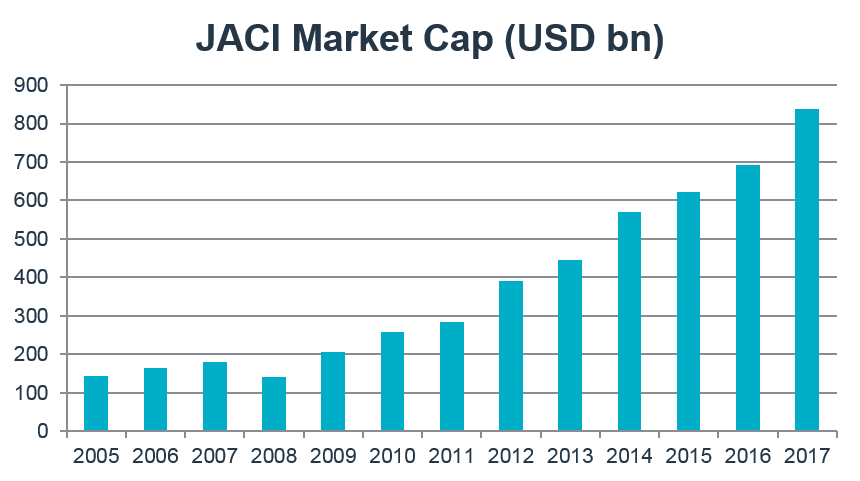

- With a size of USD 839 billion at the end of 2017, the growth of Asian USD credit has been substantial over recent years. This asset class is receiving both increased attention and allocation from global asset allocators.The asset class might be able to cross the USD 1 trillion mark by the end of 2018.

JACI: JP Morgan Asia Credit Index TR USD

- Asian hard currency bonds offer a good balance between yield and credit/duration risk compared to EUR IG and HY. The so-called “Asian premium”, due to investor perception for the region’s credit risk, present an attractive yield uptick for European investors. Asian IG and HY yield 4.16% and 6.84% respectively (in USD, as of January 31st, 2018).

- Since 2009, there has been only one down year for the JP Morgan Asia Credit Index TR USD (-1.4% in 2013). The average return for the past 5 years has been 5.93%. The key reasons behind this solid performance includes:

- Robust demand from local investors

- Lower default rate

- JACI composition of 80% IG / 20% HY

By registering to this communication, you are agree to provide your personal data to RAM Group (controller), Swisscom and any other selected processor. There are operational, marketing and compliance purposes for this data collection. Your data will be treated as confidential. For further information on our data protection and your rights, please refer to the Legal section of our website or contact us through contact@ram-ai.com

Read carefully before subscribing: this communication is for informative purpose only and does not constitute an investment advice, offer or solicitation to purchase or sell any investment product mentioned therein. The information which will be expressed during the event will not take into account individual clients' circumstances, objectives, or needs. Past performance is not a guide to current or future results. Before entering into any transaction, each client is urged to consider the suitability of the transaction to his particular circumstances and to independently review, with professional advisors as necessary, the specific risks incurred, in particular at the financial, regulatory, and tax levels. Additionally, clients are invited to base their investment decisions on the most recent prospectus, key investor information document (KIID) and financial reports which contain additional information relating to the investment products. These documents together with the articles of incorporation are available free of charge from the SICAV's and Management company’s head office, and from its representative and distributor in Switzerland, RAM Active Investments S.A. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it directed to any person or entity to which it would be unlawful to direct such a document. In particular, the investment products are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). Consequently, if you don’t meet the compliance requirements, it will not be possible for you to participate in the communication. Without prejudice of the due addressee’s own analysis, RAM understands that this communication should be regarded as a minor non-monetary benefit according to MIFID regulations. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the Management Company RAM Active Investments (Luxembourg) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg. Nexus Capital Management Limited 10/F, 8 Queen's Road Central, Hong Kong is a regulated investment manager acting by delegation of RAM Active Investment (Luxembourg) S.A. for RAM Tactical Funds II.