Commentaries

8 October 2019

September 2019 - What Lies Beneath Equity Market Rotation - Systematic Fund Manager's Comments

September’s market rotation has been violent, impacting us particularly in Europe. Stocks with positive price momentum and low volatility have seen a sudden reversal of investor flows, simultaneous with a global rebound of interest rates (the 10-yr US Treasury yield moved from 1.49% at month-end to 1.90% last Friday, with similar moves across developed markets). Value names printed strong performance owing to a reversal of value dislike that has been in place for many years. That said, the rebound in Value names this month doesn’t seem to be the long expected beginning of a structural Value recovery, as it seems primarily driven by short covering in the market; we saw a widespread unselective rebound of Low-Quality, leveraged Value-biased names in our short book (those actually already reverted back, cf. below charts on RAM L/S European Equities) along with a rebound of attractive Value picks in our Longs.

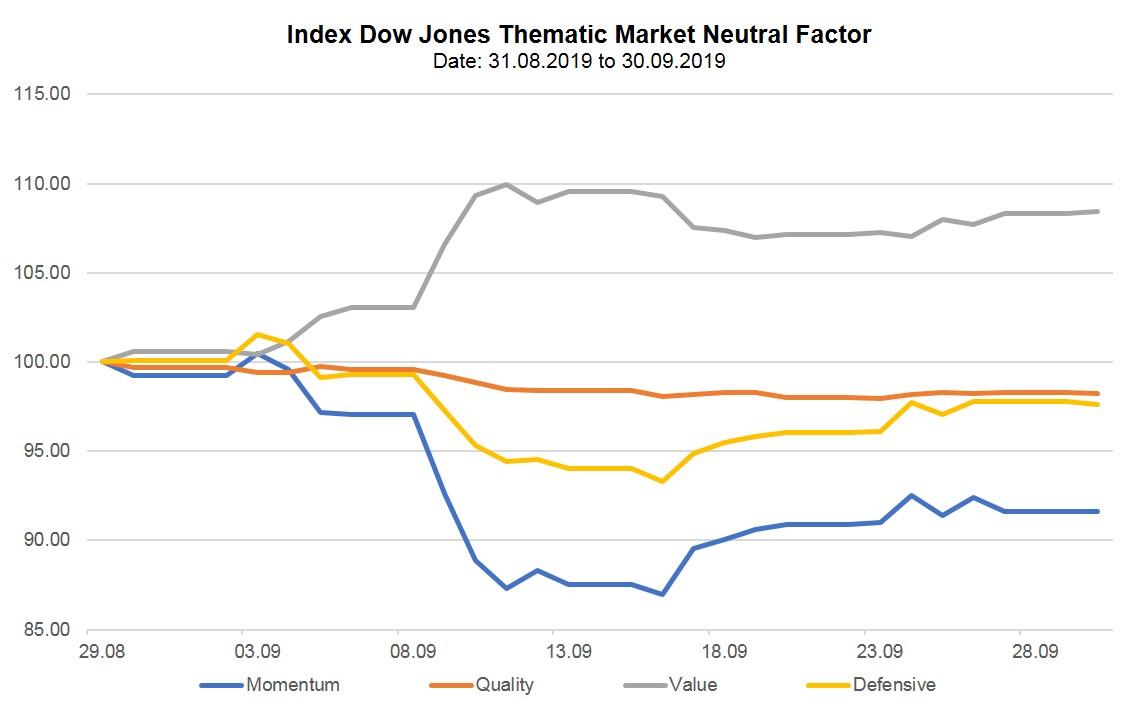

The following table shows the signicant returns dispersion across equity market neutral factor indices in the U.S. from 31.08.2019 to 30.09.2019. The primary reason for this performanc dispersion resides in a pronounced short covering activity. The below results can be extented across the European market.

Dow Jones Thematic Market Neutral Factor Indices

From 31.08.2019 to 13.09.2019

Source: Bloomberg, RAM Active Investments, from 30.08.2019 to 30.09.2019

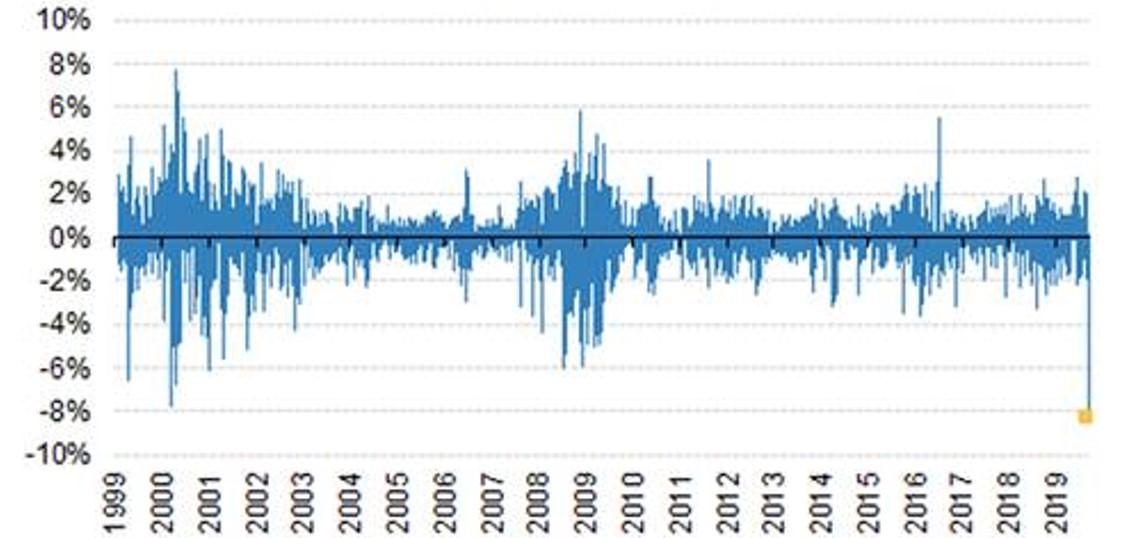

To provide an additional sense of the rotation’s violence, the below chart, courtesy of Morgan Stanley, shows that the 2-day return of the sector-neutral momentum factor has been the worst registered since 1999:

2-day return of sector-neutral Momentum factor

Source: Morgan Stanley QDS

The reasons behind this rotation

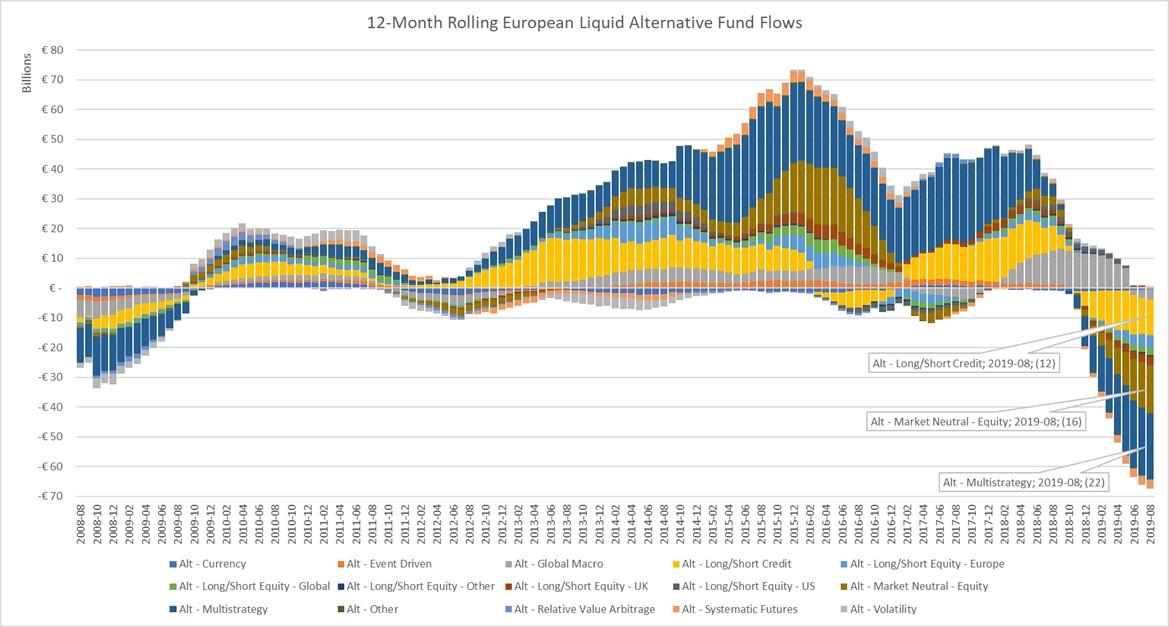

Record large outflows out of Market-Neutral and Multi-Strategy Equity strategies, as well as the record number of fund closures is probably the trigger for this large unwind of positions in the market and momentum rotation. Crowding in trend-following supported by central bank actions probably made the situation worse.

1. Central bank policy

Central banks’ action is favoring crowding effect in financial markets. On top of fundamental-agnostic behavior, which can trigger erratic moves leading to an indiscriminate buying/selling activity. Stocks correlated to the long-end part of the interest rates curve are directly impacted by the adverse move in rates that generally triggers a sharp reversal in positioning.

2. Investor’s flows

Cumulative momentum flows reached a point not seen since 2017, creating a crowding effect which is highly subject to reversals (see chart below).

Source: Morningstar Liquid Alternatives, as of 09.09.2019

3. Deleveraging by a number of market participants

The high dispersion in equity markets has been pushed over the past few months and especially the severity of this rotation has forced some market participants to continue to deleverage. This type of situation magnifies the moves, making the environment extremely challenging for fundamentally-driven investors.

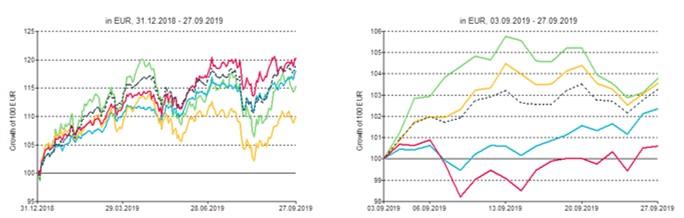

RAM Long/Short European Equities Impact

Most of our intra-month drawdown came from the short single names book given the violence of the deleveraging and short covering in the market.

On the Long side of the book, the hit on our Long Momentum and Low-Volatility engines was partly offset by a positive return of our Value and Machine Learning engines during the rotation, once again illustrating the merit of diversification.

Long Strategies

Source: Factset, RAM Active Investments

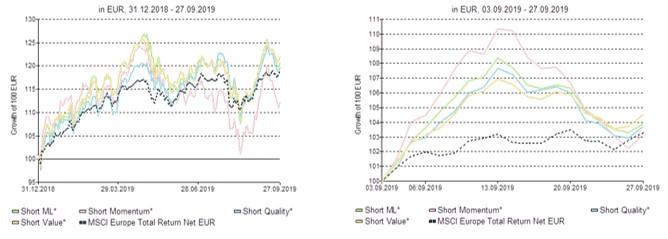

Short Strategies

The short covering led to a large rebound of names across our Short single-names selections, with all our Short engines suffering from this short squeeze. However, by the end of the month our short positions losses had reverted back to flat with the index, indicating that the momentum rotation was liquidity-driven by large book unwinds over a short period rather than a structural market shift.

Source: Factset, RAM Active Investments

What can we expect from here?

We believe that the current adverse moves in our Short book, the largest performance detractor in September, is linked with transitory flows due to the current market deleveraging on Momentum/Low Risk.

The high valuations, high leverage, negative free cash flow dynamics and refinancing needs characterizing companies in our Short book make them vulnerable as financing costs rebound, their financing costs getting rapidly out of control. We hence believe that these companies have strong downside potential at current levels and there is likely to be a positive reversal on the alpha of our short strategies as the rotation subsides.

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the Management Company RAM Active Investments (Europe) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg. The reference to RAM AI Group includes both entities, RAM Active Investments S.A. and RAM Active Investments (Europe) S.A.