News

13 August 2019

The RAM L/S European Equities Fund will offer daily liquidity 13 August 2019

From the 26th of August 2019, the RAM (LUX) SYSTEMATIC FUNDS – LONG/SHORT EUROPEAN EQUITIES FUND (“The Fund”) will provide investors with daily liquidity thanks to the successful implementation and development of our Machine Learning ("ML") Strategies.

This decision was taken in coordination with the board of the SICAV in order to meet market appetite for more liquid solutions as well as move in line with our other Long/Short products. This change of liquidity can provide investors with timely and easier access to our Fund, helping them to develop a greater understanding of how market movements can impact performance, allowing them to take more informed decisions. The move represents a logical evolutionary step in the research conducted historically, focusing on highly liquid, diversified and quality-biased Long/Short solutions.

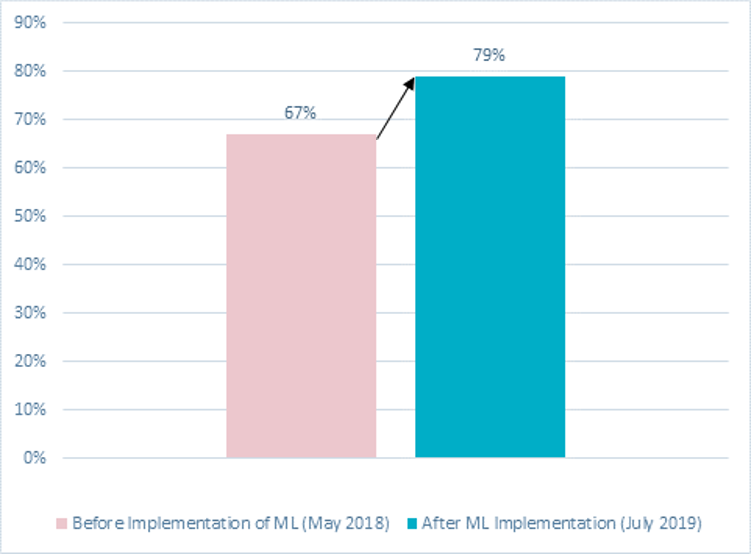

This change in liquidity occurs 12 months after the implementation of our Machine Learning strategies across the long and short books, validating the extensive research done with our Machine Learning Infrastructure. Indeed, our ML approach has significantly improved the liquidity profile of the Fund, granting access to new sources of inefficiencies (and potential alpha) and liquidity. The implementation and integration of new short-term signals with our ML Strategies have also proven helpful in enhancing the 1-day liquidity curve of the Fund (by 12%):

% liquidated after 1-Day

Based on 20% ADV (Average Daily Volume) - 20 days

Source: RAM Active Investments

We would like to take this opportunity to remind investors that liquidity has, and continues to remain, a key focus across all our products. All Funds benefit from RAM AI’s proprietary market impact models that help to mitigate liquidity risks and costs, scaling down positions with limited liquidity, while maximizing expected alpha. Our Funds continue to offer investors transparency, liquidity and now daily market access.

Please contact our IR department for further details: contact@ram-ai.com.