Commentaries

15 May 2020

April 2020 - Remain tactical and selective in global fixed income - Tactical Fund Manager's Comments

Economy in “full” support mode

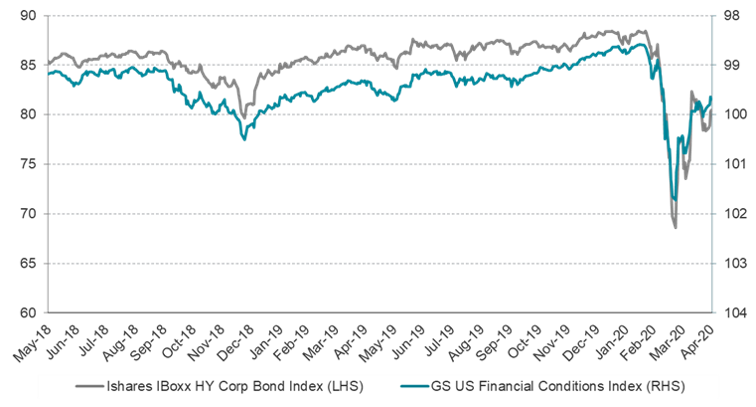

Central banks and governments have reacted relatively fast in order to prevent a free fall of the economy. This support diverges across regions though, with the US being more reactive than Europe. The economic answer to the current extraordinary deflationary situation follows Bank of Japan policy of Zero Interest Rate Policy combined with large amounts of assets buying. Despite all these measures, the impact on corporate profit and government receipt will be massive. The below chart shows a US High Yield ETF performance versus US financial conditions, reflecting somehow the fragility of the recovery:

High Yield Bond vs US Financial Conditions Index

Source: Bloomberg, RAM AI, as of 30.04.2020

Arbitrage between larger opportunities and higher risks

In the investment grade bond space, attractive opportunities have emerged after the March 2020 dislocation. Nevertheless, uncertainties still prevail with respect to the full impact of Covid-19 on global growth and we expect volatility to stay with us in the coming quarters. Therefore, keeping a strong discipline in managing the quality and the liquidity of a fixed income portfolio will be key to preserve capital and participate to the upside in the coming quarters.

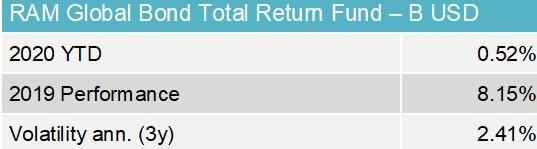

RAM Global Bond Total Return approach to weather a volatile environment

We continue to believe that very long duration or large credit exposures do not represent the only options faced by investors. A high quality traditional bond portfolio, which is actively managed in terms of duration and credit risk, can be complemented with additional sources of performance in credit, rates and forex markets. By using the available liquid instruments globally in an appropriate and disciplined way, these complementary performance engines have the primary objective of providing uncorrelated return sources and immunise partially or fully portfolio risks. Our investment process, focused on assessing the risk/reward at several levels, proved to be the adequate approach in this environment.

Source: RAM AI, as of 30.04.2020

Recent portfolio changes

- The strong activity in the primary market during the month of March and April presented attractive opportunities in high quality Investment Grade bonds

- We have recently added new opportunities in EUR and USD Investment Grade corporate bonds since our exposure was mainly tilted towards Sovereign and Quasi-Sovereign names

- After the strong performance since March, we booked profit on some European corporates

- With an aggressive Fed and a more constrained ECB, we reduced our European periphery exposure and increased the US IG and Canada agencies exposure

- In non-traditional strategies, we booked profit on the US 5y10y steeper and USD Asset Swap strategies

- The portfolio’s average credit quality stands at A-

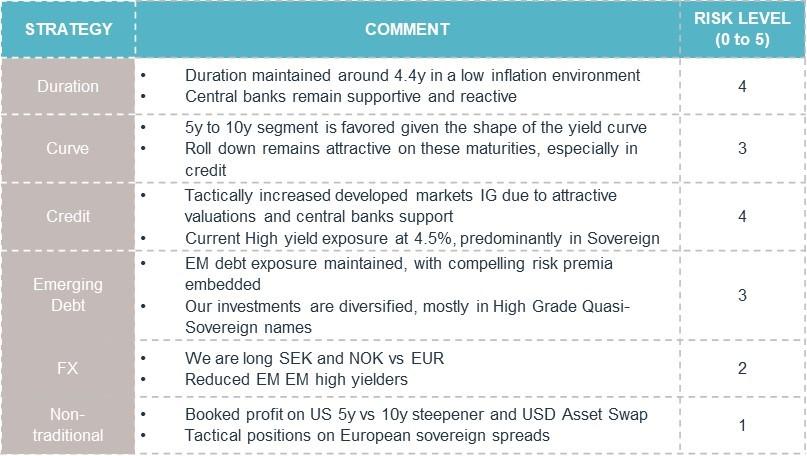

Current positioning

The below table summarizes the positioning of the fund. The “Risk Level” represents our internal risk scaling by strategy, ranging from 0 to 5, with the latter being the highest level of risk within our investment guidelines.

Source: Bloomberg, RAM AI, as of 30.04.2020

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments SA and the date of reference is the date of this document, end of the previous month.