Commentaries

4 July 2023

Overcoming Liquidity Issues in Managing Corporate Bond Exposures

Since 2008, several regulations have limited the balance sheet capacity of bond dealers, resulting in a rapid reduction of corporate bond liquidity during times of stress. This poses a significant concern considering the upcoming refinancing needs in 2024/2025.

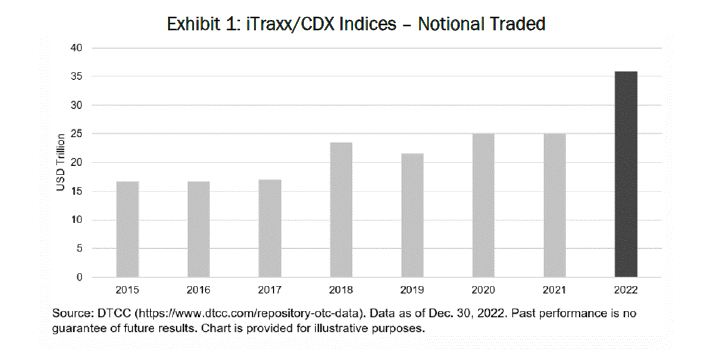

During the same period, credit indices like the US CDX and European ITRAXX have experienced substantial growth, with a record trading volume of $36 trillion in 2022. These indices offer deep liquidity, even during challenging periods such as the COVID-19 pandemic and the banking stress in March 2023.

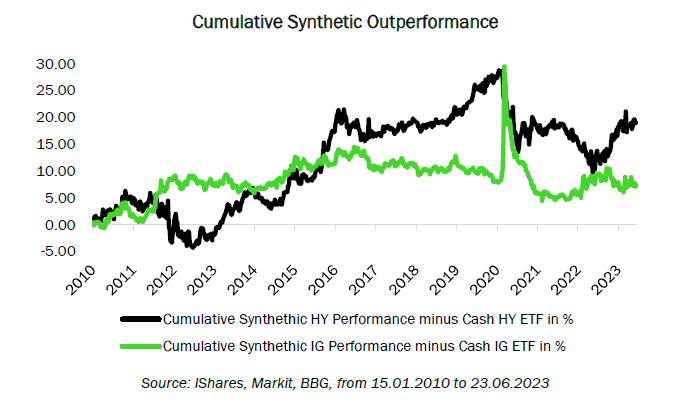

Originally designed as hedging tools, these indices can also be utilised to gain credit exposure by selling protection on the underlying indices. This raises the question of whether this strategy can effectively replicate the performance of traditional corporate bonds, especially for investors aiming to mitigate idiosyncratic risks through diversification.

Our objective is to replicate the performance of US investment-grade (IG) and high-yield (HY) bonds. To achieve this, we allocate 90% of the cash to US Treasuries ETFs to approximate the duration component. The remaining 10% of cash is used to finance a short protection position on either the US IG CDX or the US HY CDX. This approach allows us to construct a ‘Synthetic US IG Exposure’ with a duration of approximately 5.9 years, and a ‘Synthetic US HY Exposure’ with a duration of about 3.3 years.

Both the Synthetic IG and HY strategies have outperformed their respective ETF counterparts by a significant margin, even after adjusting for the total expense ratio (TER) to match the highest-cost ETF. This outperformance is particularly notable during periods of market stress since 2010. Coupled with their deep liquidity, these instruments prove to be highly effective in managing corporate exposure from a top-down perspective, as we do in the RAM GBTR strategy.

________________

Disclaimer

The figures, comments, opinions and/or analyses contained herein reflect the sentiment of RAM with respect to market trends based on its expertise, economic analyses and the information in its possession at the date on which this document was drawn up and may change at any time without notice. They may no longer be accurate or relevant at the time of reading, owing notably to the publication date of the document or to changes on the market.

This document is intended solely to provide general and introductory information to the readers, and notably should not be used as a basis for any decision to buy, sell or hold an investment. Under no circumstances may RAM be held liable for any decision to invest, divest or hold an investment taken on the basis of these comments and analyses.

RAM therefore recommends that investors obtain the various regulatory descriptions of each financial product before investing, to analyse the risks involved and form their own opinion independently of RAM. Investors are advised to seek independent advice from specialist advisors before concluding any transactions based on the information contained in this document, notably in order to ensure the suitability of the investment with their financial and tax situation.

Past performance and volatility are not a reliable indicator of future performance and volatility and may vary over time, and may be independently affected by exchange rate fluctuations.

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is forbidden, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the investment products are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation, and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary.

The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM Active Investments S.A. cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Subscriptions will be accepted only if they are made on the basis of the most recent prospectus and the latest annual or half-year reports for the financial product. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM Active Investments S.A. will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not a reliable guide to future results. The prospectus, KIID, constitutive documents and financial reports are available free of charge from the SICAV’s head office , its representative and distributor in Switzerland, RAM Active Investments SA, and the distributor in Luxembourg, RAM Active Investments SA. This document is confidential and addressed solely to its intended recipient; its reproduction and distribution are prohibited. RAM Active Investments SA is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the Management Company RAM Active Investments (Europe) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg.

No part of this document may be copied, stored electronically or transferred in any way, whether manually or electronically, without the prior agreement of RAM Active Investments S.A.

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments SA and the date of reference is the date of this document, end of the previous month.