Commentaries

13 November 2020

October 2020 - Carbon accountability and Sustainable Standards - Systematic Fund Manager's Comments

Launched in July 2020, in the middle of the pandemic, the RAM Stable Climate Global Equities Strategy has been behaving well (class Ip$-Net) outperforming the MSCI World TRN$ Index (The portfolio is actively managed on a systematic basis without using a reference benchmark. Comparison is for illustration purposes only), posting a return of +3.27 (Past performance is not an indicator of future returns). In term of sustainability our portfolio has been in line with our objectives in term of ESG selection and total Carbon Emission. Our portfolio did generate 331 TCO2 (scope 1 and 2) over the period vs around 1000 TCO2 for the MSCI World Index (considering equivalent AUM). As expected, we did do our quarterly exercise in October to offset the portfolio CO2 emissions selecting 2 CDM projects with interesting additionality and co-benefits:

- Biomass based power project by Harinagar Sugar Mills Ltd : the project based in Bihar/India aims to generate electricity by the combustion of bagasse ( a residue of sugar cane) which is a carbon neutral fuel . In addition to reduction of GHG emission, this biomass project provides new opportunities for industries and economic activities in the area. (read more here)

- Methane recovery from waste water generated from wheat straw wash at Paper manufacturing unit of Shreyans Industries Limited: The project based in Punjab/India consists in installations able to capture methane and burning it for the generation of boilers with a paper manufacturing unit. It offers number of co-benefits in term of environment, jobs and welfare in the area. (read more here)

Performance review and positioning

In terms of performance since launch on 09 July 2020, the Strategy benefited highly from a good selection in Communication services in US. We also benefited strongly from our underweight in highly emitting activities in the Energy sectors and within Information Technology. Initially, we could have believed that the pandemic investors would have turn away from ESG considerations given the worrying economic perspective. But we continue to see sustainable issues making the headlines.

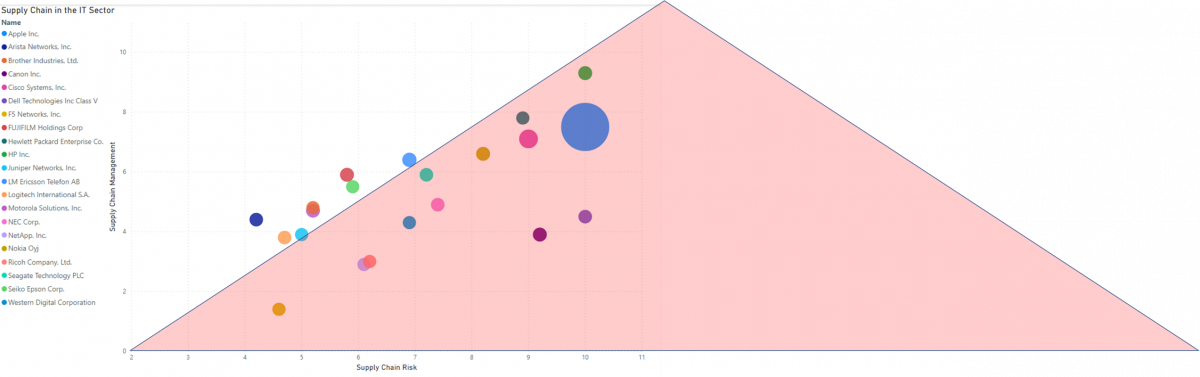

Our current largest underweight, the Technology sector have been struggling more than usual lately on their sustainability ratings despite their stellar performance this year. Because of their size it is more and more difficult for them to control their supply chain, often situated in countries less regarding in term of worker conditions (see scatter plot fig.1]. Furthermore, the impact on our societies of the data collection by the largest tech firms and the personal data oligopoly that profiles itself on the horizon will probably at some point raise more questions about the Social impact these firms have, as well as their Governance.

[figure 1 – Do IT companies have enough process in place to manage ESG risk in their supply chains? ]

Note: Scale from 1 to 10, the higher the Supply Chain Risk score is, more a company’s business is vulnerable to the ESG risk of its supply chain. Higher the Supply Chain Management score is, more a company’s organization is able to manage ESG risk and opportunities.

Source: RAM AI, MSCI ESG data on the MSCI World Index Constituent as of 30/09/2020

Augmented data integration – Using news flow with Natural Language Processes

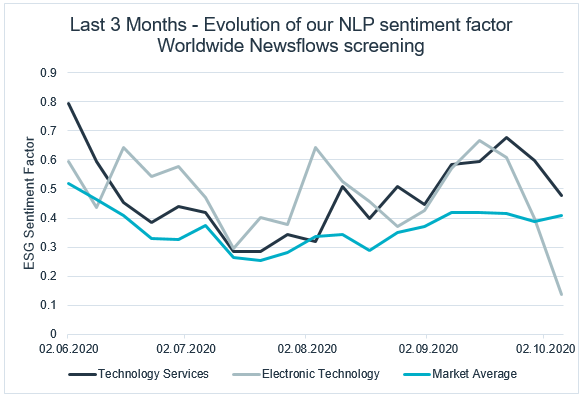

These observations have been accelerating over the last months. Nevertheless, observing change through the prism of ESG scores of companies remains challenging as downgrades/upgrades are not as frequent as within the realm of traditional financial information. But looking at more dynamic data such as unstructured data coming from news flows, it helps to add one more dimension to the paradigm change we are observing. Screening the media and news over the last 3 months, we can see increasing concern on ESG related issues within the technology sector. Thanks to Natural Language Processing, we are able to interpret news flows quantitatively, assigning a sentiment factor to it. Over the last quarter we observed a violent shift in ESG sentiment in the Technology sector, while the overall market sentiment has been quite stable.

[figure 2 – Increase concern in the IT sector sustainability?]

Note: We aggregate the sentiment factor of each company mentioned in our new flows screend, aggregating the seitment factor by sector. On a scale from -1 to +1, a negative sentiment leads to potential controversies of the company, closer to 1 the sentiment factor is, more positive is the news.

Source: RAM AI as of 20/10/2020

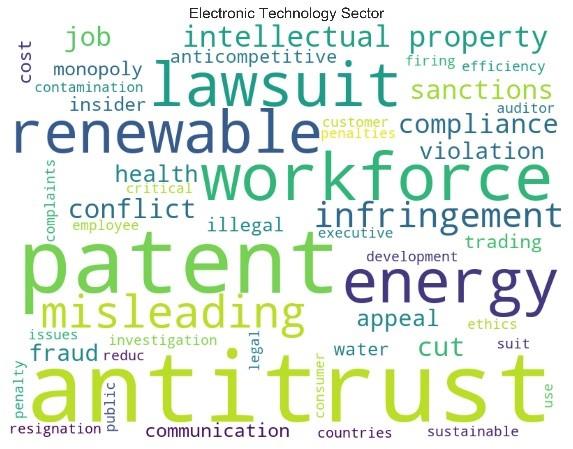

[Figure 3 – Word Cloud in the Electronic Technology Sector looking at news flows in Q3 2020]

The Electronic Technology sector seems to be the most impacted by recent news flows when looking at ESG controversies. Number of tech firms are strongly impacted by news on antritrust , workforce as well as energy issues (cf figure 3). While the frontpages of the media have only focused mostly on a couple of IT sector leaders, the relevance of these questions however is valid for a great number of companies. In our view these issues are highly scrutinized by politics worldwide and the volatility of the political agenda will be reflected also in the market in the coming months.

Note: We show in this word cloud main ESG topics identify by our NLP tool that screen news flow on Companies globally.

Source: RAM AI as of 20/10/2020

ESG investing and flows have tended to benefit large companies in recent years, the current dynamic of ESG improvement in the small-cap space pleads for more diversified and active All-Cap sustainable investing. After a few years of small caps underperforming larger caps, it is probably the right time for investors to look deeper into the opportunities in this segment of the market.

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments SA and the date of reference is the date of this document, end of the previous month.