Commentaries

6 December 2019

November 2019 - VIX Awakens from its slumber & Value marks its comeback - Systematic Fund Manager's Comments

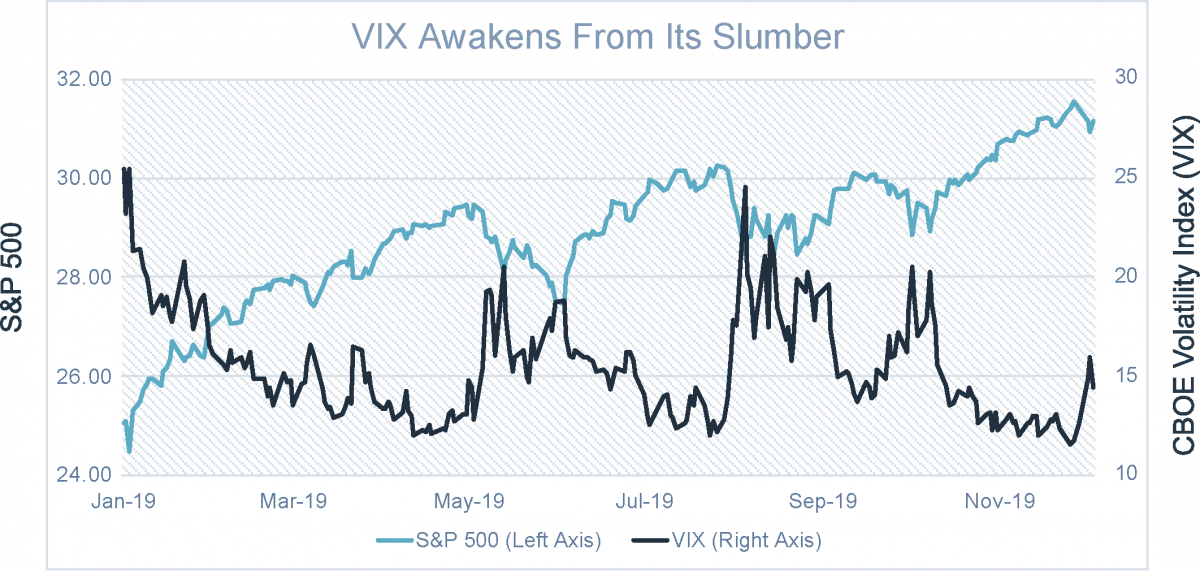

The VIX (a measure of equity volatility) made headlines over the month having receded to record lows in tandem with U.S. and European equities reaching record highs amid record lows in global interest rates. The “fear gauge” remains well below its long-term average after posting its lowest close since August (11.30) — a decline that we believe is indicative of the growing complacency surrounding downside risks. But given the level of risk on the table, why were investors so complacent in November?

Well, just two days after the end of the month the VIX touched 17.99, up an astonishing 26.5% in just a 48-hour period (see chart below). Closing above its 200-day moving average for the first time since mid-October, it remains on track to test that month’s peak of 20.46. The move was largely attributable to disappointing data on U.S. manufacturing activity and a tweet by President Trump that underlined the scope for trade-related turmoil beyond U.S.-China talks.

Source: Bloomberg & RAM Active Investments

Meanwhile, speculative short bets on the VIX hit a record high, perhaps reflecting a fearful market away from the trade war. These bearish bets on stock volatility continue the narrative that beneath the veneer of record stock market highs for Europe and the U.S., the market is ripe for turmoil. We’ve discussed in last month’s editorial that there are many potential sources of volatility, from the U.S. protectionist push and Central Banks’ uncharted territory to a marked deceleration of global growth, but perhaps the most worrying is global debt levels. China’s default level has already equaled last year’s total ($17.1bn), a prime example of the credit tensions and corporate struggles. We remain highly cautious of portfolio level diversification as we move into 2020. Investors should also understand their exposure and liquidity levels amid the VIX’s reawakening.

Value back in fashion?

Value stocks have underperformed growth stocks for over a decade now. With growth stocks outperforming almost every other factor over recent years, largely explained by the performance of the technology and communication services sectors with so-called “FAANG” stocks (Facebook, Amazon, Apple, Netflix and Alphabet). The Growth style is typically in favour during periods when the economy is growing, while Value is popular when the cycle is at an end, as lower-valuation stocks tend to fall less than more expensive growth stocks.

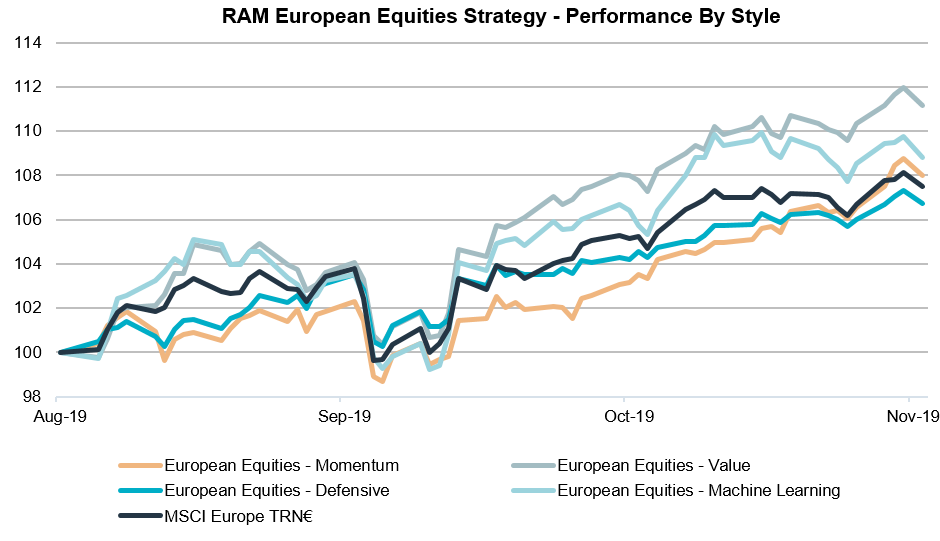

What does this mean to our Strategies? Well, as per our chart below, within Europe, our Value style has benefitted from the nascent recovery of the factor in recent months. Given our ML Strategy has an intrinsic bias towards Value, it’s also positively benefited. The key indicator here is the amount of short covering in Cyclical industries relative to Defensive industries witnessed in recent months has reached extreme levels relative to the last few years. It remains to be seen whether Value can continue its recovery in the coming months and quarters.

Source: RAM Active Investments

Note: Table shown is for illustration purpose only. On the long-side sub-strategy performance is calculated based on simulated model portfolios rebalanced monthly on RAM equity investment screenings and may not represent the exact contribution of strategies in real portfolio. Strategy performance is adjusted considering their long-term theoretical fixed allocation in the fund. Performance is gross of management and performance fee. Client’s return will be reduced by such fees in case of investment in such strategies.

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments SA and the date of reference is the date of this document, end of the previous month.