Commentaries

19 March 2024

Emerging Markets: Compelling Value and Quality

After years of lagging behind developed markets, Emerging Markets showcase exceptionally attractive valuation levels and robust cash flow independence, highlighting unprecedented investment opportunities in both absolute and relative terms.

1. EM: The Value Equities

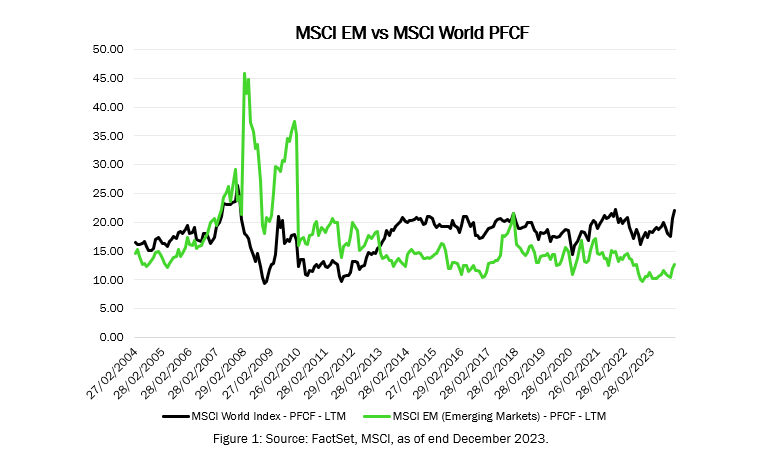

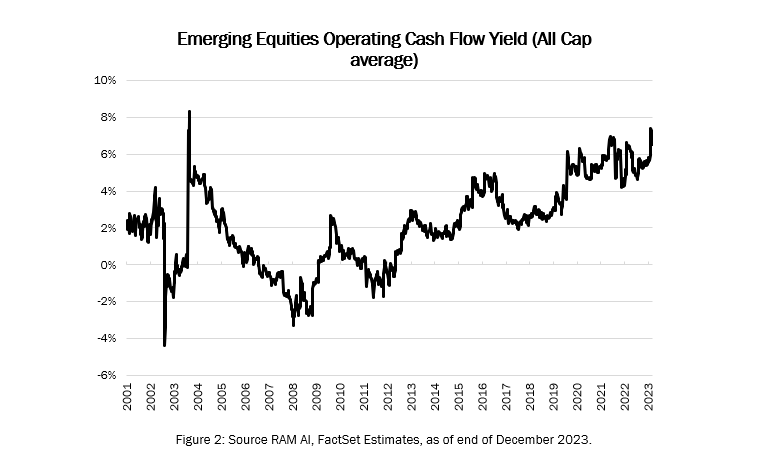

EM equities are now trading attractively on pretty much any valuation metric, on an absolute and relative perspective. Emerging companies are also generating strong operating cash flows overall, limiting their reliance on external financing to fund new investments/capex or to retribute shareholders. They are well positioned to retribute shareholders on the back of future growth.

All Cap stocks across EM currently trade at close to 7% operating cash flow yield to market cap, close to their most attractive valuations reached at the beginning of 2004 (cf. fig. 2), levels from which they performed very well versus their developed counterparts.

2. Not just China

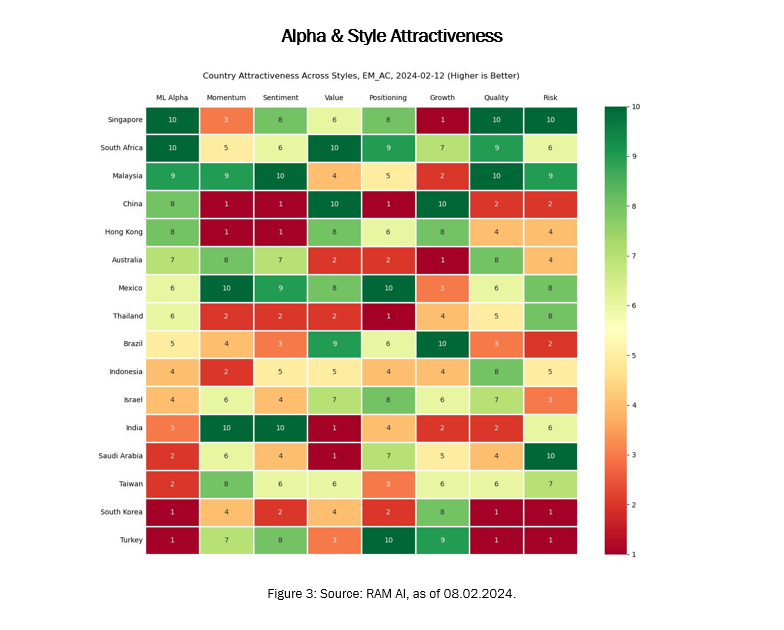

China is not the only EM country trading at very compelling levels of valuation, as other Emerging Markets have been penalised in recent years by a lack of investor interest. Some of the countries looking the most attractive on a combo valuation perspective aside from China/Hong-Kong are South Africa, Brazil and Mexico (cf. fig. 3 exhibiting style attractiveness across Emerging and a few select Developed Markets).

3. Momentum, beyond India

India is now the favoured top-down pick by investors to play growth momentum, but there is a high downside risk at this level given the very stretched valuations of local companies relative to their competitors.

More attractive picks are found across Malaysian companies among the top momentum stocks, still trading at more reasonable valuation levels than their Indian counterparts and exhibiting much stronger quality of earnings and balance sheets. Our strategies find them to be a much less risky momentum play at the moment (cf. our estimated Machine Learning Alpha, fig.3). Companies in both countries are estimated to face growth headwinds in the future, as historical growth will be difficult to match in coming years. A selective approach can help uncover the most attractive names there.

4. Passive flows creative opportunities

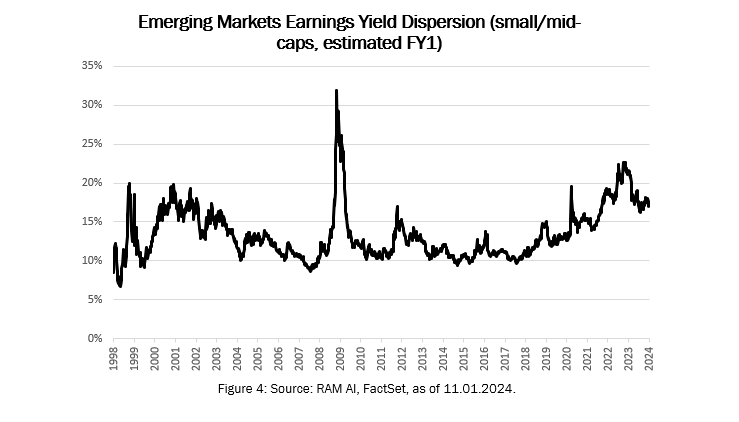

Most EM equity flows in recent years have been directed to passive investments, which has contributed to a consistently high level of valuation dispersion across the markets. We believe EM is a space where it is particularly important to be selective, as an active investment approach will ensure fundamentals, market dynamics and good governance align for a positive investment outcome.

5. Current performance drivers

The RAM Emerging Markets strategy finished 2023 up 14%,* significantly outperforming the market on the upside, the strategy being now ahead of the market by more than 25%* over the last three years and over 28% over the last five years.

The portfolio is actively managed on a discretionary basis with reference to a benchmark. While the product compares its performance against the MSCI Daily TR Net Emerging Markets, it does not try to replicate this benchmark and freely selects the securities that it invests in. The deviation with this benchmark can be significant.

*Source: RAM Active Investments, as of end of December 2023. Performance is shown cumulative. Past performance is no guarantee of future performance. Returns are calculated in the strategy’s reference currency. They reflect the current fees, include management commissions and possibly also performance commissions. They do not, however, take into account any entry fees that the investor might be required to pay. All returns are calculated from NAV to NAV with dividends reinvested.

With the current backdrop of high dispersion, all market cap segments in the strategy contributed positively over the year. There was similar positive contribution across investment strategies, our Machine Learning and our growth-momentum selections outperforming the most.

The strategy’s underweight position in China over the year contributed once again positively, our selection in the country helping also. The underweight to China was strongly reduced in the final quarter, as Mega Cap Tech names in the country started entering our top positions again after their large underperformance, boosting our Consumer Discretionary, IT and Communication Services exposures in the country. The strategy is now close to equal-weight in the country, after three years of very significant underweight to the MSCI EM worst performer.

The strategy’s selection of stocks in Turkey, despite being small at less than 2% allocation, was among the positive contributors also as local retailer picks performed strongly.

Our underweight position in India was the largest detractor (again) last year as valuations get even more stretched in the country. We expect this to revert again in favour of the strategy at some point given the very high growth expectations currently priced in by the market.

by Emmanuel Hauptmann

CIO, Partner and Head of Systematic Equities

Disclaimer

Marketing Material. All forms of investment involve risk. The value of investments and the income derived from them is not guaranteed and it can fall as well as rise and you may not get back the original amount invested.

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments SA and the date of reference is the date of this document, end of the previous month.