Commentaries

30 October 2024

The China Comeback in Emerging Markets

September has marked a strong rebound for Emerging Markets Equities, with the MSCI EM TRN index up 6.7% while MSCI World TRN was up 1.8%, bringing them close to in line with developed Equities year-to-date.

The 50bps rate cut by the Fed and the announcement of one of the largest Chinese monetary and fiscal stimulus packages in September led to a 29% surge in Chinese equities between September 23 and October 2—a welcome boost for Emerging Markets equities, which were trading at historically attractive valuation levels compared to developed markets (cf. Emerging Markets: What’s Next, RAM AI, Aug 2024).

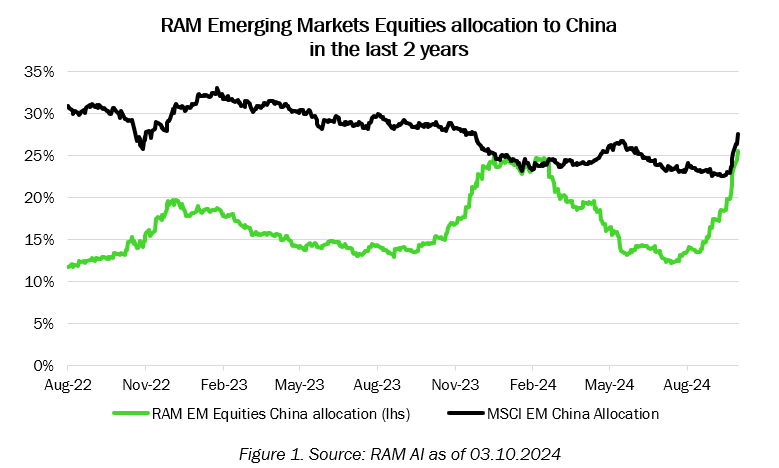

Due to the low quality of the average Chinese company—characterised by highly leveraged balance sheets and low operating cash flow generation—our blend of strategies has maintained a low exposure to China, averaging an underweight position of nearly 10% over the past three years. Interestingly, however, our strategies began a significant reallocation to Chinese equities in August, reaching a near equal-weight position in the country by the end of September.

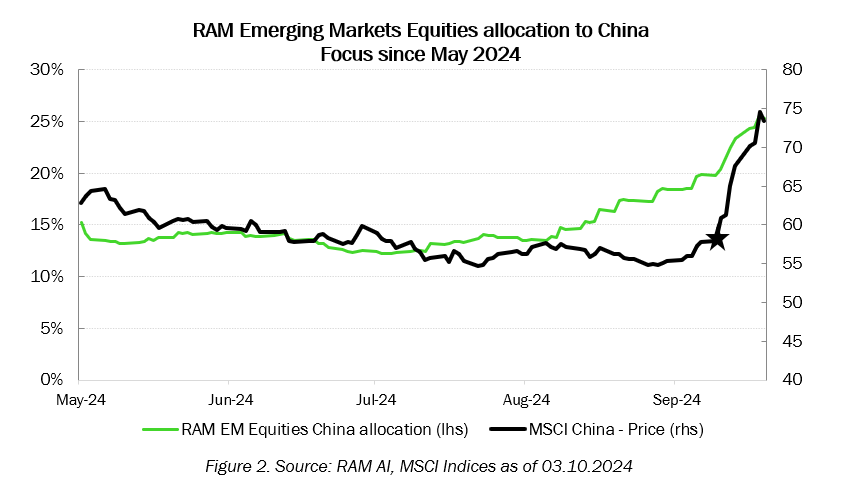

The strategies' reallocation preceded the historic two-week surge in Chinese equities beginning on September 23.

The reallocation towards China in our strategies was driven by a combination of highly attractive valuations across the country, positive growth dynamics in select tech and consumer discretionary companies, and extremely negative market sentiment. This mix prompted a significant increase in exposure to selected Chinese names within our deep value and agnostic Machine Learning strategies.

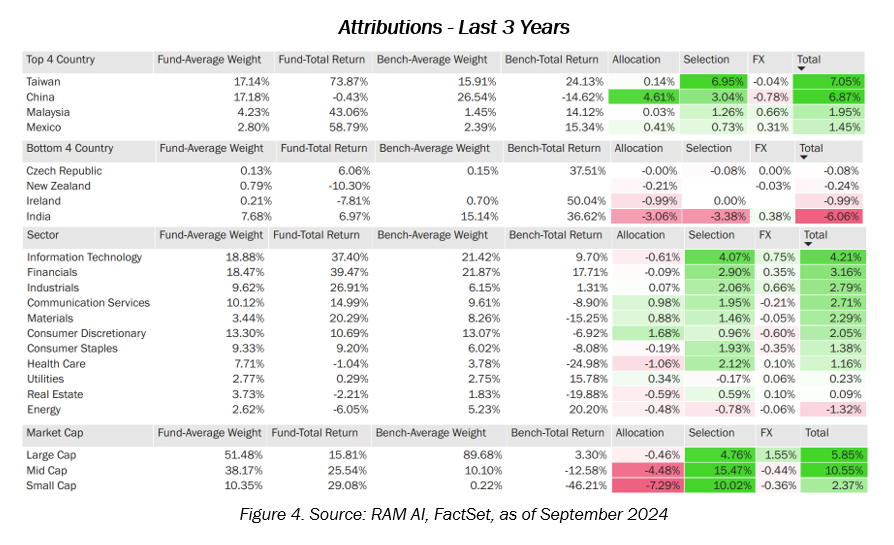

The underweight position of our strategy blend in China has positively contributed to the fund’s relative performance versus the benchmark over the past three years. Following the recent rebound, China continues to be a positive contributor to the fund’s year-to-date relative performance, both from an allocation and selection perspective.

After the recent reallocation, the strategy is close to in line with the MSCI EM index in terms of Chinese allocation.

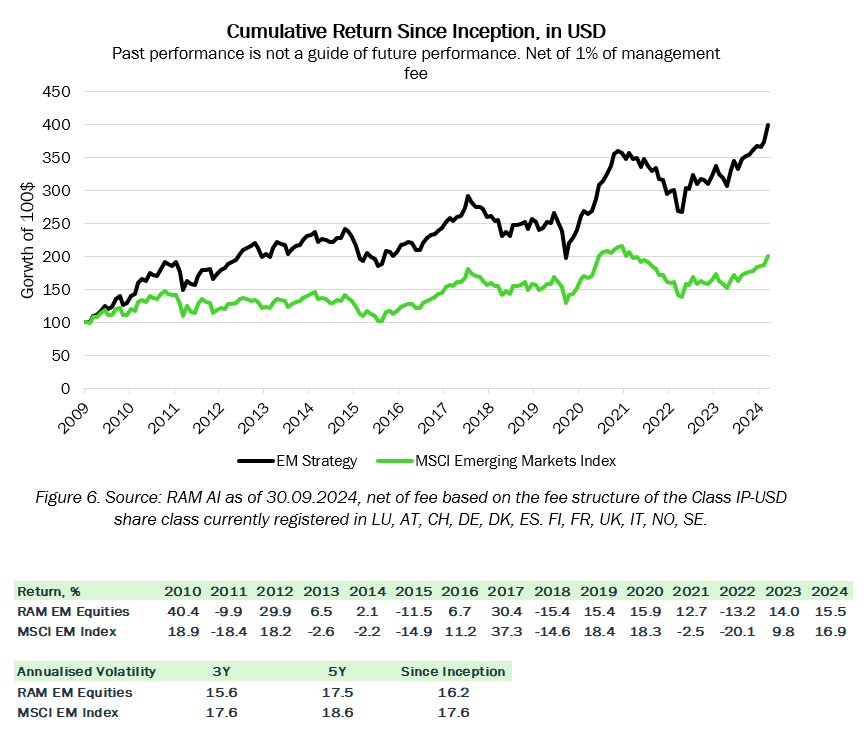

Recent market dynamics underscore the value of our dynamic approach to capturing fundamental opportunities across Emerging Markets, which has enabled us to generate strong excess returns over the past 15 years with lower risk than the index.

Disclaimer

The fund is a Sub-Fund of a Luxembourg SICAV with registered office: 14, Boulevard Royal L-2449 Luxembourg, approved by the CSSF and constituting a UCITS (Directive 2009/65/EC). This marketing document is only provided for information purposes to professional clients, and it does not constitute an offer, investment advice or a solicitation to subscribe shares in any jurisdiction where such an offer or solicitation would not be authorised or it would be unlawful. In particular, the Fund is not offered for sale in the United States or its territories and possessions, nor to any US Person (citizens or residents of the United States of America). Note to investors domiciled in Singapore: shares of the Sub-Fund offered in Singapore are restricted schemes under the Sixth Schedule to the Securities and Futures (Offers of Investments)(Collective Investment Schemes) Regulations of Singapore. This document is confidential and is intended only for the use of the person to whom it was delivered; it may not be reproduced or distributed. There is no guarantee that the holdings shown will be held in the future. The investment described concerns the acquisition of shares in the Sub-Fund and not in a specific underlying asset. Past performance is not a guide to current or future results. There is no guarantee to get back the full amount invested. The performance data do not take into account fees and expenses charged on subscription and redemption of shares nor any taxes that may be levied. As a subscription fee calculation example, if an investor invests EUR 1000 in a fund with a subscription fee of 5%, the investor will pay to his financial intermediary EUR 47.62 on the investment amount, resulting with a subscribed amount of EUR 952.38 in fund shares. In addition, potential account keeping costs (by investor’s custodian) may reduce the performance. Some shares in the Sub-Fund may apply a performance fee. Please refer to the section “Charges” and to the “Glossary” in this document for further details. Leverage intensifies the risk of potential increased losses or returns. RAM Active Investments may decide to terminate the marketing arrangement in place in any given country in accordance with Article 93a of Directive 2009/65/EC. Changes in exchange rates may cause the NAV per share in the investor’s base currency to fluctuate. Particular attention is paid to the contents of this document but no guarantee, warranty or representation, express or implied, is given to the accuracy, correctness or completeness thereof. Prior to any transaction, clients should check whether it is suited to their personal situation, and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. Please refer to the Key investor document and prospectus with special attention to the risk warnings before investing. For further information on ESG, please refer to https://www.ram-ai.com/en/regulatory-information and the relevant Sub-Fund webpage on the section «Sustainability-related disclosures.” The prospectus, constitutive documents and financial reports are available in English and French while KIDs are available in the relevant local languages. These documents can be obtained, free of charge, from the SICAVs’ and Management Company’s head office and www.ram-ai.com, its representative and distributor in Switzerland, RAM Active Investments S.A. and the relevant local representatives in the distribution countries. A summary of Investors’ rights is available on https://www.mediobancamanagementcompany.com/sites/duemme/files/mb_manco_-_investors_rights.pdf

Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company S.A., 2 boulevard de la foire 1528,Grand-Duché de Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments and the date of reference is the date of this document.

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments SA and the date of reference is the date of this document, end of the previous month.