Commentaries

2 July 2019

June 2019 - Central banks’ prop up risky assets - Systematic Fund Manager's Comments

Trade concerns, political indecision and slowing growth all abated in June, as markets were increasingly focused on central banks’ rhetoric. The Fed reinforced investor expectations for an interest rate cut in 2019, while the ECB suggested additional eurozone stimulus could be necessary. China’s market rallied on news that Beijing and Washington officials would resume their negotiations, after talks faltered in May. There appears a palpable disconnect between the central bank-led rally with investors unwilling to price in their downside risks, and leading indicators which continue to soften; a bad omen for the business cycle and corporate profits. Further downside risks to the global economy could translate into an outright earnings recession, a scenario which is not reflected in most investor portfolios. With risks (liquidity and market) quietly seeping into portfolios, as outperformance becomes concentrated amongst a small portion of the market, we believe that a fundamentally driven, all-cap approach can offer a degree of downside protection for the coming months

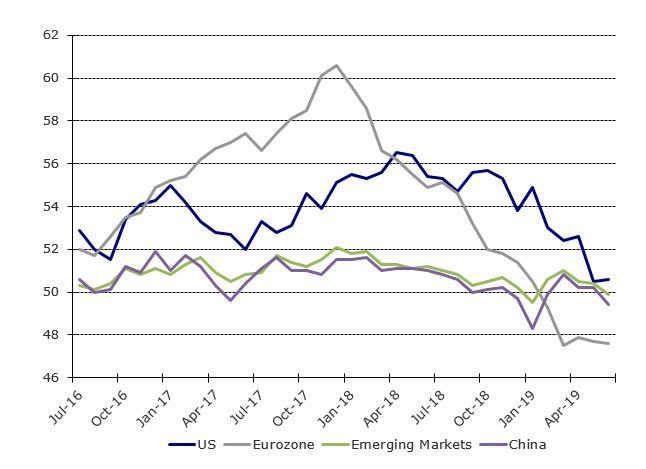

PMI contracting

Several PMI indicators have crossed the 50 mark recently, with countries like China, Spain, UK joining the Germany, Japan, South Korea, that shifted earlier in the year in signs of economic contraction territory. Indicators in the US are not glowing either, with the tax cut plan having now little effect on growth expectations, and the central bank leeway to galvanize investors confidence reducing increasingly.

Source: Bloomberg, RAM Active Investments, as of 30.06.2019

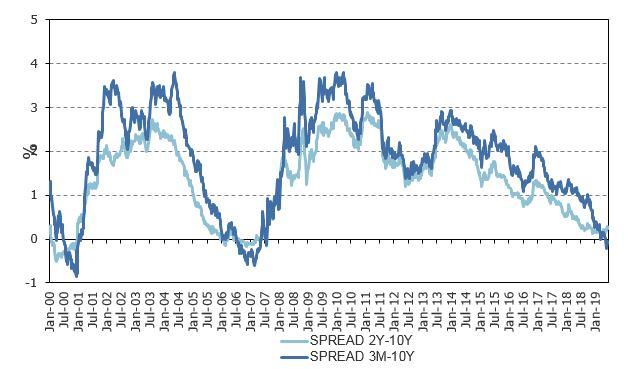

Inverted Yield Curve

Historically, inverted yield curves have been a decent indicator of recession risk. Central banks have the possibility to be aggressive in their action to temper a potential slowdown in the economy, but when earnings momentum starts to falter and the investment cycle decelerate, it is hardly possible to fully offset recessionary pressure simply by cutting rates. Amongst market pundits, there are more voices arguing that given the low level of interest rates globally and the fact that central banks have extensively explored unconventional measures, any significant boost to the economy needs to come from fiscal policies.

US Treasury Yields – Spread

Source: Bloomberg, RAM Active Investments, as of 30.06.2019

These first signs of a potential cycle-end in the market mean investors should more than ever focus on:

- Quality: the ability of firms to run their operations on a self-standing basis and to refinance themselves even in the case of more adverse financing conditions should be at the forefront of stock selection in a late-cycle phase

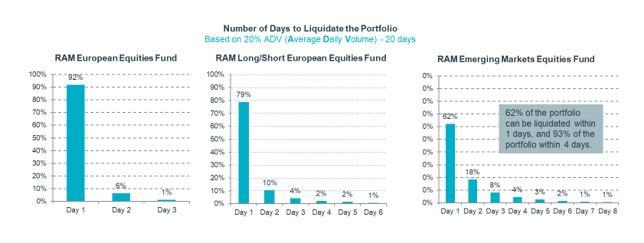

- Liquidity: the situation in stress periods could be drastically different from what can be observed in normal market conditions and managing dynamically this downside liquidity risk is essential

- Diversification: while market uptrends are built through several quarters/years, downturns happen very fast and with an amplitude that is hardly predictable. Therefore, diversification is of outmost importance, especially at this point in the economic cycle.

We are convinced that our highly liquid, diversified and quality-biased long-only and long/short solutions across regions and market caps are well adapted to the current investment environment. Finally, RAM’s proprietary market impact models reduce liquidity risk and costs, scaling down positions with limited liquidity while maximizing expected alpha.

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the Management Company RAM Active Investments (Europe) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg. The reference to RAM AI Group includes both entities, RAM Active Investments S.A. and RAM Active Investments (Europe) S.A.