Commentaries

13 June 2019

May 2019 - May rang the diversification bell- Systematic Fund Manager's Comments

Markets appear in disarray. While 2019 began in serene fashion, as markets were led by monetary policy rhetoric and fewer negative news on the macroeconomic front, it took just a handful of provocative tweets by President Trump to shatter complacency and send volatility soaring.

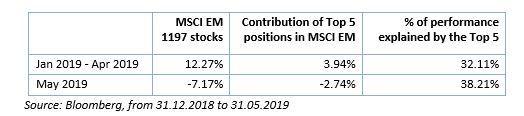

Globally, a handful of stocks have been the main explanation behind the recent equity market performance. Whether through large inflows into passive investments displaying striking concentration features or investors’ perception in terms of growth pattern of these companies, the notion of fair value seemed to be put aside. However, May provided us with a flavour of what could happen if these stocks, having created the bright spells for global equities, produced the opposite effect.

MSCI EM performance vs MSCI EM largest 5 stocks performance

Our performance contribution analysis of the largest stocks in MSCI EM could well be extended sector and country concentration issues, which would translate into relatively similar results. In this context, at the risk of repeating ourselves, diversification at single stock, sector and country level is not only a textbook recommendation but rather a valuable risk management tool, especially in light of what has been accumulated throughout this economic cycle.

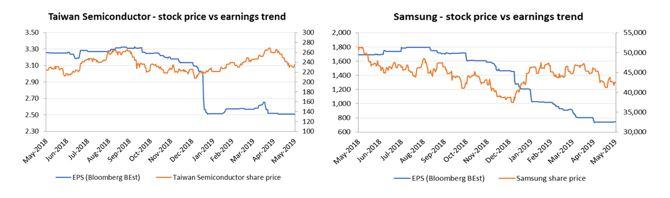

Tech mega cap stocks - room on the downside yet if fundamentals prevail

Comparing the share price and earnings expectations of The Tech/Communication Services companies, largely responsible for MSCI EM performance over the past years, we notice a significant divergence between the two. The below examples illustrating Taiwan Semiconductor and Samsung, which are certainly not isolated cases and are a good representation of many large/mega cap Tech stocks, underline the share price disconnect to fundamentals. The month of May doesn’t simply tell us the end of the story in terms of repricing since there’s some significant asymmetry in sight if fundamentals of these companies do not adjust on the upside in the near-term.

Stock price vs Earnings trend

Source: Bloomberg, RAM Active Investments, as of 31.05.2019

Value hammering continued but our strategy diversification played its role

In May, a striking phenomenon in global equity markets was the further deterioration of Value versus Growth stocks. Lower interest rates partly explain the enthusiasm for high growth companies, but the fundamentals are telling a different story when companies are analysed through the lens of P/E to growth ratio. In Europe for example, the cumulative performance divergence between Value and Growth companies has been building up since 2006, touching now a significant level.

Unsurprisingly, Value-biased managers suffered the most in this context, and continued to see outflows, reinforcing the negative trend of Value stocks.

Net flows into Value vs Growth European funds over 1 year

We see several potential catalysts at this point that might bring mean reversion. Firstly, the recent acceleration of outflows suffered from Value-biased funds looks like a capitulation trade. Secondly, a potential reversal of the dominant mega-cap growth names theme in passive investment vehicles would certainly turn the attention to company fundamentals. Finally, the current economic backdrop doesn’t speak in favor of a strong growth cycle. In that respect, we believe Value companies with a “Quality” aspect would perform extremely well on a relative basis with the comeback of stocks discrimination in the market.

Our asymmetrical profile expressed itself despite Value being out-of-favor in Europe

Despite both Value and “Quality” being out-of-favour in Europe, our funds exhibited a positive behavior. Our selection effect and diversification in terms of strategies were the key drivers of positive performance. The asymmetry of our books’ fundamentals, on the long and short side, enabled us to extract alpha despite the extreme inefficiencies staying large enough, or even increasing in the case of Value vs Growth stocks in Europe.

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the Management Company RAM Active Investments (Europe) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg. The reference to RAM AI Group includes both entities, RAM Active Investments S.A. and RAM Active Investments (Europe) S.A.