Commentaries

14 September 2020

August 2020 - A handful of stocks driving the equity market euphoria - Systematic Fund Manager's Comments

When the market starts showing signs of “irrational exuberance”, it is difficult to refrain from drawing historical similarities. The recent rally, especially for the NASDAQ, recalls us the late 90’s. The Fed Chairman Alan Greenspan was forced to cut rates in October 1998 to bring back liquidity to the markets after the LTCM debacle. The main beneficiaries were Technology stocks, which had a tremendous run. The rest of the story and how the market unraveled is known to everyone. However, it would be too simple to think that the current situation would develop in the same way. What is certain low rates alone can’t act as a safety net for all the extreme situations in financial markets today.

Far from being penny stocks, the likes of Tesla and Apple had a tremendous run over the past weeks, namely due to:

- The thirst by the market for growth companies and long duration assets

- The recent stock split operation, making the stock accessible to Robinhood accounts and triggering further euphoria

- Fed’s inflation target adjustment, allowing any overshoots and opening the door for keeping interest rates low for longer

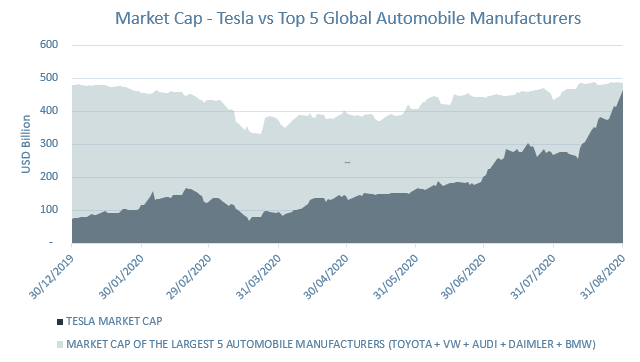

The case of Tesla – a puzzling market cap

The company might be close to being able to bring lighter and durable batteries or significantly increase its production capacity, but the fact remains that its market cap has almost reached that of the top 5 global automobile manufacturers combined. In 2019, Toyota alone sold just under 11 million vehicles, while Tesla sold less than 300’000 cars.

Source: Bloomberg, RAM AI, as of 31.08.2020

In the wake of the Fed’s announcement, highly levered and low quality companies’ stock benefitted from the news, while Value names continued to be ignored by market participants. Additionally, cosmetic operations such as stock split have pushed some segments of the market to unchartered territory. In our view, investors shouldn’t be fooled by the level of equity indices, as a handful of stocks are “partying like it’s 1999”. The key is to remain well diversified in terms of strategy and market cap, and be focused on liquidity.

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the Management Company RAM Active Investments (Europe) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg. The reference to RAM AI Group includes both entities, RAM Active Investments S.A. and RAM Active Investments (Europe) S.A.