Commentaries

16 May 2020

April 2020 - Reversal in April for our funds’ Value & Small Cap selections - Systematic Fund Manager's Comments

Reversal in April for our funds’ Value & Small Cap selections

While the first quarter of 2020 witnessed the worst performance since the fourth quarter of 2008 and the height of the Global Financial Crisis. April’s bounce saw global equities post their best monthly return since April 2009.

Value outperforms the market

We saw after years of under-performance our Value selection outpace the wider market in April, as anticipated our Value and Machine Learning selections are capturing in the rebound some of the opportunities created by the March dislocation and are likely to do well if the recovery continues. The Quality bias of our Value engine Value, tilted towards attractive free-cash-flow names should help if the market were not to hold at current levels.

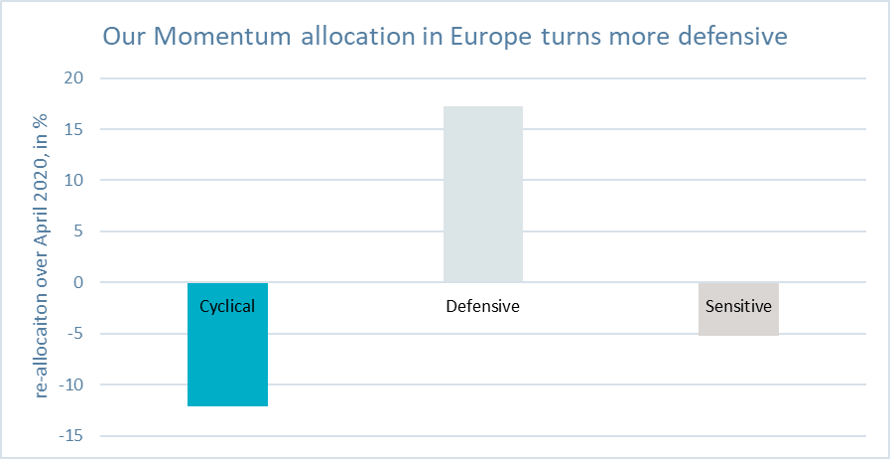

On the other side of the book, our Momentum engines are still capturing the negative earnings dynamics that keep building up for a lot of companies and have turned significantly more defensive in anticipation of potentially resilient volatility and a potential further leg down for equity markets.

Source: RAM AI as of 30.04.2020

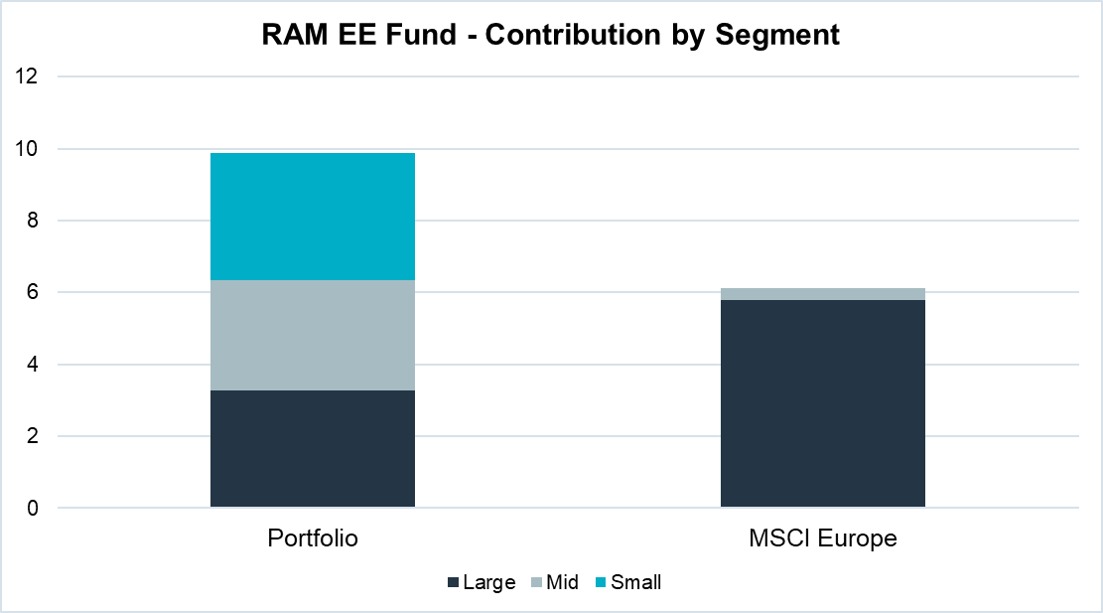

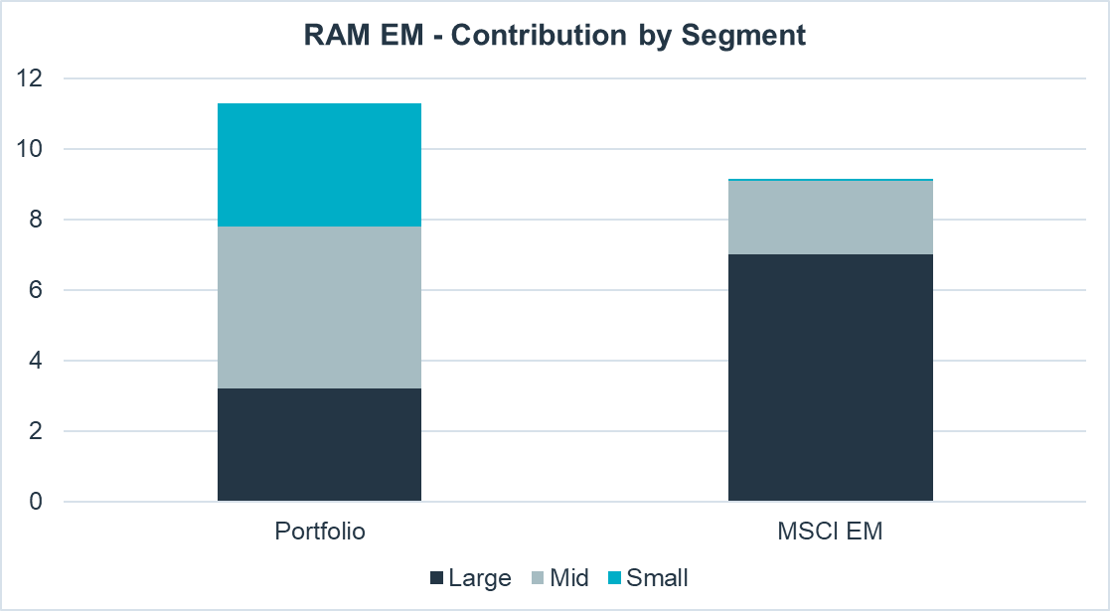

Small Cap outperformance

Small caps also enjoy a profitable month, and given their significant underperformance in recent years, it’s an encouraging for an all-cap manager like us to see. Not only this segment offers strong opportunities given the current dispersion observed, this relative outperformance of small and mid-cap names is an encouraging sign, where we believe that these stocks tend to be more sensitive to economic fluctuations and are among the first areas of the market to reflect both downturns and rebounds.

We’ve shown below the contribution by market cap segment in April, across both Europe and Emerging Markets.

Source: MSCI indices, RAM AI as of 30.04.2020

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the Management Company RAM Active Investments (Europe) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg. The reference to RAM AI Group includes both entities, RAM Active Investments S.A. and RAM Active Investments (Europe) S.A.