Commentaries

10 March 2020

February 2020 - The virus reveals preexisting instabilities in the market - Systematic Fund Manager's Comments

Global markets reacted to the coronavirus outbreak with varying degrees of distress, increasing volatility (with the VIX hitting a high of 54.39 - its highest level since January 20, 2009), leaving investors anxious over decelerating economic growth, at least in the short-term. February saw investors ditching stocks, in favour of “safe-haven” assets such as U.S. government debt, which helped to drive U.S. borrowing costs to record lows. While the virus is indeed a problem, we believe that it simply revealed preexisting instabilities; a bull market run built on central banks’ liquidity and passive investments flows, not driven by fundamental reasons.

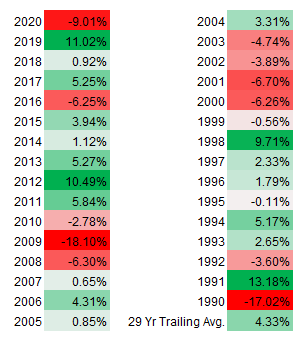

The start to the current year has been the 3rd worst for global equity markets since 1990. We believe that, given the length of the current economic cycle and the excesses in financial markets, the early 2000s are probably the closest reference point to our current situation.

Performance of the MSCI World TRN USD Index (December 31st to February-end) since 1999

Source: Bloomberg, RAM AI, as of February 28th, 2020

The virus, which has now infected more than 100,000 people and killed over 3,400* continues to rattle markets and policy makers alike. This is despite coordinated action by global central banks (the Fed cut its benchmark interest rate by 50 basis points). The potential impact on the wider economy is the key concern, but investors should be equally mindful of the diversification and adaptability of their portfolios given it’s increasingly likely that the impact on corporate profits will be sizeable. The medium-term stocks price behavior is largely driven by corporate profits, so the anticipated economic slowdown will likely impinge and thus force a major revision on earnings.

With markets changing at such a pace, adaptability and positioning are key for managers to help mitigate the volatility we are currently seeing. Our diversified and defensive positioning across our liquid alternatives range should enable us to navigate these choppy waters. The latest rebalancing of our RAM Long/Short European Equities Strategy (for example) has revealed a cyclical risk reduction; with Consumer Discretionary and IT names seeing their exposure trimmed at the expense of more defensive sectors such as Utilities and Telcos. This current context presents compelling opportunities for our strategies, especially in addition to the extreme inefficiencies that have been building over the last two years.

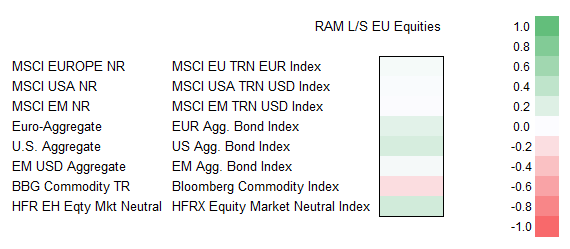

Our RAM Long/Short European Equities Strategy’s average correlation to traditional assets has been low historically. The fund is designed to take advantage of dispersion through a market-neutral approach. With liquidity, diversification and multi-performance engines being at core of the fund’s investment process, we are convinced it is well-suited to navigate a heightened volatility environment.

Correlation of RAM Long/Short European Equities Strategy vs traditional assets

Source: Bloomberg, RAM AI, from March 31st, 2009 to February 28th 2020

*Taken from https://www.worldometers.info/coronavirus/ as at 6th March 2020

Direct access per fund to our latest Fund Manager's Comments:

Legal Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund units on the most recent reports and prospectuses. These contain further information on the products concerned. The value of units and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, key investor information document, articles of association and financial reports are available free of charge from the SICAVs’ and management company’s head offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the funds’ representative in the country in which the funds are registered. This marketing document has not been approved by any financial Authority, it is confidential and its total or partial reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the Management Company RAM Active Investments (Europe) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg. The reference to RAM AI Group includes both entities, RAM Active Investments S.A. and RAM Active Investments (Europe) S.A.