Aktuelles

4 Mai 2018

Inclusion of China A-shares in the MSCI EM Index

Starting in May 2018, effective with the RAM Emerging Markets Equities Fund’s May rebalancing, MSCI will include 222 large-cap, China A-shares in the MSCI Emerging Markets (EM) Index.

What is the weighting of the planned inclusion factor of the A-Shares?

Although the initial weighting of Chinese A-shares in the MSCI EM Index is relatively small (c.0.73%), the full impact (potentially 100% inclusion over the next decade) will be substantial. In our view, the inefficient nature of the A-Shares will, we believe, present an excellent opportunity for our stock-picking strategies (which look to capitalise on inefficiencies on a global basis). Our research suggests that further inclusion of A-Shares could represent a significant risk for the benchmark overall. Our Fund’s strategy here would be to invest via our counterparties in CFDs (should access not be possible via cash).

Allocation to China & HK in the RAM EME Fund average over the last quarter (by strategy):

In terms of our Strategy’s allocation to China & HK over the previous quarter*, all three maintain an underweight relative to the benchmark (30%). While our Momentum engine maintaining the largest weighting (26.2%), we have seen a general reduction in size over the quarter (peak of 26.2%, to a low of 22.9%). Our Value engine has a 25.8% allocation to China & HK, below the benchmark. Lastly our Defensive engine has the lowest relative allocation (22.8%). Again the reduction theme was evident here (peak of 25.8% to a low of 19.5%).

Potential Risks and Challenges

Market Valuation:

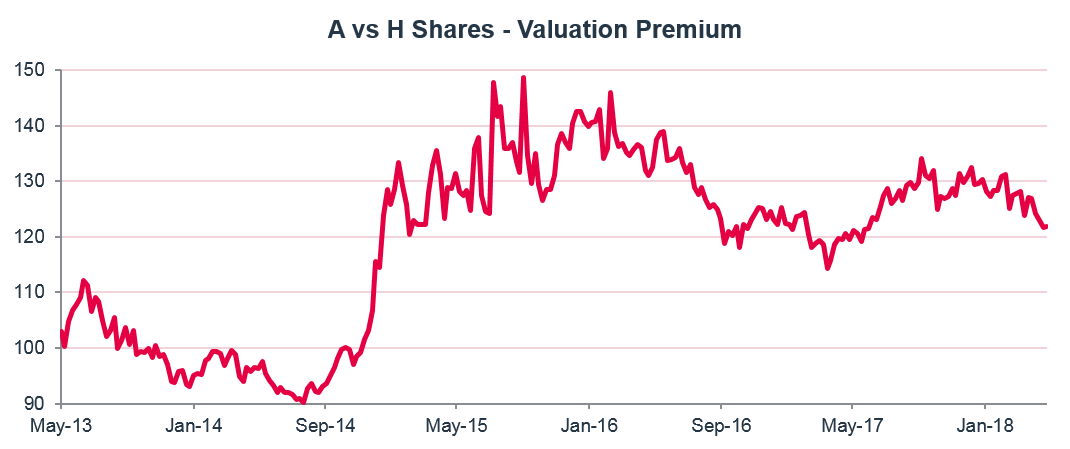

A consequence of the historically limited access to offshore investments here is the potential risk of overvaluation of the China A-Share market. As the integration of A-Shares increases over time, shorting and arbitrage opportunities could arise, leading to divergence in the valuations of the A- and H-Share markets. The market appears largely in favour of H-shares (trading at 23% discount, while also being cheaper to trade) versus A-shares listings for dual-listed stocks (see chart below).

As of March 2018, the valuation of the MSCI China A-Share Index was roughly double the valuation of the MSCI China H-Share Index:

Source: Bloomberg from 3rd May 2013 to 23rd April 2018.

Lack of Shorting Availability:

Given the high levels of valuation, our research indicates that we would rather identify short rather than long opportunities in the A-Shares universe. However, it is very difficult to capture these shorts and build a significant short position in the market, as borrowing availability in A-Shares is scarce given very low borrowable stock inventory.

Rising Costs:

In addition to the above, we can expect higher exchange fees and higher taxes, as well as higher commissions amounting to around 25bps of trading costs in A-shares, which could prove to be a costly exposure for our Strategies.

Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial product mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund shares on the most recent financial reports, key investor information document (KIID) and prospectus which contain further information on the products concerned. The value of shares and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. Changes in exchange rates may cause the NAV per share in the investor's base currency to fluctuate and may cause the value of an investment to rise or fall. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. Without prejudice of the due addressee’s own analysis, RAM understands that this information should be regarded as a minor non-monetary benefit according to MIFID regulations. The prospectus, KIID, articles of association and financial reports are available free of charge from the SICAV’s and Management Company’s registered offices, from its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the relevant SICAV’s representative in the country in which the SICAVs are registered. This marketing document has not been approved by any financial Authority, it is confidential and addressed solely to its intended recipient; its partial or total reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the Management Company RAM Active Investments (Luxembourg) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg. The reference to RAM AI Group includes both entities, RAM Active Investments S.A. and RAM Active Investments (Luxembourg) S.A. RAM (LUX) Systematic Funds – Emerging Markets Equities Fund (the "Fund" or "RAM Emerging Markets Equities Fund"), a Luxembourg investment company with variable capital (SICAV) having its registered office at 14, Boulevard Royal L-2449 Luxembourg, approved by the Commission the Surveillance du Secteur Financier (CSSF) and constituting a UCITS in accordance with the Directive 2009/65/EC of 13 July 2009.