Kommentare

30 Juni 2023

Update on RAM European Stock Selection Strategies Q2/2023 [ENG]

European Stock Prices Disconnect from Fundamentals with Small Caps Behind

Strong optimism across European markets has recently led some European indices to new highs despite clear decelerating economic trends and monetary tightening by the European Central Bank (ECB).

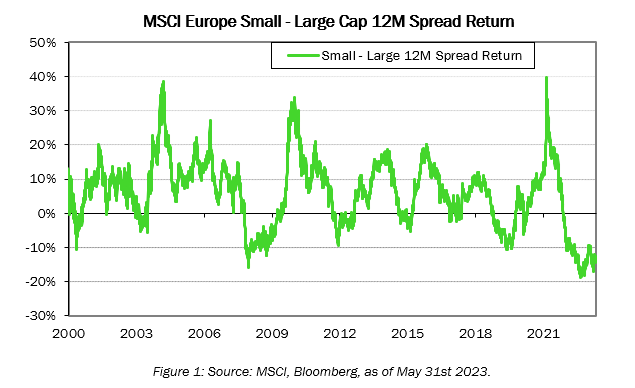

Equity Flows have largely flown towards large caps, as investors seem to have invested back into European markets through passive vehicles mostly, which has led to a historical underperformance of small caps, at levels not seen before, not even during the financial crisis (cf. fig.1).

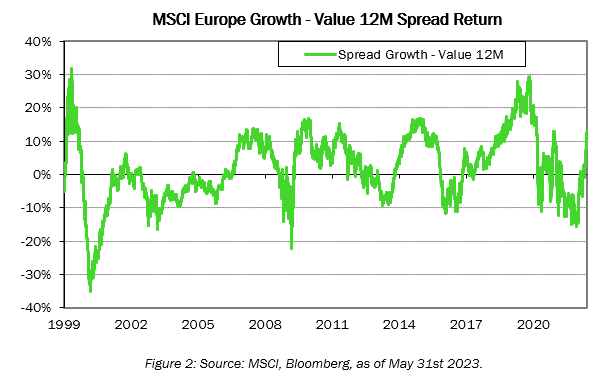

The move has been synchronous to a sharp appreciation of Growth stocks versus Value (cf. fig.2), as mega-cap growth names still dominate the index.

This leads to a compelling opportunity to allocate into flexible cap approaches able to capture attractive valuation opportunities across market cap segments, which provide strong risk-adjusted returns over the long-term.

Momentum Not Immune

In a remarkable conjunction of factors, companies with resilient earnings and price momentum dynamics have also suffered since the beginning of the year, as the market has priced in a reversal into risk-on, without underlying company fundamentals indicating any turnaround so far.

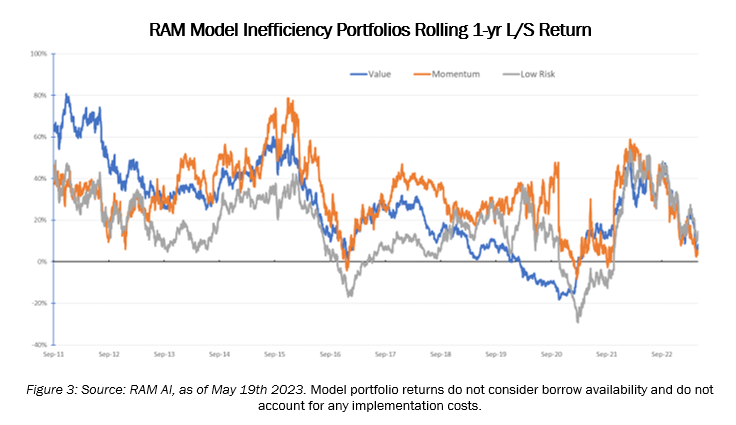

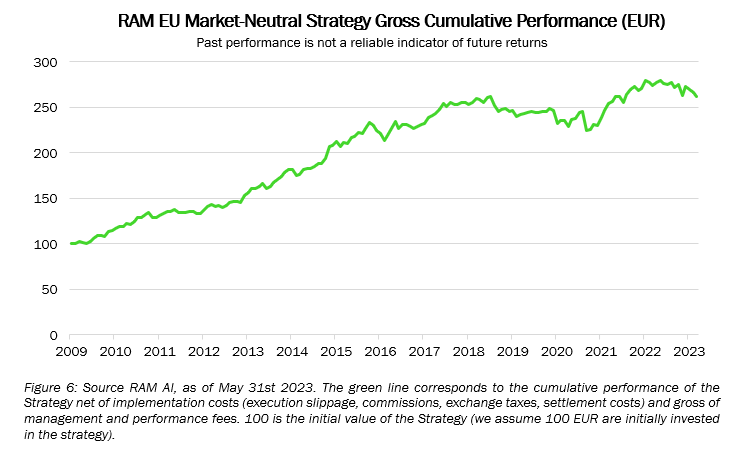

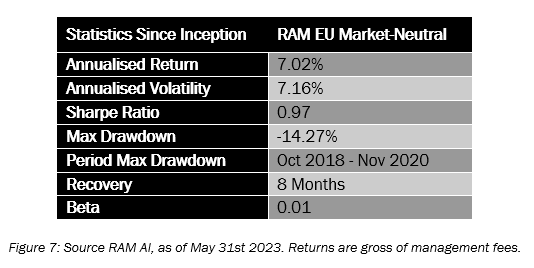

Model Long-Short portfolios across the Value, Momentum, Low Risk inefficiencies we capture have all underperformed recently. These inefficiencies are played integrating dozens of inputs capturing alpha within Value, Momentum and Low-Risk universe. The recent underperformance across engines is rare and is reminiscent in its magnitude of the drawdowns of 2016 and 2020, all followed by strong recoveries of the strategies towards their long-term expected returns (last in 2021, when our European Market-Neutral strategy recovered by 19%).

As painful as it has been to be mindful of risk and hold on market neutrals in the last five years, we believe that the asset class provides diversification benefits that practically no asset class provides, and that it is particularly important when the current reversal of monetary policy is exposing the downside risks of our highly leveraged economies.

Long-term Returns

We seek to constantly improve how we capture market inefficiencies by improving our stock selection process and integrating more data inputs (for an example of new inputs see the Go Beyond Sentiment, September 2022 paper on the integration of financial news in the process using Large Language Models).

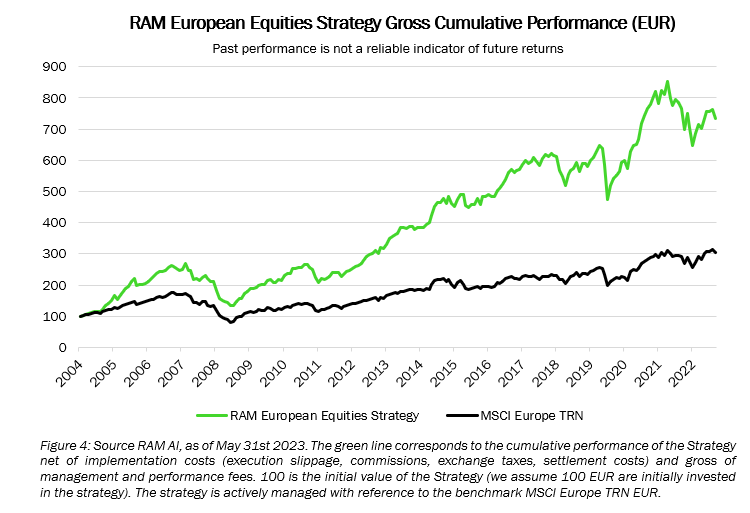

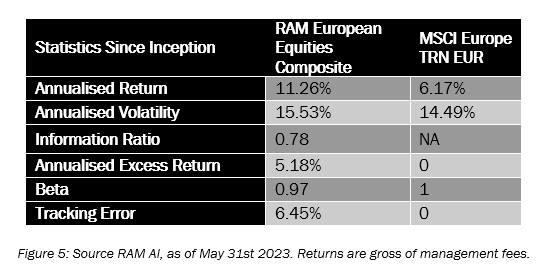

Over the long-run, these inefficiencies persist in the market and have helped us generate significant positive returns (excess returns for the long-only) for investors.

We thrive to enhance the returns of our market neutral strategy by adding more inputs or by capturing more inefficiencies (for illustration, check out The Benefits of Diversifying Frequencies, November 2022 paper). The Market Neutral strategy has delivered sub-par returns versus the long-term in the last five years of continuous exogeneous shocks (COVID-19, vaccines, the Russo-Ukrainian War) but we are confident the strategy stands to deliver strong returns when valuation of the most overvalued growth segments of the market normalise again (as it did in 2021, check out Capitalising on valuation normalisation, May 2022 in the Hedge Fund Journal).

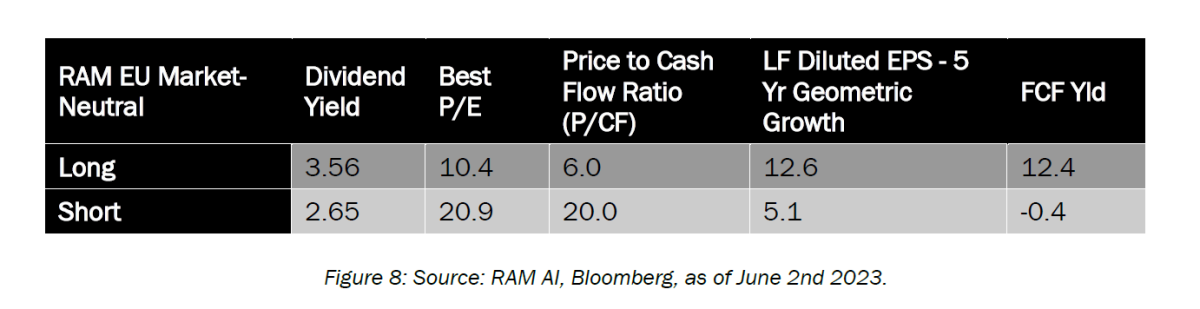

Our systematic stock selection process aims to optimally leverage all information inputs on stocks but retains very strong fundamental qualities which are key over the long-term.

Here are the current fundamentals of our Long and Short single-name selections in the strategy, illustrating the strong value and quality bias of our selection on the Long side, and the financing fragility of our short picks in the current tightening environment (for instance negative free cash flow dynamics):

Conclusion

To conclude, the recent surprisingly strong risk-on in a shaky economic environment has benefitted a fraction of large cap growth stocks in the market. This has negatively impacted the performance of our European Long-Only Equities and Market Neutral strategies, given their value bias and net mid cap exposures. The recent risk-on by the market is leading to a very attractive set of relative value opportunities to capture.

Across valuation, risk and earnings growth dynamics, the recent rally stands out of the norm, which tends to be followed by strong recovery of our systematic stock selection engines towards superior long-term returns.

by RAM AI's Systematic Equity Team - Emmanuel Hauptmann, Valentin Betrix, Nicolas Jamet, Tian Guo, Louis-Alexandre Piquet

________________

Disclaimer

RAM (Lux) Systematic Funds - European Equities and RAM (Lux) Systematic Funds - Long/Short European Equities are Sub-Funds of RAM (Lux) Systematic Funds, a Luxembourg SICAV with registered office: 14, Boulevard Royal L-2449 Luxembourg, approved by the CSSF and constituting a UCITS (Directive 2009/65/EC). This marketing document is only provided for information purposes to professional clients, and it does not constitute an offer, investment advice or a solicitation to subscribe shares in any jurisdiction where such an offer or solicitation would not be authorised or it would be unlawful. In particular, the Fund is not offered for sale in the United States or its territories and possessions, nor to any US Person (citizens or residents of the United States of America). Note to investors domiciled in Singapore: shares of the Sub-Fund offered in Singapore are restricted schemes under the Sixth Schedule to the Securities and Futures (Offers of Investments) (Collective Investment Schemes) Regulations of Singapore. This document is confidential and is intended only for the use of the person to whom it was delivered; it may not be reproduced or distributed. There is no guarantee that the holdings shown will be held in the future. The investment described concerns the acquisition of shares in the Sub-Fund and not in a specific underlying asset. Past performance is not a guide to current or future results. There is no guarantee to get back the full amount invested. The performance data do not take into account fees and expenses charged on subscription and redemption of shares nor any taxes that may be levied. As a subscription fee calculation example, if an investor invests EUR 1000 in a fund with a subscription fee of 5%, the investor will pay to his financial intermediary EUR 47.62 on the investment amount, resulting with a subscribed amount of EUR 952.38 in fund shares. In addition, potential account keeping costs (by investor’s custodian) may reduce the performance.

Some shares in the Sub-Fund may apply a performance fee. Please refer to the section “Fees and Charges” and to the “Glossary” in this document for further details. Leverage intensifies the risk of potential increased losses or returns. RAM Active Investments may decide to terminate the marketing arrangement in place in any given country in accordance with Article 93a of Directive 2009/65/EC. Changes in exchange rates may cause the NAV per share in the investor’s base currency to fluctuate. Particular attention is paid to the contents of this document but no guarantee, warranty or representation, express or implied, is given to the accuracy, correctness or completeness thereof. Prior to any transaction, clients should check whether it is suited to their personal situation, and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. Please refer to the Key Investor Information Document and prospectus with special attention to the risk warnings before investing. For further information on ESG, please refer to https://www.ram-ai.com/en/regulatory-information and the relevant Sub-Fund webpage. The prospectus, constitutive documents and financial reports are available in English and French while KIIDs are available in the relevant local languages. These documents can be obtained, free of charge, from the SICAVs’ and Management Company’s head office and www.ram-ai.com, its representative and distributor in Switzerland, RAM Active Investments S.A. and the relevant local representatives in the distribution countries. A summary of Investors’ rights is available on: https://www.ram-ai.com/en/regulatory-information Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, RAM Active Investments (Europe) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments and the date of reference is the date of this document.

Legal Disclaimer

Das vorliegende Dokument wurde ausschließlich zu Informationszwecken erstellt. Es stellt weder ein Angebot noch eine Aufforderung zum Kauf oder Verkauf der darin erwähnten Anlageprodukte dar und darf nicht als Anlageberatung aufgefasst werden. Es ist nicht zum Vertrieb, zur Veröffentlichung oder Verwendung in einer Rechtsordnung bestimmt, in der ein solcher Vertrieb, eine solche Veröffentlichung oder Verwendung verboten ist, und richtet sich nicht an natürliche oder juristische Personen, an welche ein solches Dokument von Gesetzes wegen nicht weitergegeben werden darf. Insbesondere werden die hierin aufgeführten Produkte nicht zum Verkauf in den Vereinigten Staaten von Amerika oder ihren Territorien oder Besitzungen oder an US-Personen (Bürger oder Einwohner der Vereinigten Staaten von Amerika) angeboten. Die hierin zum Ausdruck gebrachten Meinungen berücksichtigen nicht die individuelle Situation, die Ziele oder die Bedürfnisse jedes Kunden. Die Kunden sollten sich über die in diesem Dokument erwähnten Wertpapiere oder Finanzinstrumente ihre eigene Meinung bilden. Vor jeder Transaktion sollten die Kunden prüfen, ob sie für ihre persönliche Situation geeignet ist, und die mit ihr verbundenen spezifischen Risiken analysieren, insbesondere die finanziellen, rechtlichen und steuerlichen Risiken, und falls nötig professionelle Berater konsultieren. Die in diesem Dokument enthaltenen Informationen und Analysen stützen sich auf Quellen, die als zuverlässig erachtet werden. RAM AI Group kann jedoch nicht garantieren, dass die genannten Informationen und Analysen aktuell, zutreffend oder vollständig sind, und übernimmt keine Haftung für Verluste oder Schäden, die sich aus ihrer Verwendung ergeben können. Alle Informationen und Beurteilungen können sich ohne Vorankündigung ändern. Anlegern wird geraten, ihre Entscheidung über eine Anlage in den Fondsanteilen auf Grundlage der jüngsten Geschäftsberichte und Verkaufsprospekte zu treffen. Diese beinhalten weitere Informationen über die betreffenden Produkte. Der Wert von Anteilen und die darauf entfallenden Erträge können steigen oder fallen und sind in keiner Weise garantiert. Der Preis der in diesem Dokument genannten Finanzprodukte kann schwanken und sowohl plötzlich als auch stark sinken. Es ist sogar möglich, dass Anleger das gesamte angelegte Kapital verlieren. Auf Anfrage erteilt RAM Active Investments Kunden weitere Auskünfte zu den Risiken, die mit bestimmten Anlagen verbunden sind. Veränderungen der Wechselkurse können ebenfalls zur Folge haben, dass der Wert einer Anlage steigt oder sinkt. Die reale oder simulierte Wertentwicklung in der Vergangenheit ist nicht unbedingt ein verlässlicher Anhaltspunkt für die künftige Performance. Der Verkaufsprospekt, die wesentlichen Anlegerinformationen (KIID), die Satzung und die Geschäftsberichte sind gebührenfrei von der Hauptgeschäftsstelle der SICAV, ihrem Vertreter und Vertriebspartner in der Schweiz, der RAM Active Investments S.A., Genf, und dem Vertreter der Fonds in den Ländern, in denen die Fonds zugelassen sind, erhältlich. Dieses Dokument ist vertraulich und richtet sich nur an den beabsichtigten Empfänger; seine Vervielfältigung und Verbreitung sind verboten. Ausgestellt in der Schweiz von RAM Active Investments S.A., die in der Schweiz von der Eidgenössischen Finanzmarktaufsicht (FINMA) zugelassen und reguliert ist. In der Europäischen Union und dem EWR von der zugelassenen und beaufsichtigten Verwaltungsgesellschaft, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxemburg, Großherzogtum Luxemburg, herausgegeben. Die Quelle der oben genannten Informationen (sofern nicht anders angegeben) ist RAM Active Investments SA und das Bezugsdatum ist das Datum dieses Dokuments, Ende des Vormonats.