Aktuelles

27 März 2018

5 reasons to invest in Asian credit

By Ani Deshmukh, Fund Manager of RAM Asia Bond Total Return Strategies

- The rapid expansion of the Asian hard currency bond market makes it a visible asset class for global asset allocators

- The structure of this asset class’ buyers makes it less vulnerable to global selloffs than in the past

- Asian hard currency credit offers attractive yields in respect to credit/interest rate risks

- The Asian default rates over the past years have been largely better than the EM average

- Asian countries present today better fundamentals than other Emerging Markets

Asian hard currency credit posted solid performances with limited downside during market stress periods over the past years, becoming an appealing area to invest in. Considering the JP Morgan Asia Credit Index TR USD (JACI), the market has been experiencing an impressive 6-fold growth since 2008 (from $141 billion to over $900 billion currently). In terms of sector, the Asian market is a highly diversified universe: the JACI Index includes 14 sectors, with the largest ones being Financials and Quasi-Sovereign and Sovereign bonds, and 17 countries.

Source: JP Morgan, 31.12.2018

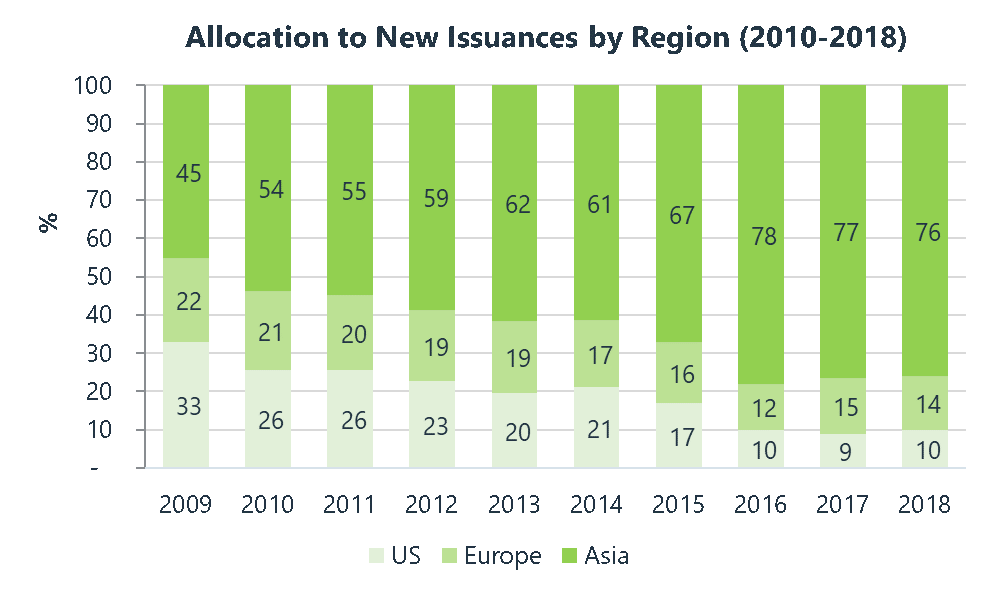

The importance of local investors into Asian hard currency credit as a whole has grown significantly since 2010, if we look at the allocation of new issuances by region (figure 1), we can observe that in 2010 local demand for Asian credit new issuances accounted for about 50% of the global number, while at the end of 2018 this percentage significantly changed: 76% of the demand came from Asian investors last year. A feature that makes this universe completely unique compared to other emerging market regions is the fact that Asian investors tend to be very devoted to local bonds: private banks’ clients in particular generally buy and hold local bonds until maturity. This special and unique characteristic of the Asian bond market has helped increasing the market stability and its resilience to potential external shocks.

Asian markets have proved their strength even in terms of default rate. The Asian default rates have been largely better than other EM regions considering the average levels over the last decade. Additionally, due to favorable financing conditions, many Asian issuers were able to roll their debt to longer maturity and secure cheaper funding. Amid this background, we believe Asian hard currency credit has become an established asset class, which offers a good balance between yield and credit/duration risk compared to other emerging markets regions. Additionally, the so-called “Asian premium”, due to investors’ perception for the region’s credit risk, presents an attractive yield uptick for European investors. The performances of this asset class have also remained relatively stable during different macro-economic environments, and this represents another positive feature for global investors. Last but not least, fundamentals: Asian countries present better fundamentals than other emerging markets peers and continue to implement structural reforms that should lead to medium term economic and financial improvements.

Nexus Investment Advisors Limited, subject to the supervision of the Securities and Futures Commission (SFC) in Hong Kong, has been appointed by the fund's management company as investment manager to RAM (Lux) Tactical Funds II - Asia Bond Total Return Fund.

Disclaimer

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial product mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM AI Group cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund shares on the most recent financial reports, key investor information document (KIID) and prospectus which contain further information on the products concerned. The value of shares and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. Changes in exchange rates may cause the NAV per share in the investor's base currency to fluctuate. If requested, RAM AI Group will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. Without prejudice of the due addressee’s own analysis, RAM understands that this information should be regarded as a minor non-monetary benefit according to MIFID regulations. The prospectus, KIID, articles of association and financial reports are available free of charge from the SICAV’s and Management Company’s registered offices, from its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the relevant SICAV’s representative in the country in which the SICAVs are registered. This marketing document has not been approved by any financial Authority, it is confidential and addressed solely to its intended recipient; its partial or total reproduction and distribution are prohibited. Issued in Switzerland by RAM Active Investments S.A. which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the Management Company RAM Active Investments (Europe) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg. The reference to RAM AI Group includes both entities, RAM Active Investments S.A. and RAM Active Investments (Luxembourg) S.A.. Nexus Capital Management Limited 10/F, 8 Queen's Road Central, Hong Kong is a regulated investment manager acting by delegation of RAM Active Investment (Europe) S.A. for RAM (Lux) Tactical Funds II. This Fund is registered in Austria, Belgium, Switzerland, Germany, Denmark (professional investors), Spain, Finland, France, United Kingdom, Italy, Luxembourg, Netherlands, Norway, Portugal and Sweden.