Aktuelles

8 November 2017

Decrease Your Beta, Diversify Your Sources of Return - Q&A with RAM’s Equity

"Diversify your sources of alpha"

Q&A With RAM’s Systematic Equity Investment Team

Can you provide an overview of the "RAM" approach to investing across the beta-neutral strategies?

Emmanuel Hauptman: “We use a rules-based approach aiming to capture fundamental opportunities arising from market anomalies. Our stock selection on the long side relies on fundamental, behavioural and risk criteria to identify attractive stocks. On the short side, we look to identify companies with negative fundamental momentum or which destroy value, this approach identifies stocks that will fall more than the market during a correction.

What we’ve built is a highly disciplined, bottom-up selection engine whose rules are, in effect, a system. In turn, this systematic approach draws upon a blend of distinct strategies that search the market for anomalies.

We have a blend of alpha generative (i.e. adding returns independent from market direction) strategies. They include; Value Convergence, Low Volatility income and Growth/Momentum or trend following strategies. Value Convergence, for example, looks at cash flow generation among companies in a specific sector to identify stocks that may be undervalued. Our aim is to have a stable blend of these ‘alpha’ generating engines to select both the long and short side of the portfolio.

"There are likely to be pockets of concentrated risk"

This helps us deliver performance which is less correlated to extreme fluctuations in the market and with less volatility over the business/ economic cycle.”

In the current market environment, what challenges does the Strategy face?

Emmanuel Hauptman: "We tend to have periods of underperformance during risk-on phases, coupled with high levels of beta in Equity markets. We’ve seen equity valuations rise for eight years almost uninterrupted, with US stocks at record highs and Fixed Income yields at all-time lows. Valuations in other areas like real estate reflect a high level of investment optimism. At the same time, markets have seen sustained low volatility. But experience tells us that with valuations pronounced, there are likely to be pockets of concentrated risk. Take mega-cap stocks. An ETF primarily targeting mega caps would be vulnerable to share underperformance in the event of a market downturn. But our long approach does not have that type of concentration, so an investor is ultimately running less risk. We look to mitigate this risk by not relying too much on any single strategy or factor (such as market momentum or out-performance of value stocks) that is utilised in constructing the portfolio.

“Essentially, this ensures we are diversified away from hot-spots”

A key part of this is not trying to time the various strategies we use. If one strategy is performing strongly in a specific phase of the market, we could allocate more to it. But we don’t. We also look to mitigate concentration risk and avoid being trapped during a market sell-off. We utilise a stable blend of our strategies to help us dampen the impact of risk-off phases and market declines in the portfolio. Additionally, it is worth recalling that the rules we follow in our systematic strategies are strongly grounded in traditional stock fundamentals.

Each factor we develop must be understood by the equity investment team. In addition to, say, price-based trend or low-volatility factors used by most quantitative funds, we integrate a number of selection factors analysing free cash-flow dynamics, dividend or earnings growth. We also incorporate quality factors, like return on equity, in the building blocks of our strategies. This tends to give us an attractive performance profile during risk-off periods and market declines relative to peers."

Markets can change quickly. How do you protect against the positive performance of themes and factors reversing when they have previously had success? Is there a risk of your methodology failing?

Thomas de Saint-Seine: "Our aim is to capture a number of divergent inefficiencies which tend to prevail in both emerging and developed markets, across both the long and the short side (albeit in a slightly different way). In certain specific phases of the market cycle some of these inefficiencies can become "overcrowded".

“This provides us with an unparalleled level of diversification in the portfolio”

For us, this can translate into additional costs and a decline in the quality of the inefficiency itself. We take this risk into account when constructing our model portfolios and during the testing phase of our research process. With each new inefficiency our research uncovers, we consider how best to capture it in a way that protects us from overcrowding risk. Essentially, this ensures we are diversified away from hot-spots where investor allocations have bid up prices beyond fair value for particular themes and factors.

A good example here is in our low-volatility inefficiency. For our Strategies, it’s a highly attractive play since these stocks over the long-term exhibit lower risk than the wider market. This means they significantly outperform. Yet during certain stages of the market cycle, this trait can exercise a herding effect among investors and make overcrowding likely.

We try to mitigate this in two ways:

- First, we screen for fundamental volatility as well as low stock price volatility. In sum, we look for stocks with a low-volatility profile and low volatility fundamentals. For instance, we like stocks with a strong record of revenue growth (which thus exhibit low growth volatility) since this characteristic is proven to be extremely helpful in mitigating overcrowding risk.

- Second, we embed certain specific valuation factors, searching for the most attractive companies that produce steady cash flow and dividend yields over time. Our strategies here are essentially low volatility income plays.

This combination of the fundamental volatility element and the fundamental value bias in our stock selection trigger profit-taking in our portfolio when investors overcrowd an opportunity".

Given the launch of your new Global Long/Short Strategy how can it be attractive for investors? Can you describe any interesting performance traits this year?

Emmanuel Hauptman: "We look to capture our pre-defined inefficiencies – Value, Low-Volatility & High Income and Growth / Momentum – on the long side. On the short side our strategies are themed around negative momentum, value and cash flow destruction. We are able to capture these inefficiencies in a very broad dispersed investment universe.

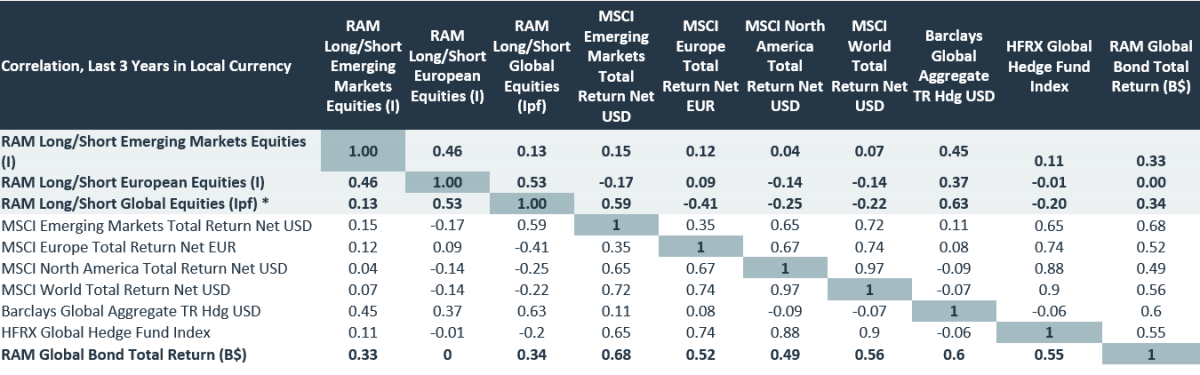

Correlation Matrix – RAM’s Liquid Alternatives Strategies

Past performance is not a reliable indicator of future results. Please refer to the disclaimer at the end of this document.

The high degree of dispersion the market exhibits in certain phases, enables us to identify and select stocks across the US, Europe and Asia Pacific, (including Hong Kong listings and H-shares). This provides us with an unparalleled level of diversification in the portfolio, helping us to generate alpha across a wide range of markets. Additionally, this helps enhance our risk-adjusted returns. This globally dispersed universe is an extremely attractive landscape for our engines.

With our Global Long/Short Strategy we’ve already seen our models being tested this year. In January and May we witnessed a large and rather violent rotation in US momentum stocks, especially in the small and mid-cap segment of the market. These moves hurt our long GARP/Momentum book. However, this relative underperformance was nicely offset by the strong alpha generation of our long Momentum picks in Europe, as well as by our short strategies in several US sectors. Both months ended positively for us, despite a very difficult US market, which highlights the importance of having a fundamental and quality bias.

Where are you seeing the best opportunities right now based on your models?

Thomas de Saint-Seine: "Some of the strategies we use on the short side of the book are very different in terms of the investment rationale from what we do on the long side. It’s important to understand that a short opportunity does not display the same symmetry as a long opportunity. Using bottom-up analysis, we look for specific short inefficiencies.

One of these is in Emerging Markets. It looks at potentially fraudulent accounts and where companies might be overstating their earnings. You don’t have the symmetry of this factor on the long side of the book, so it’s a specific short opportunity we look to capture. We are careful to use different lenses to evaluate the data we screen. Our aim has always been to maximise both the number of alpha engines and the types of philosophies we can utilise. Our belief is that the more alpha engines we have, the better.

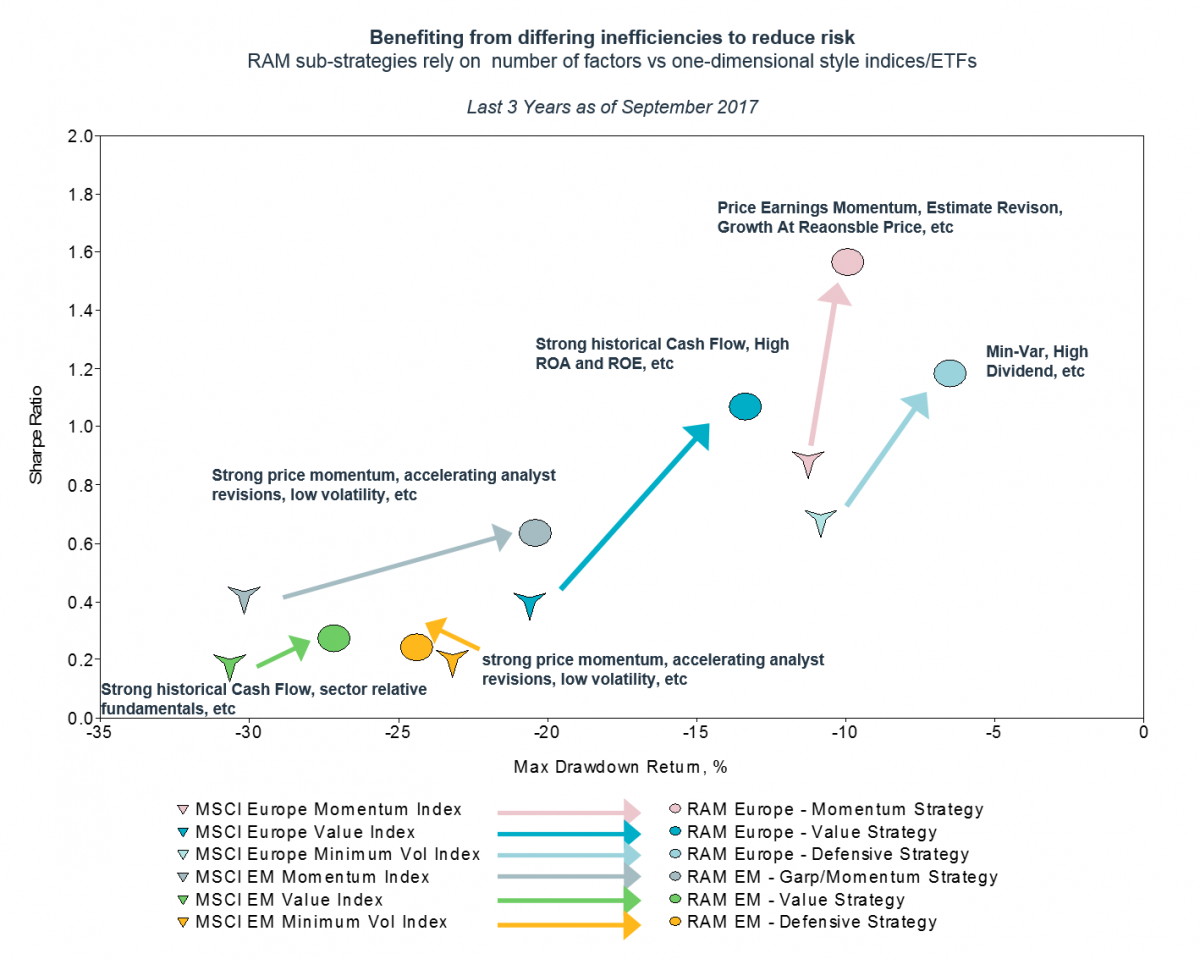

Chart: Sub-strategy performances are calculated based on simulated model portfolios rebalanced monthly on RAM equity investment screenings and may not represent the exact contribution of strategies in real portfolio. Strategies performances are here adjusted considering their long-term theoretical fixed allocation in the fund and to match the GAV performance (R share class) therefore should serve for informative purposes only .

Source: RAM Active Investments as of 29.09.2017

How does RAM’s offering sit within the Liquid Alternatives landscape?

Emmanuel Hauptman: "Systematic liquid alternative funds focus on value arbitrage, and we are no exception. But we take this a bit further by screening for specific themes on both sides of the book. On the long side, our aim is to find attractively-valued, growing, high quality companies. On the short side, we look for highly-valued firms that display low earnings quality and negative cash flow. This relative value play means we look to be beta-neutral in our Strategies, and not be overly reliant on the risk-on market environment for alpha generation.

Our aim is to ensure we can preserve investor capital in times of stress, while simultaneously generating alpha. If a reversal of the current cycle happened tomorrow, for example, a large proportion of the liquid alternative space, which is in long-biased equity funds, would contain much more directional risk than us. We also look to differentiate ourselves from the overly-simplistic Factor investing and Smart Beta strategies which have grown in prominence. The same can be said for managed futures strategies, which also have high directional risk. In contrast, our beta-neutral approach is much less directional and thus offers considerable diversification opportunities to investors.

The downside for investors looking to allocate more to beta-neutral strategies is the fact that what we capture is limited to market niches. A lot of our exposure is in small and midcap stocks.

Since we provide daily or weekly liquidity in our Strategies it means our capacity is limited as we need to scale portfolio positions to those trading volumes. Beta-neutral long-shorts will never become the new core of global investors’ portfolios, but as a satellite they generate performance that provides valuable portfolio diversification from core Equity and Fixed-Income allocations."

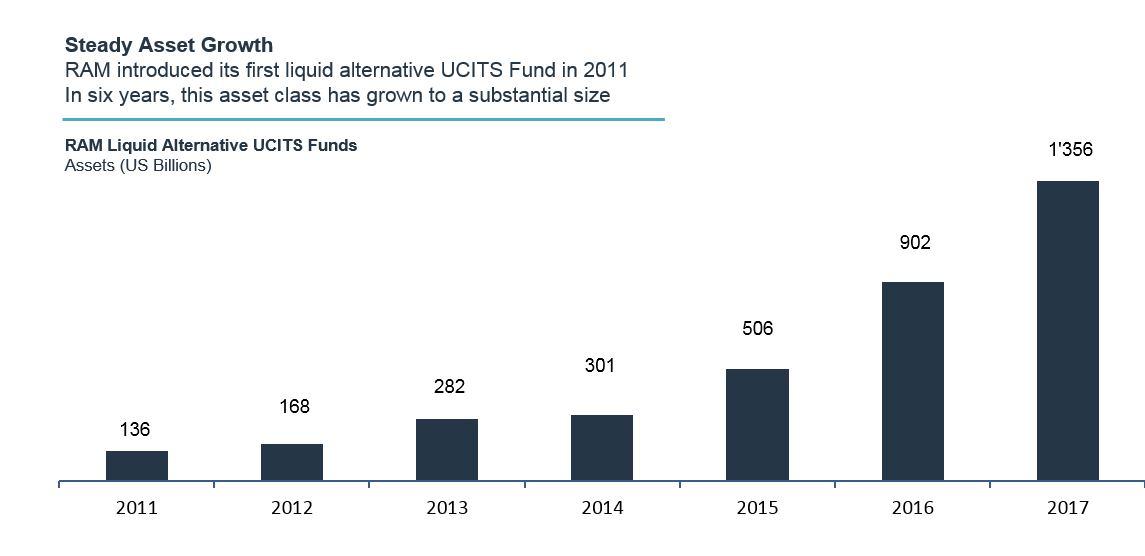

RAM has been managing liquid alternatives since 2009, and via UCITS format since 2011. As of today*, RAM has a total of US $1.4bn of liquid alternative assets under management.

RAM’s Liquid Alternative UCITS range offers superior long-term risk-adjusted performance for investors, as well as offering key diversification opportunities or reducing volatility.

*As at 31 October 2017

Past performance is not a reliable indicator of future results. Please refer to the disclaimer at the end of this document.

Important Information:

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is prohibited, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the products mentioned herein are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). Important warning to clients in some countries, please note that the Sub-fund: RAM (Lux) TACTICAL FUNDS-Global Total Return Fund is not currently registered for distribution in Sweden, Denmark, Finland and Norway. RAM (Lux) SYSTEMATIC FUNDS- Long/Short Global Equities Fund is not currently registered for distribution in Denmark, Portugal and Singapore. The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial product mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary. The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice. Investors are advised to base their decision whether or not to invest in fund shares on the most recent financial reports, key investor information document (KIID) and prospectus which contain further information on the products concerned. The value of shares and income thereon may rise or fall and is in no way guaranteed. The price of the financial products mentioned in this document may fluctuate and drop both suddenly and sharply, and it is even possible that all money invested may be lost. Changes in exchange rates may cause the NAV per share in the investor's base currency to fluctuate. If requested, RAM Active Investments S.A. will provide customers with more detailed information on the risks attached to specific investments. Exchange rate variations may also cause the value of an investment to rise or fall. Whether real or simulated, past performance is not necessarily a reliable guide to future performance. The prospectus, KIID, articles of association and financial reports are available free of charge on www.ram-ai.com, from the SICAV’s and Management Company’s registered offices, its representative and distributor in Switzerland, RAM Active Investments S.A., Geneva, and the SICAV’s representative in the country in which the SICAVs are registered. This marketing document has not been approved by any financial Authority, it is confidential and addressed solely to its intended recipient; its reproduction and distribution are prohibited. RAM Active Investments S.A. is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the UK to professional investors only by RAM Active Investments (UK) Limited, 35 Berkeley Square, London W1J5BF, incorporated in England and Wales, No 9338325. Issued in the Continental Europe by the Management Company RAM Active Investments (Luxembourg) S.A., 51 av. John F. Kennedy L-1855 Luxembourg, Grand Duchy of Luxembourg.